Article Text

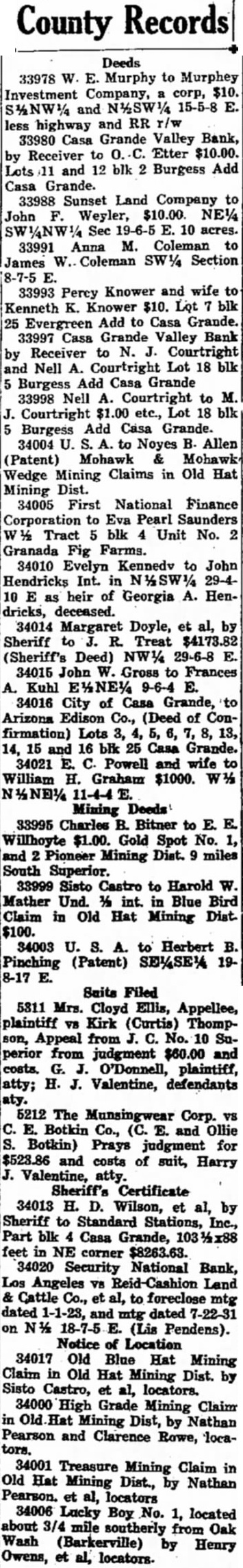

County Records Deeds 33978 W. E. Murphy to Murphey Investment Company, corp, $10. less highway and RR r/w 33980 Casa Grande Valley Bank, by Receiver to Etter $10.00. Lots 11 and 12 blk 2 Burgess Add Casa Grande. 33988 Sunset Land Company to John F. Weyler, $10.00. NE1/4 SW1/4NW½ Sec 19-6-5 10 acres. 33991 Anna M. Coleman to James W. Coleman SW 1/4 Section 8-7-5 33993 Percy Knower and wife to Kenneth K. Knower $10. Lot blk 25 Evergreen Add to Casa Grande. 33997 Casa Grande Valley Bank by Receiver to N. J. Courtright and Nell A. Courtright Lot 18 blk 5 Burgess Add Casa Grande 33998 Nell A. Courtright to M. J. Courtright $1.00 etc., Lot 18 blk 5 Burgess Add Casa Grande. 34004 U. S. to Noyes B. Allen (Patent) Mohawk & Mohawk Wedge Mining Claims in Old Hat Mining Dist. 34005 First National Finance Corporation to Eva Pearl Saunders Tract blk 4 Unit No. 2 Granada Fig Farms. 34010 Evelyn Kennedv to John Hendricks Int. in 29-410 E as heir of Georgia A. Hendricks, deceased. 34014 Margaret Doyle, et al, by Sheriff R. Treat $4173.82 (Sheriff's Deed) NW½ 29-6-8 E. 34015 John W. Gross to Frances A. Kuhl E%NE% 9-6-4 E. 34016 City of Casa Grande, to Arizona Edison Co., (Deed of Confirmation) Lots 3, 4, 5, 6, 8, 13, 14, 15 and 16 blk 25 Casa Grande. 34021 E. C. Powell and wife to William H. Graham $1000. 11-4-4 E. Mining Deeds 33995 Charles B. Bitner to E. E. Willhoyte $1.00. Gold Spot No. 1, and 2 Pioneer Mining Dist. 9 miles South Superior. 33999 Sisto Castro to Harold W. Mather Und. ½ int. in Blue Bird Claim in Old Hat Mining Dist. $100. 34003 U. S. A. to Herbert B. Pinching (Patent) SE%SE% 198-17 E. Suits Filed 5311 Mrs. Cloyd Ellis, Appellee, plaintiff V8 Kirk (Curtis) Thompson, Appeal from J. C. No. 10 Superior from judgment $60.00 and costs. G. J. O'Donnell, plaintiff, atty; H. J. Valentine, defendants aty. 5212 The Munsingwear Corp. VS C. E. Botkin Co., (C. E. and Ollie S. Botkin) Prays judgment for $523.86 and costs of suit, Harry J. Valentine, atty. Sheriff's Certificate 34013 H. D. Wilson, et al, by Sheriff to Standard Stations, Inc., Part blk Casa Grande, feet in NE corner $8263.63. 34020 Security National Bank, Los Angeles V8 Reid-Cashion Land & Cattle Co., et to foreclose mtg dated 1-1-23, and mtg dated 7-22-31 on 18-7-5 E. (Lis Pendens). Notice of Location 34017 Old Blue Hat Mining Claim in Old Hat Mining Dist. by Sisto Castro, et al, locators. 34000 High Grade Mining Claim in Mining Dist, by Nathan Pearson and Clarence Rowe, locators. 34001 Treasure Mining Claim in Old Hat Mining Dist., by Nathan Pearson. et al, locators 34006 Lucky Boy No. 1, located about 3/4 mile southerly from Oak Wash (Barkerville) by Henry Owens, et al, locators.