Click image to open full size in new tab

Article Text

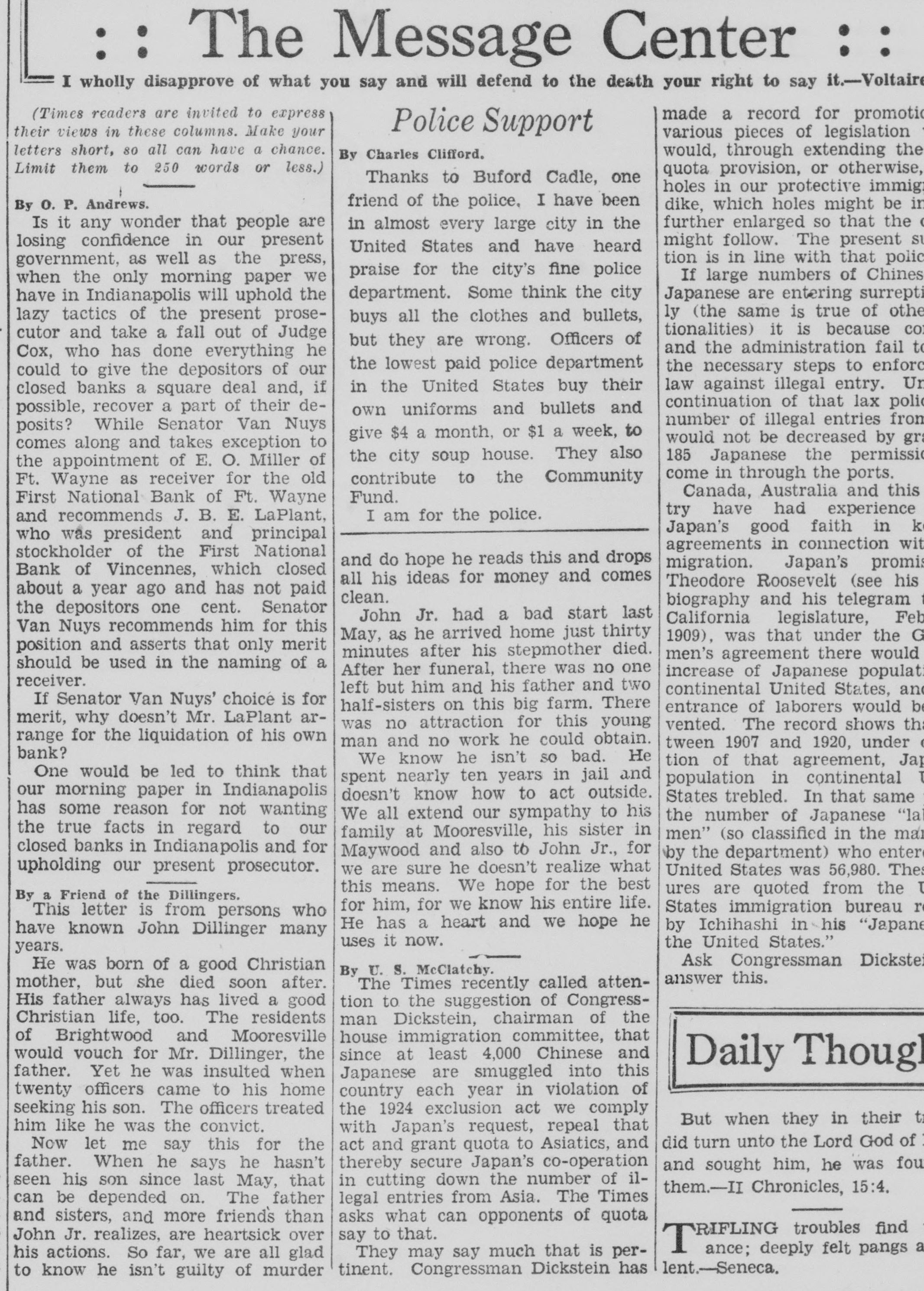

The Message Center I wholly disapprove of what you say and will defend to the death your right to say it.-Voltaire (Times readers are invited to express made a record for promotic Police Support their views in these columns. Make your various pieces of legislation 1 letters short, 80 all can have a chance. would, through extending the By Charles Clifford. Limit them to 250 words or less.) quota provision, or otherwise, Thanks to Buford Cadle, one holes in our protective immig friend of the police. I have been By O. P. Andrews. dike, which holes might be in further enlarged so that the ( Is it any wonder that people are in almost every large city in the might follow. The present su losing confidence in our present United States and have heard tion is in line with that polic government, as well as the press, praise for the city's fine police If large numbers of Chines when the only morning paper we Japanese are entering surrepti department. Some think the city have in Indianapolis will uphold the ly (the same is true of othe lazy tactics of the present prosebuys all the clothes and bullets, tionalities) it is because co cutor and take a fall out of Judge but they are wrong. Officers of and the administration fail to Cox, who has done everything he the lowest paid police department the necessary steps to enforc could to give the depositors of our law against illegal entry. Un in the United States buy their closed banks a square deal and, if continuation of that lax polic possible, recover a part of their deown uniforms and bullets and number of illegal entries fron posits? While Senator Van Nuys give $4 a month, or $1 a week, to would not be decreased by gra comes along and takes exception to 185 Japanese the permissio the city soup house. They also the appointment of E. O. Miller of come in through the ports. contribute to the Community Ft. Wayne as receiver for the old Canada, Australia and this Fund. First National Bank of Ft. Wayne try have had experience and recommends J. B. E. LaPlant, I am for the police. Japan's good faith in k who was president and principal agreements in connection wit stockholder of the First National and do hope he reads this and drops migration. Japan's promis Bank of Vincennes, which closed all his ideas for money and comes Theodore Roosevelt (see his about a year ago and has not paid clean. biography and his telegram 1 the depositors one cent. Senator John Jr. had a bad start last California legislature, Feb Van Nuys recommends him for this May, as he arrived home just thirty 1909), was that under the G position and asserts that only merit minutes after his stepmother died. men's agreement there would should be used in the