Article Text

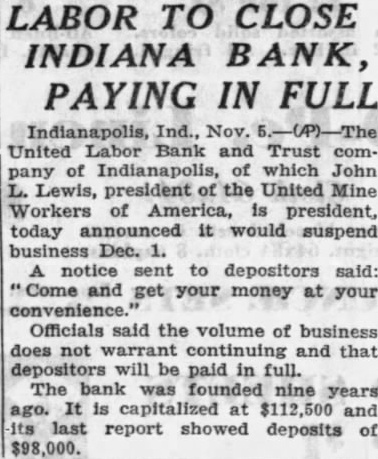

LABOR TO CLOSE INDIANA BANK, PAYING IN FULL Indianapolis, Ind., Nov. United Labor Bank and Trust company of Indianapolis, of which John L. Lewis, president of the United Mine Workers of America, is president, today it would suspend Dec. notice sent to depositors said: Come and get your money at your convenience. Officials said the volume of business does not continuing and that depositors will be paid in full. The bank was founded nine years ago. It is capitalized at $112,500 and its last report showed deposits of $98,000.