Article Text

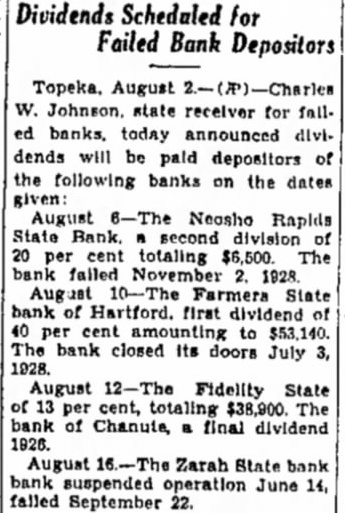

Dividends Scheduled for Failed Bank Depositors W. Johnson, state receiver for fall. ed banks, today announced dividends will be paid depositors of the following banks on the dates given: August 6-The Neosho Rapids State Bank. a second division of 20 per cent totaling $6,500. The bank failed November 2. 1928 Aug 10-The Farmers State bank of Hartford. first dividend of 40 per cent amounting to $53,140. The bank closed its doors July 3, 1928. August 12-The Fidelity State of 13 per cent, totaling $38,900. The bank of Chanute, B final dividend 1926. August 16-The Zarah State bank bank suspended operation June 14, falled September 22.