naming of a After her funeral, there was no one increase of Japanese populati receiver. left but him and his father and two continental United States, and If Senator Van Nuys' choice is for half-sisters on this big farm. There entrance of laborers would be merit, why doesn't Mr. LaPlant arwas no attraction for this young vented. The record shows th range for the liquidation of his own man and no work he could obtain. tween 1907 and 1920, under a bank? We know he isn't so bad. He tion of that agreement, Jap One would be led to think that spent nearly ten years in jail and population in continental T our morning paper in Indianapolis doesn't know how to act outside. States trebled. In that same has some reason for not wanting We all extend our sympathy to his the number of Japanese "lal the true facts in regard to our men" (so classified in the mai family at Mooresville, his sister in closed banks in Indianapolis and for Maywood and also to John Jr., for by the department) who enter upholding our present prosecutor. we are sure he doesn't realize what United States was 56,980. The this means. We hope for the best ures are quoted from the I By a Friend of the Dillingers. for him, for we know his entire life. States immigration bureau r This letter is from persons who He has a heart and we hope he by Ichihashi in his "Japane have known John Dillinger many uses it now. the United States." years. Ask Congressman Dickste He was born of a good Christian By U. S. McClatchy. answer this. mother, but she died soon after. The Times recently called attenHis father always has lived a good tion to the suggestion of CongressChristian life, too. The residents man Dickstein, chairman of the of Brightwood and Mooresville house immigration committee, that since at least 4,000 Chinese and would vouch for Mr. Dillinger, the Daily Though father. Yet he was insulted when Japanese are smuggled into this twenty officers came to his home country each year in violation of the 1924 exclusion act we comply seeking his son. The officers treated But when they in their t him like he was the convict. with Japan's request, repeal that did turn unto the Lord God of : Now let me say this for the act and grant quota to Asiatics, and father. When he says he hasn't thereby secure Japan's co-operation and sought him, he was fou in cutting down the number of ilseen his son since last May, that them.-II Chronicles, 15:4, can be depended on. The father legal entries from Asia. The Times and sisters, and more friends than asks what can opponents of quota RIFLING troubles find John Jr. realizes, are heartsick over say to that. T ance; deeply felt pangs a They may say much that is perhis actions. So far, we are all glad lent.-Seneca. tinent. Congressman Dickstein has to know he isn't guilty of murder