Click image to open full size in new tab

Article Text

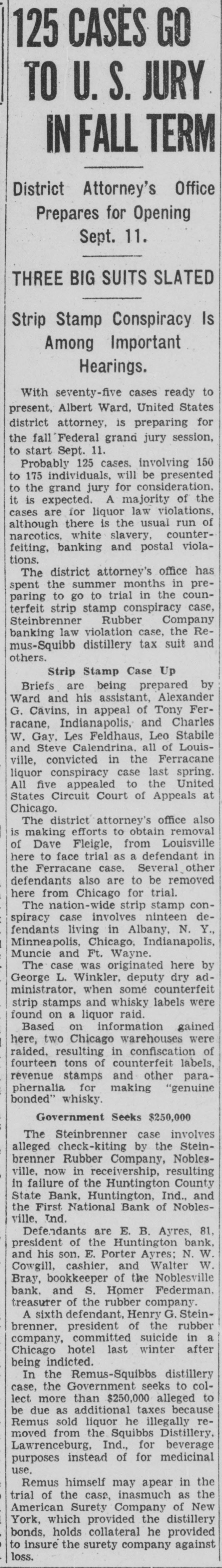

125 CASES GO TO U.S. JURY IN FALL TERM District Attorney's Office Prepares for Opening Sept. 11. THREE BIG SUITS SLATED Strip Stamp Conspiracy Is Among Important Hearings. With seventy-five cases ready to present, Albert Ward, United States district attorney, is preparing for the fall Federal grand jury session, to start Sept. 11. Probably 125 cases. involving 150 to 175 individuals, will be presented to the grand jury for consideration. it is expected. A majority of the cases are for liquor law violations, there is run of white although narcotics, slavery, the usual counterfeiting, banking and postal violations. The district attorney's office has the summer to to spent paring go trial months in the in coun- preterfeit strip stamp conspiracy case, Steinbrenner Rubber Company banking law violation case, the Remus-Squibb distillery tax suit and others. Strip Stamp Case Up Briefs are being prepared by Ward and his assistant, Alexander G. Cavins, in appeal of Tony Ferracane, Indianapolis, and Charles W. Gay, Les Feldhaus, Leo Stabile and Steve Calendrina, all of Louisville, convicted in the Ferracane liquor conspiracy case last spring. All five appealed to the United States Circuit Court of Appeals at Chicago. The district attorney's office also is making efforts to obtain removal of Dave Fleigle, from Louisville here to face trial as a defendant in the Ferracane case. Several other defendants also are to be removed here from Chicago for trial. The nation-wide strip stamp conspiracy case involves ninteen defendants living in Albany, N. Y., Minneapolis, Chicago, Indianapolis, Muncie and Ft. Wayne. The case was originated here by George L. Winkler, deputy dry administrator, when some counterfeit strip stamps and whisky labels were found on a liquor raid. Based on information gained here, two Chicago warehouses were raided. resulting in confiscation of fourteen tons of counterfeit labels, revenue stamps and other paraphernalia for making "genuine bonded" whisky. Government Seeks $250,000 The Steinbrenner case involves alleged check-kiting by the Steinbrenner Rubber Company, Noblesville, now in receivership, resulting in failure of the Huntington County State Bank, Huntington, Ind.. and the First National Bank of Noblesville, Ind. Defendants are E. B. Ayres, 81. president of the Huntington bank. and his son. E. Porter Ayres; N. W. Cowgill, cashier. and Walter W. Bray, bookkeeper of the Noblesville bank. and S. Homer Federman. treasurer of the rubber company. A sixth defendant, Henry G. Steinbrenner. president of the rubber company, committed suicide in a Chicago hotel last winter after being indicted. In the Remus-Squibbs distillery case, the Government seeks to collect more than $250,000 alleged to be due as additional taxes because Remus sold liquor he illegally removed from the Squibbs Distillery, Lawrenceburg, Ind., for beverage purposes instead of for medicinal use. Remus himself may apear in the trial of the case, inasmuch as the American Surety Company of New York, which provided the distillery bonds, holds collateral he provided to insure the surety company against loss.