Article Text

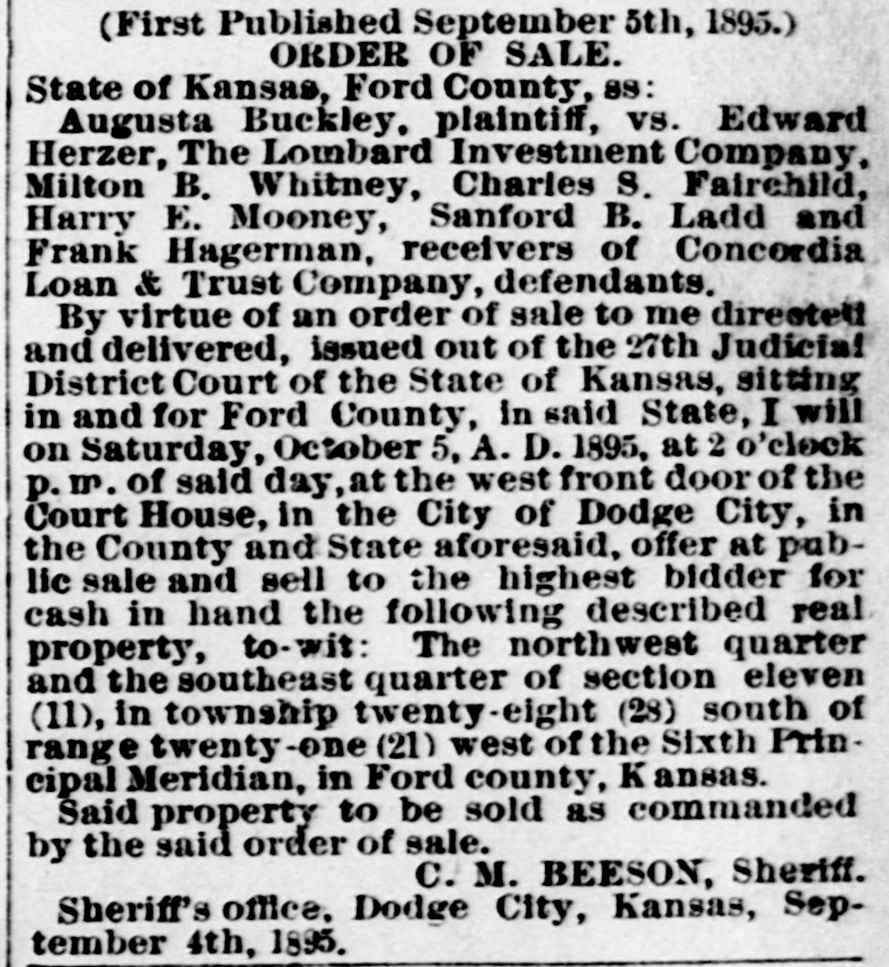

(First Published September 5th, 1895.) # ORDER OF SALE. State of Kansas, Ford County, ss: Augusta Buckley, plaintiff, vs. Edward Herzer, The Lombard Investment Company, Milton B. Whitney, Charles S. Fairchild, Harry E. Mooney, Sanford B. Ladd and Frank Hagerman, receivers of Concordia Loan & Trust Company, defendants. By virtue of an order of sale to me dirested and delivered, issued out of the 27th Judicial District Court of the State of Kansas, sitting in and for Ford County, in said State, I will on Saturday, October 5, A. D. 1895, at 2 o'clock p. m. of said day, at the west front door of the Court House, in the City of Dodge City, in the County and State aforesaid, offer at pub- lic sale and sell to the highest bidder for cash in hand the following described real property, to-wit: The northwest quarter and the southeast quarter of section eleven (11), in township twenty-eight (28) south of range twenty-one (21) west of the Sixth Prin- cipal Meridian, in Ford county, Kansas. Said property to be sold as commanded by the said order of sale. C. M. BEESON, Sheriff. Sheriff's office, Dodge City, Kansas, Sep- tember 4th, 1895.