Click image to open full size in new tab

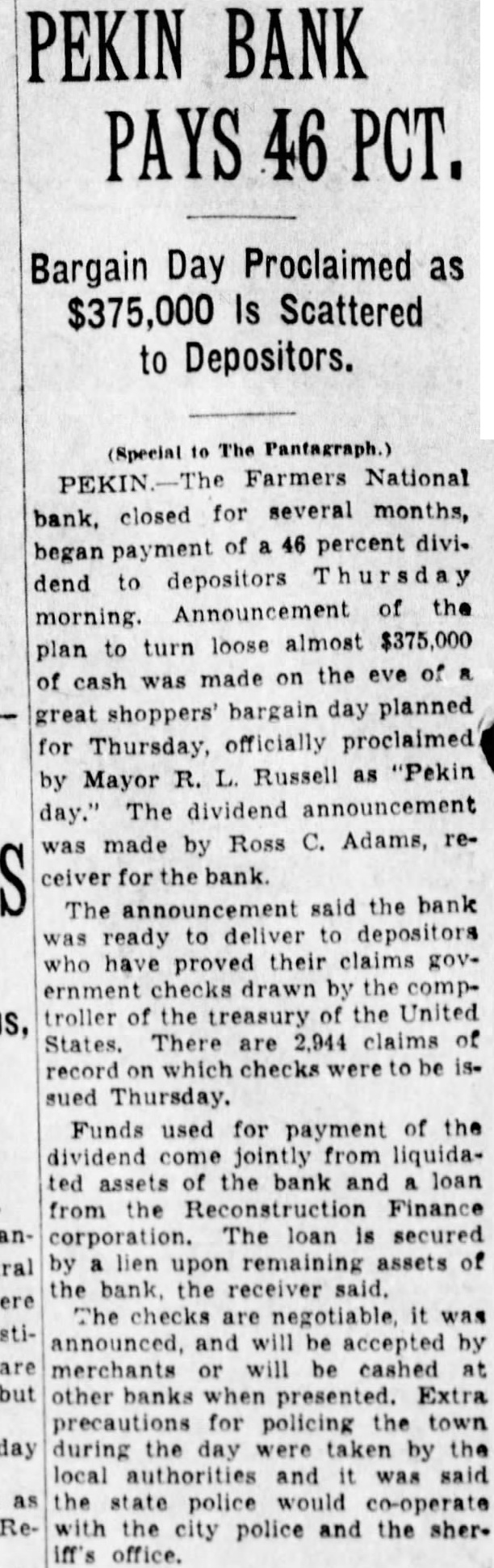

Article Text

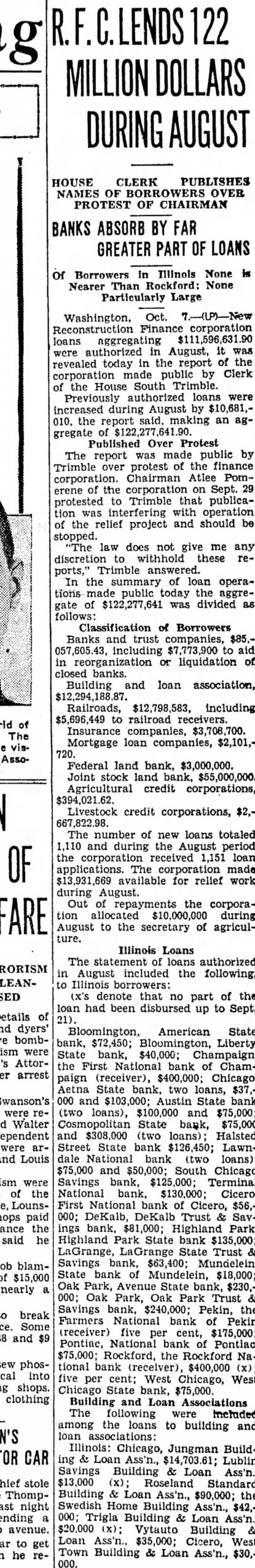

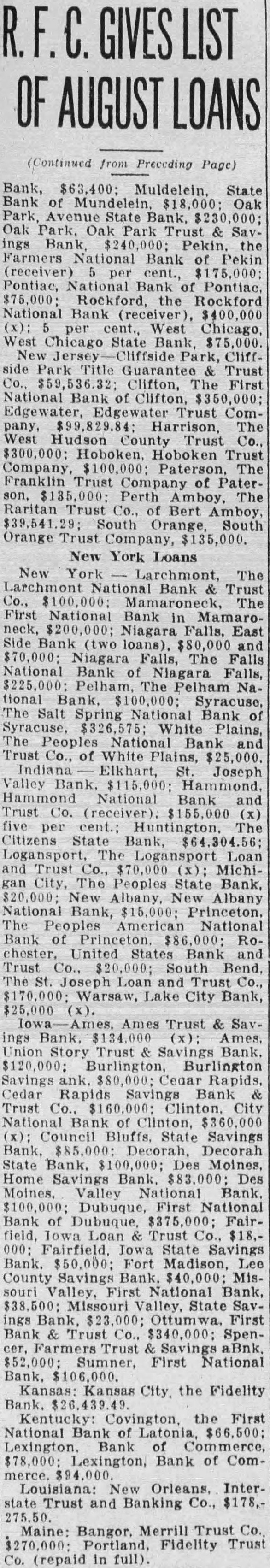

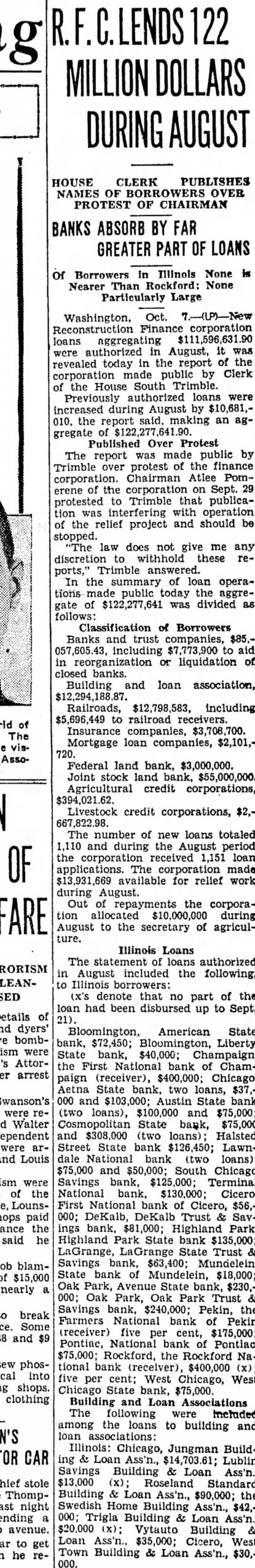

HOUSE CLERK PUBLISHES NAMES OF BORROWERS OVER PROTEST OF CHAIRMAN

BANKS ABSORB BY FAR GREATER PART LOANS

Of Borrowers Illinois None Nearer Than None Particularly Large

Washington, Oct. Reconstruction Finance corporation loans aggregating August, revealed today in the report of the made public by Clerk corporation the House South Trimble. Previously authorized loans were increased during August by $10,681,010. the report said, making an gregate Published Over Protest The report was made public by Trimble over protest of the finance corporation. Chairman Atlee Pomerene of the corporation on Sept. protested Trimble that publication was interfering with operation the relief project and should be stopped. law does not give me any discretion to withhold these reTrimble answered. In the summary loan operations made public today the aggreof $122,277,641 was divided follows: Classification of Borrowers Banks and trust companies, $85.including $7,773,900 to aid reorganization liquidation of closed banks. Building and loan association, Railroads, including to railroad receivers. Insurance companies, Mortgage loan companies, $2,101,720.

Federal land bank, $3,000,000. Joint stock bank, $55,000,000. Agricultural credit corporations, Livestock credit corporations, $2,The number of new loans totaled and during the August period the corporation received 1,151 loan The corporation made available for relief work during August. Out of repayments the corporation allocated $10,000,000 during August to the secretary of agriculture.

Illinois Loans The statement loans authorized in August included the following, to Illinois borrowers: (X's denote that no part of the loan had been disbursed up to Sept.

