Click image to open full size in new tab

Article Text

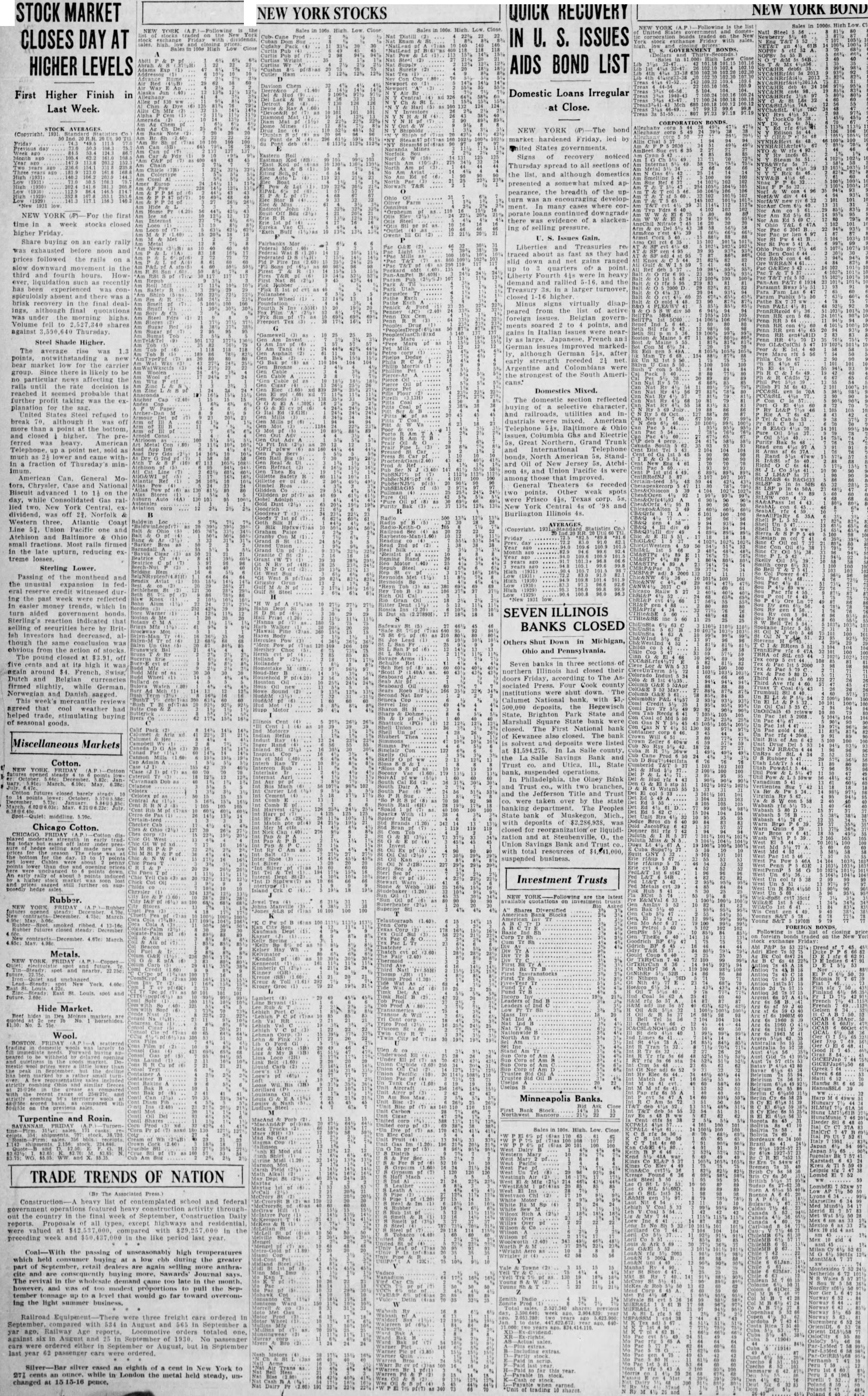

