Article Text

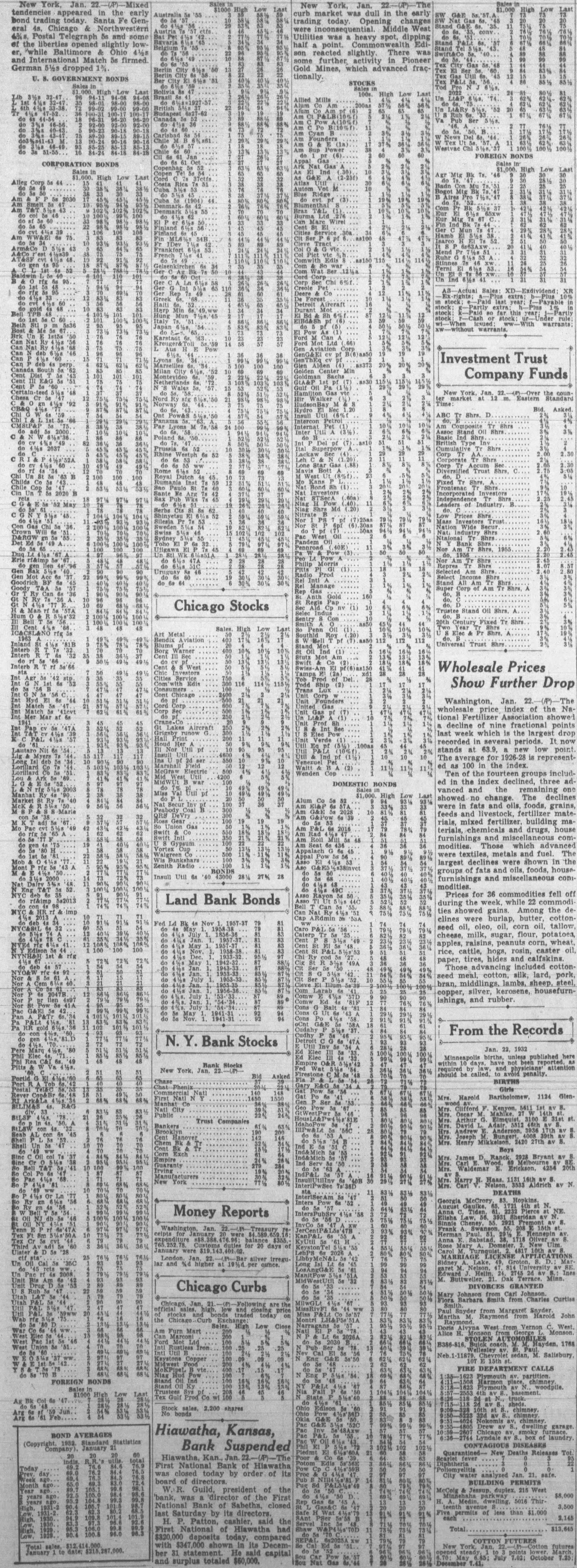

Land Bank Bonds Money Reports New York, Jan. The curb market was dull in the early trading today. Opening changes were Middle West Utilities was heavy spot, dipping half point. Commonwealth Edireacted There activity in Pioneer Gold Mines, which advanced fraç- tionally. Last STOCKS Last warrants. Investment Trust Company Funds Trust Chicago Stocks Century Fixed Wholesale Prices Show Further Drop Washington, Jan. 22. wholesale price index of the National Fertilizer Association showed decline of nine fractional points last week which is the largest recorded in several periods. It now stands at low point The average for is representas 100 in the index. of the fourteen groups includin the index declined, three adDOMESTIC vanced and the remaining one showed no change. The declines in fats and oils, foods, grains, feeds and livestock, fertilizer materials, mixed fertilizer. building materials, chemicals and drugs, house furnishings and miscellaneous commodities. Those which advanced textiles, metals and fuel. The largest declines were shown in the groups of fats and oils, foods, house. furnishings and miscellaneous conimodities. Prices for 36 commodities fell off during the week, while 22 showed gains. Among the declines were burlap, butter, cottonseed oil, oleo, oil, corn oil, tallow, cheese, milk, sugar, flour, potatoes, apples, raisins, peanuts corn, wheat, rice, cattle, hogs, rosin, caster oil, paper, tires, hides and calfskins. Those advancing included cottonseed meal, cotton, silk, lard, pork, bran, middlings. lambs, sheep, steel, copper, silver, kerosene, housefurnishings, and rubber. From the Records N.Y. Bank Stocks Jan. 22, 1932 births, published here been Stocks attention should be penalty. BIRTHS Girls Bartholomew, Companies Andrew Chicago Curbs Johnson Johnson. 816, FIRE CALLS BONDS basement. shares Hiawatha, Kansas, BOND Bank Suspended CONTAGIOUS Kan. Jan. fever Bank of by order its board of PERMITS Guild, president the was the National Bank of closed Saturday its directors. H. First deposits COTTON FUTURES $347,000 31 totaled