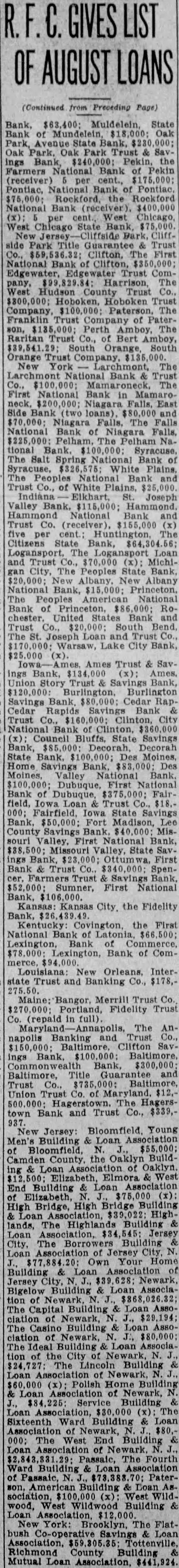

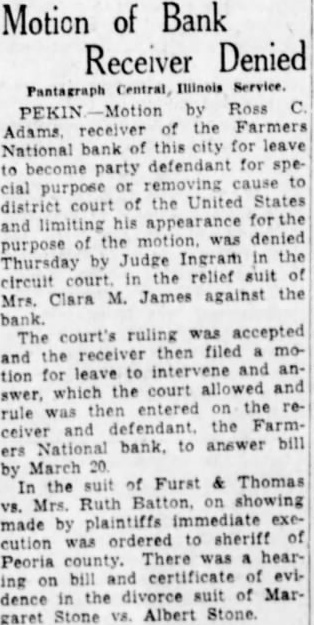

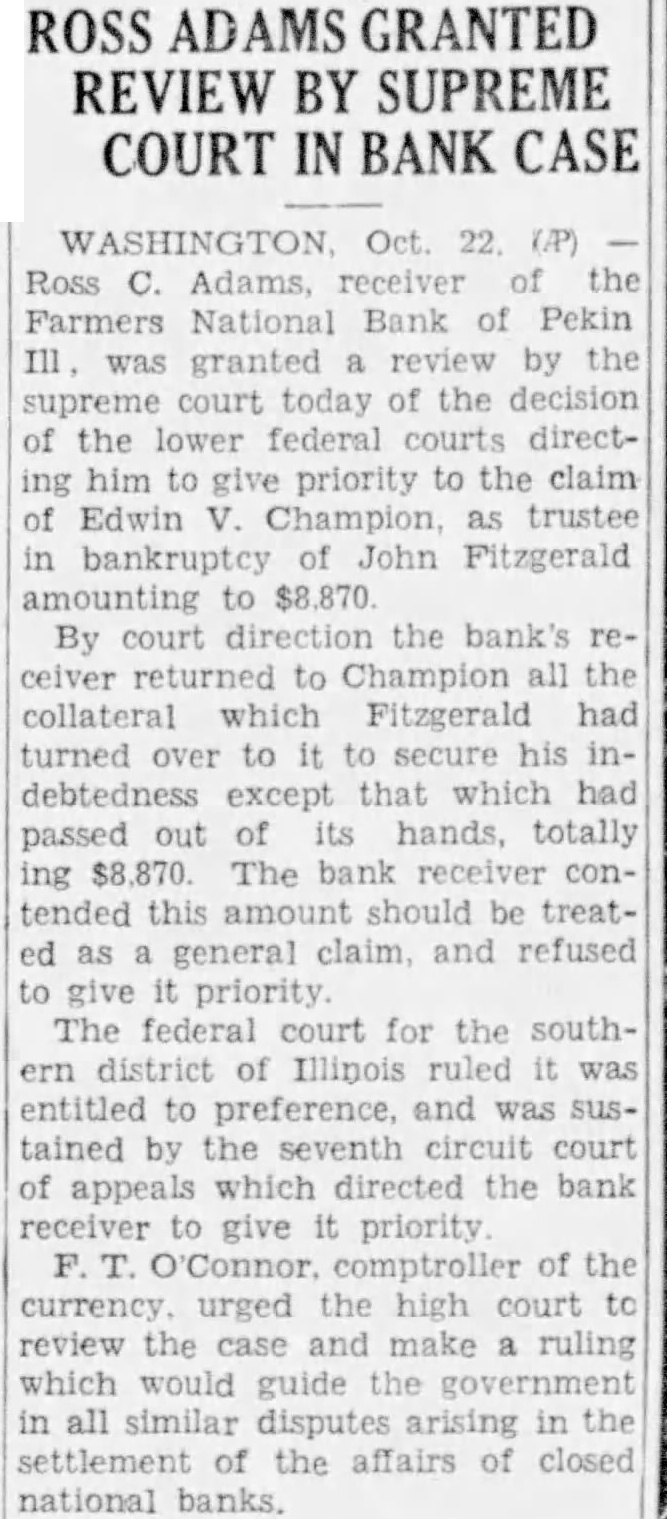

Bloomington, American State bank, Bloomington, Liberty State bank, $40,000; the First National bank of Champaign (receiver), $400,000; Chicago, Aetna State bank, two loans, 000 and Austin State bank (two loans), $100,000 and $75,000; State bank, $75,000 and $308,000 (two loans); Halsted Street State bank $126,450; Lawndale National bank (two loans), $75,000 and $50,000; South Chicago Savings bank, Terminal National bank, $130,000; Cicero, First National bank of Cicero, $56,000; DeKalb, DeKalb Trust Savings bank, $81,000; Highland Park, Highland Park State bank LaGrange, State Trust Savings bank, $63,400; Mundelein, State bank Mundelein, $18,000; Oak Park, Avenue State bank, $230,000; Oak Park, Oak Park Trust Savings bank, $240,000; Pekin, the Farmers National bank of Pekin (receiver) five per cent, Pontine, National bank of Pontiac, Rockford, the Rockford National bank (receiver), $400,000 five per cent; West Chicago, West Chicago State bank, $75,000. Building and Loan Associations The following included among the loans to building and loan Illinois: Chicago, Jungman Building Loan Lublin Building Loan (x); Roseland Standard Building Loan Ass'n., $90,000; the Swedish Home Building Ass'n., $42,000; Trigla Building Loan Ass'n., Vytauto Building Loan Ass'n., $35,000; Cicero, West Town Building Loan Ass'n., $30,000.