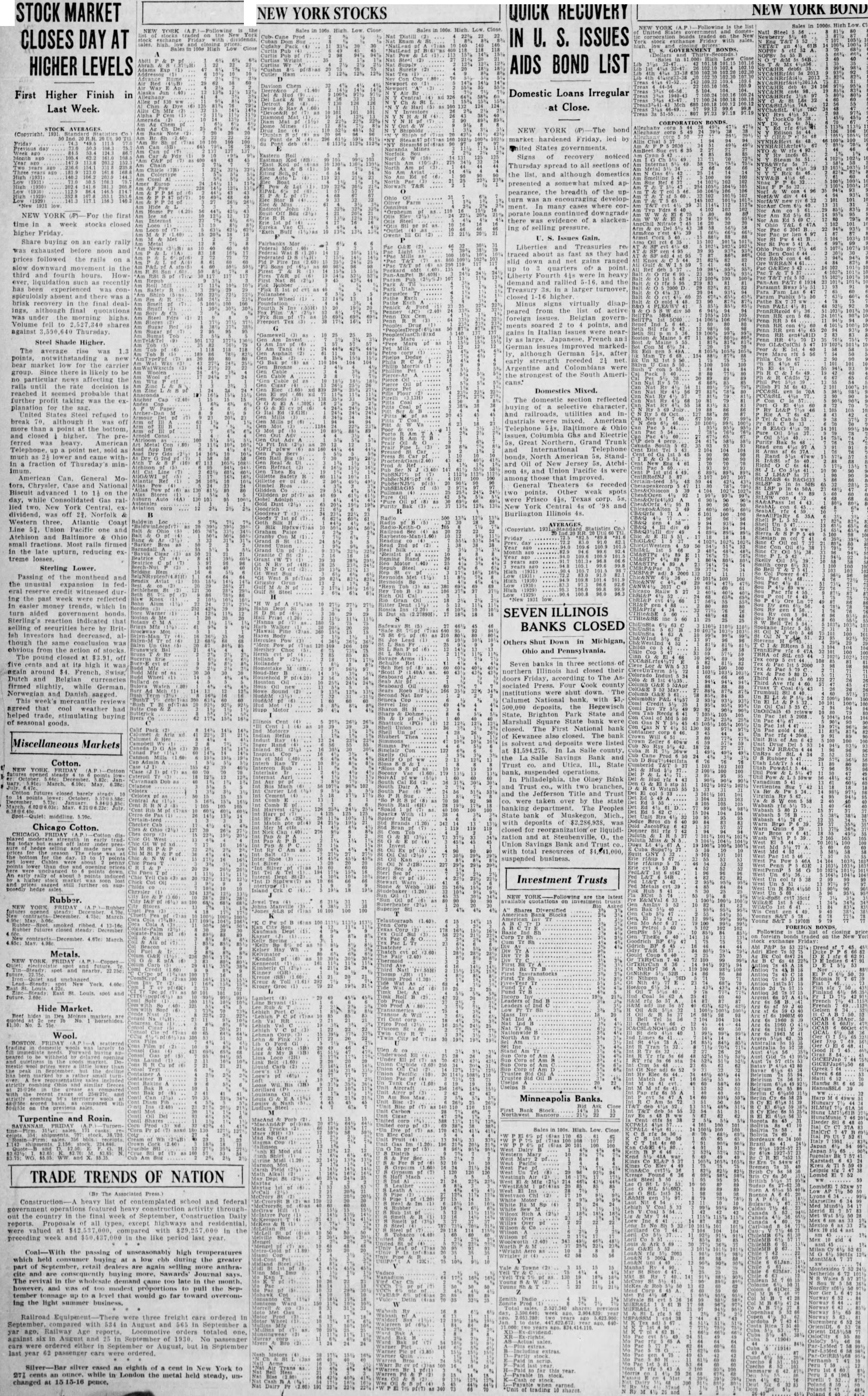

STOCK MARKET CLOSES DAY AT HIGHER LEVELS

NEW YORK STOCKS

First Higher Finish in Last Week.

