Click image to open full size in new tab

Article Text

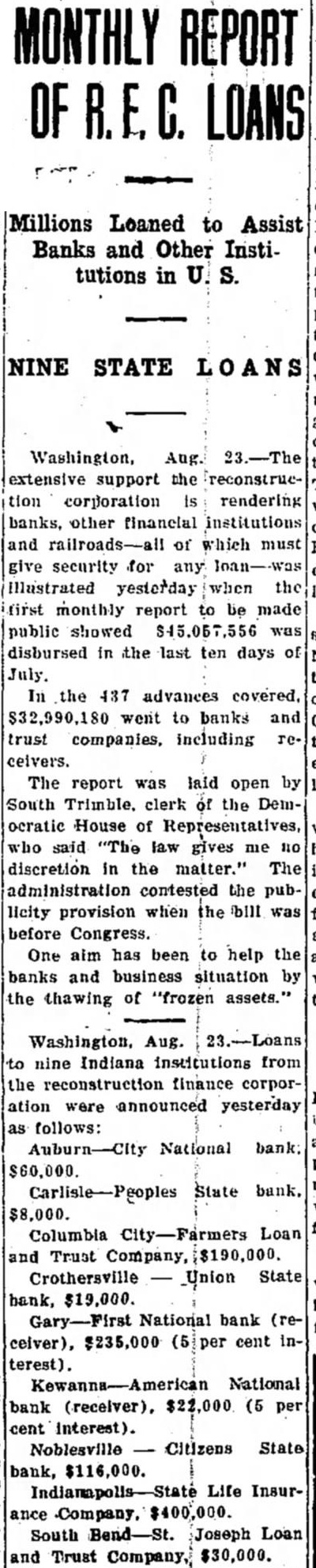

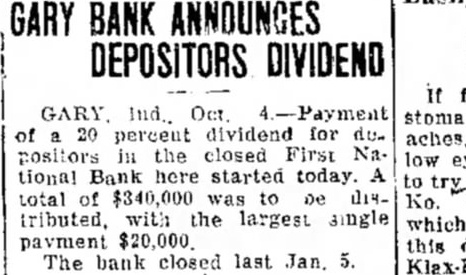

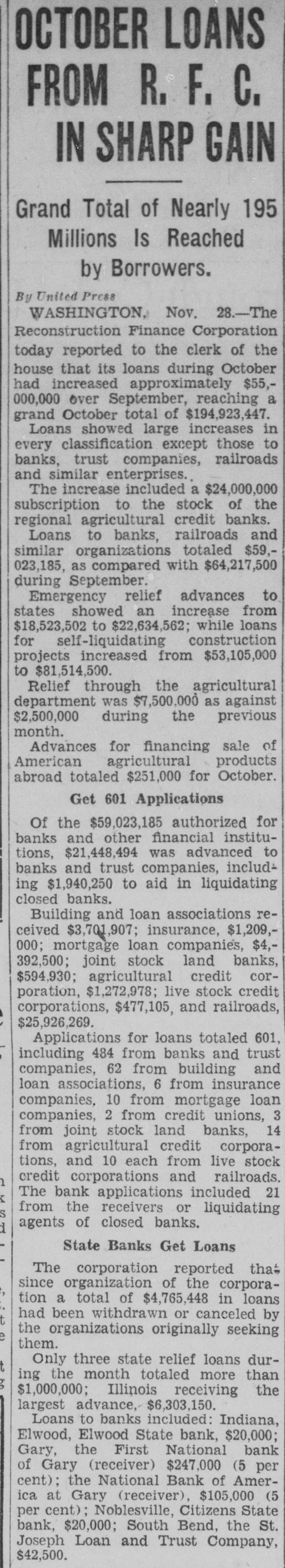

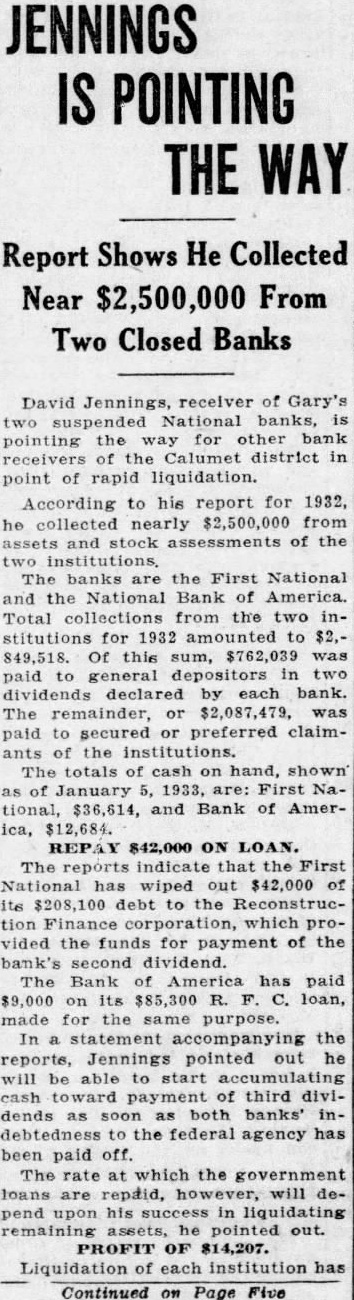

OCTOBER LOANS FROM R. F. c. IN SHARP GAIN Grand Total of Nearly 195 Millions Is Reached by Borrowers. By United Press WASHINGTON, Nov. 28.-The Reconstruction Finance Corporation today reported to the clerk of the house that its loans during October had increased approximately $55,000,000 over September, reaching a grand October total of $194,923,447. Loans showed large increases in every classification except those to banks, trust companies, railroads and similar enterprises. The increase included a $24,000,000 subscription to the stock of the regional agricultural credit banks. Loans to banks, railroads and similar organizations totaled $59,023,185, as compared with $64,217,500 during September. Emergency relief advances to states showed an increase from $18,523,502 to $22,634,562; while loans for self-liquidating construction projects increased from $53,105,000 to $81,514,500. Relief through the agricultural department was $7,500,000 as against $2,500,000 during the previous month. Advances for financing sale of American agricultural products abroad totaled $251,000 for October. Get 601 Applications Of the $59,023,185 authorized for banks and other financial institutions, $21,448,494 was advanced to banks and trust companies, including $1,940,250 to aid in liquidating closed banks. Building and loan associations received $3,701,907; insurance, $1,209,000; mortgage loan companies, $4,392,500; joint stock land banks, $594,930; agricultural credit corporation, $1,272,978; live stock credit corporations, $477,105, and railroads, $25,926,269. Applications for loans totaled 601, including 484 from banks and trust companies, 62 from building and loan associations, 6 from insurance companies, 10 from mortgage loan companies, 2 from credit unions, 3 from joint stock land banks, 14 from agricultural credit corporations, and 10 each from live stock credit corporations and railroads. The bank applications included 21 from the receivers or liquidating agents of closed banks. State Banks Get Loans The corporation reported that since organization of the corporation a total of $4,765,448 in loans had been withdrawn or canceled by the organizations originally seeking them. Only three state relief loans during the month totaled more than $1,000,000; Illinois receiving the largest advance, $6,303,150. Loans to banks included: Indiana, Elwood, Elwood State bank, $20,000; Gary, the First National bank of Gary (receiver) $247,000 (5 per cent); the National Bank of America at Gary (receiver), $105,000 (5 per cent); Noblesville, Citizens State bank, $20,000; South Bend, the St. Joseph Loan and Trust Company, $42,500.