Steel Shade Higher. The average rise was 1.3 points, notwithstanding new bear market low for the carrier group. Since there is likely to be no particular news affecting the rails until the rate decision is reached it seemed probable that further profit taking was the explanation for the sag. United States Steel refused to break 70. although it was off more than point at the bottom and closed higher. The preferred was heavy American Telephone, up point net, sold as much as 21 lower and came within fraction of Thursday's minAmerican Can, General Mo. tors, Chrysler. Case and National Biscuit advanced to 11 on the day, while Consolidated Gas rallied two. New York Central. exdividend, was off 21. Norfolk & Western three, Atlantic Coast Line 51. Union Pacific one and Atchison and Baltimore & Ohio small fractions. Most rails firmed in the late upturn, reducing ex treme losses.

Sterling Lower. Passing of the monthend and the unusual expansion in fed. eral reserve credit witnessed during the past week were reflected in easier money trends, which in turn aided government bonds. Sterling's reaction indicated that selling of securities here by Brit 1sh investors had decreased. although the same conclusion was obvious from the action of stocks The pound closed at $3.91. off five cents and at its high it was again around $4. French. Swiss, Dutch and Belgian currencies firmed slightly. while German, Norwegian and Danish sagged. This week's mercantile reviews agreed that cool weather had helped trade, stimulating buying of seasonal goods.

Miscellaneous Markets

Cotton. NEW YORK FRIDAY opened steady October. May futures closed barely steady points May. Spot- Quiet middling. 5.70c.

Chicago Cotton.

CHICAGO FRIDAY Cotton made were still further posedly

YORK FRIDAY December smoked ribbed closed steady:

Metals. NEW YORK FRIDAY spot and unchanged York East St. spot

TRADE TRENDS OF NATION

(By The Associated Press.) Construction-A heavy list of contemplated school and federal government operations featured heavy construction activity through. out the country in the final week of September, Construction Daily reports Proposals of all types, except highways and residential, were valued at 537,000, compared with $29,257 000 in the preceding week and $50,437,000 in the like period last year.

Coal-With the passing of unseasonably high temperatures which held consumer buying at low cbb during the greater part of September, retail dealers are again selling more anthracite and are consequently buying more, Sawards' Journal says. The revival in the wholesale demand came too late in the month. however, and was of too modest proportions to pull the September tonnage up to a level that would go far toward overcoming the light summer business.

Railroad Equipment There were three freight cars ordered in September, compared with 534 in August and 565 in September a yar ago, Railway Age reports. Locomotive orders totaled one, against six in August and 25 in September of 1930. No passenger cars were ordered either in September or August, but in September last year 62 passenger cars were ordered. Silver-Bar silver eased an eighth of a cent in New York to 27% cents an ounce. while in London the metal held steady, unchanged at 15 15-16 pence,

Hide Market. Beef hides Moines

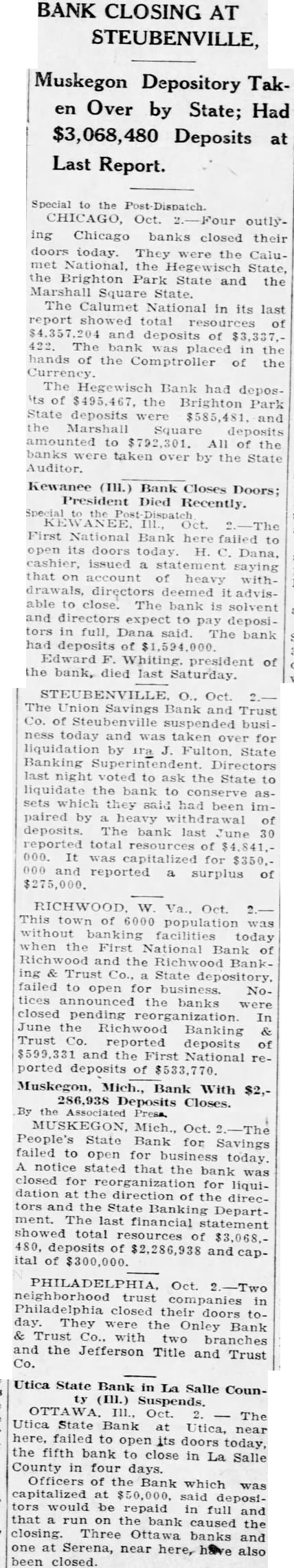

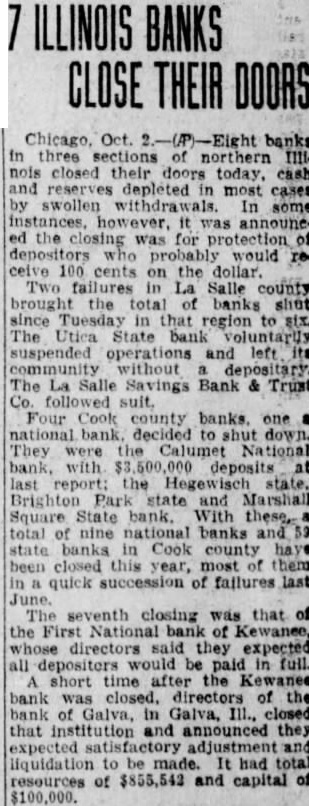

YORK Following the Sales High Prod IN U. S. ISSUES AIDS BOND LIST Domestic Loans Irregular at Close. CORPORATION BONDS STOCK AVERAGES NEW YORK The bond market hardened Friday, led Friday Previous day ited States governments. Week Signs of recovery noticed Thursday spread to all sections of the list, and although domestics presented a somewhat mixed appearance, the breadth of the up turn was an encouraging develop*New 1931 low ment. In many cases where corporate loans continued downgrade NEW YORK For the first there was evidence of a slackentime in week stocks closed ing of selling pressure. higher Friday. U. S. Issues Gain. Share buying on an early rally Liberties and Treasuries was exhausted before noon and traced about as fast as they had prices followed the rails on slid down and net gains ranged slow downward movement in the up to 3 quarters of a point third and fourth hours. How- Liberty Fourth 41s were in heavy ever. liquidation such as recently demand and rallied 5-16. and the has been experienced was con- Treasury 3s. in larger turnover spiculolsly absent and there was a closed 1-16 higher brisk recovery in the final deal- Minus signs virtually disap ings, although final quotations peared from the list of active was under the morning highs. foreign issues. Belgian govern Volume fell to 2,527,340 shares ments soared 2 to points, and against 3,590,640 Thursday gains in Italian issues were near ly as large Japanese, French an German issues improved marked ly, although German 51s. after early strength receded 21 net Argentine and Colombians were the strongest of the South AmeriDomestics Mixed. The domestic section reflected buying of selective character, and railroads, utilities and industrials were mixed. American Telephone 51s, Baltimore & Ohio issues, Columbia Ghs and Electric 5s, Great Northern, Grand Trunk and International Telephone bonds, North American 5s, Stand ard Oil of New Jersey 5s. Atchi son 4s, and Union Pacific 4s were among those that improved. General Theaters 68 receded two points. Other weak spots Auto were Frisco 41s. Texas corp. New York Central 4s of '98 and B Burlington Illinois 48. Baldwin Loc AVERAGES 193 SEVEN ILLINOIS BANKS CLOSED Others Shut Down in Michigan, Ohio and Pennsylvania. Seven banks in three sections of northern Illinois had closed their doors Friday, according to The Associated Press. Four Cook county institutions were shut down. The Calumet National bank, with $3. 500,000 deposits, the Hegewisch State, Brighton Park State and Marshall Square State bank were closed. The First National bank of Kewanee also closed. The bank is solvent and deposits were listed at $1,594,275. In La Salle county the La Salle Savings Bank and Trust co. and Utica, III., State bank, suspended operations. In Philadelphía, the Olney Bank and Trust co., with two branches, and the Jefferson Title and Trust co. were taken over by the state banking department. The Peoples State bank of Muskegon, Mich. with deposits of $2,286,938 closed for reorganization or liquidization and at Steubenville, O., the Union Savings Bank and Trust co. with total resources of $4,841,000, suspended business. Investment Trusts NEW YORK Following are the latest Rubber. quotations on Shares Diversified Following Wool. FRIDAY Minneapolis Banks. scored on the sales Bank Turpentine and Rosin. year Unit of trading earned shares