Article Text

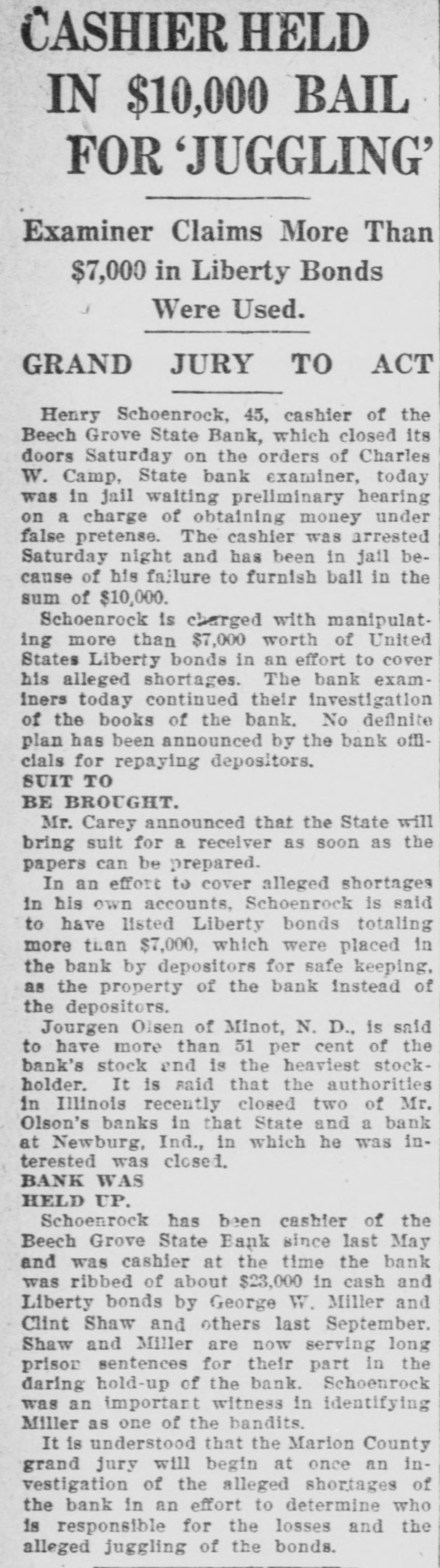

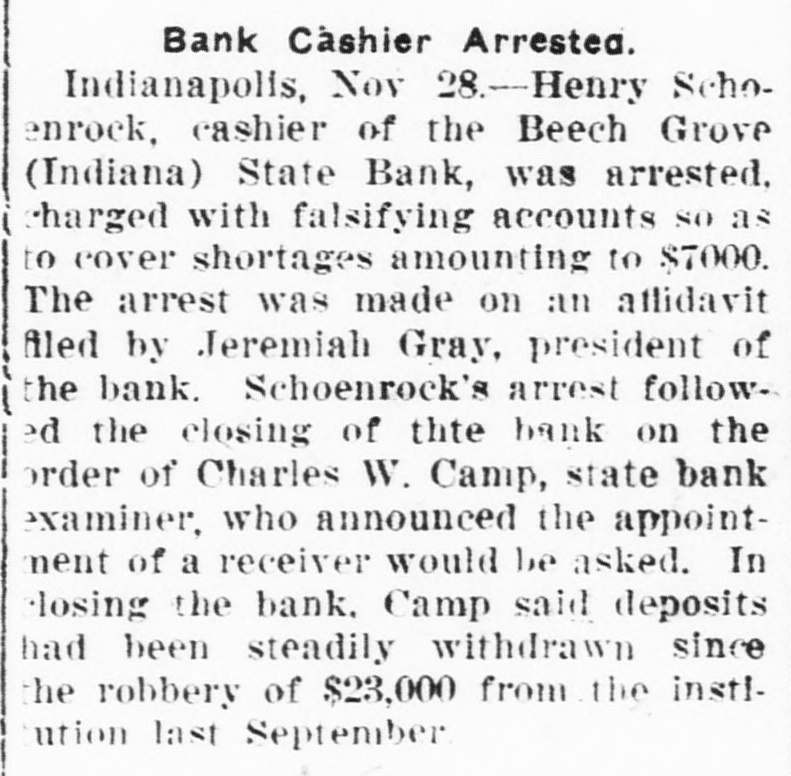

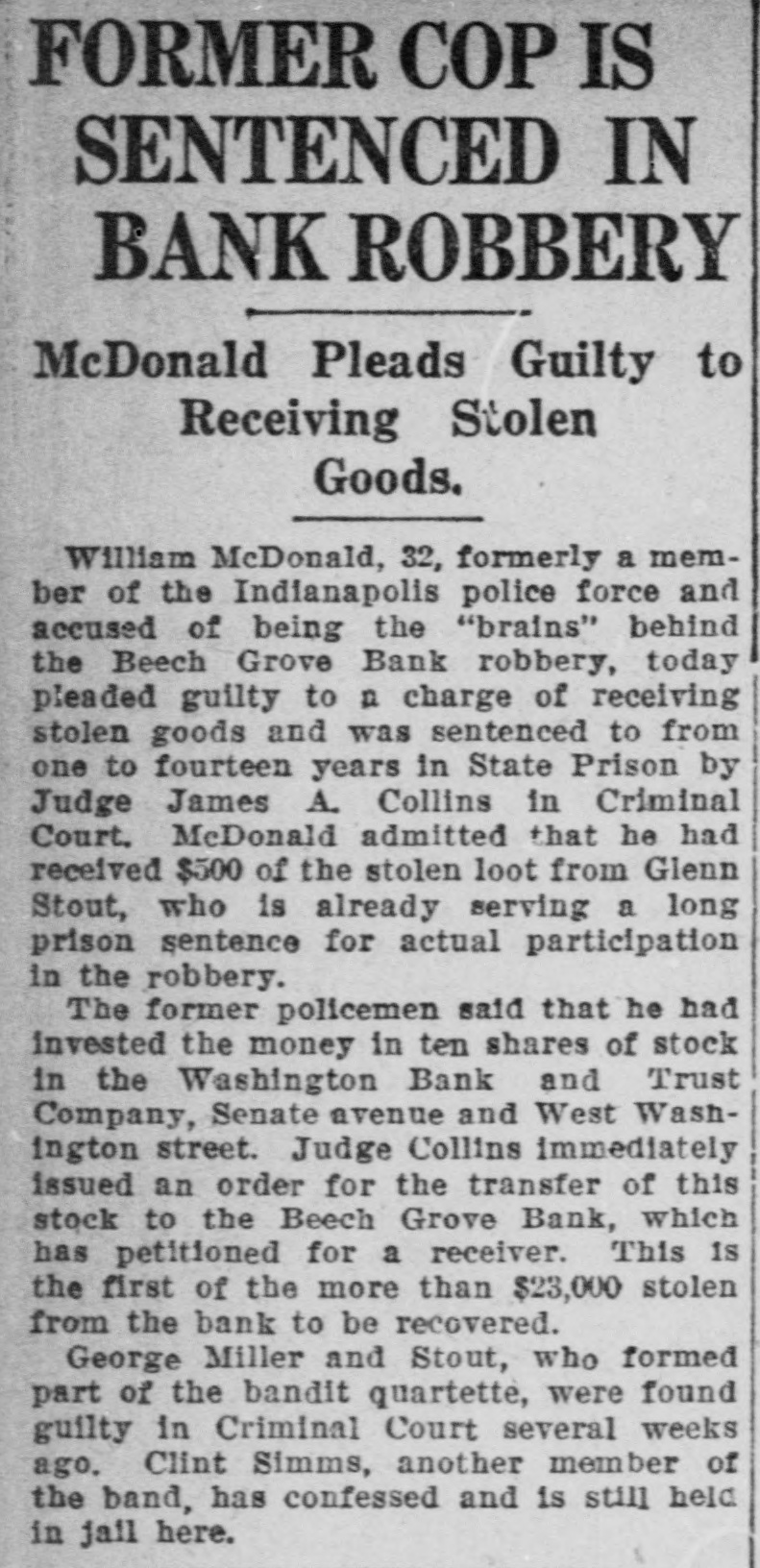

CASHIER HELD IN $10,000 BAIL FOR 'JUGGLING' Examiner Claims More Than $7,000 in Liberty Bonds Were Used. GRAND JURY TO ACT Henry Schoenrock, 45, cashier of the Beech Grove State Bank, which closed its doors Saturday on the orders of Charles W. Camp, State bank examiner, today was in jail waiting preliminary hearing on a charge of obtaining money under false pretense. The cashier was arrested Saturday night and has been in jail because of his failure to furnish ball in the sum of $10,000. Schoenrock is charged with manipulating more than $7,000 worth of United States Liberty bonds in an effort to cover his alleged shortages. The bank examiners today continued their investigation of the books of the bank. No definite plan has been announced by the bank offlcials for repaying depositors. SUIT TO BE BROUGHT. Mr. Carey announced that the State will bring suit for a receiver as soon as the papers can be prepared. In an effort to cover alleged shortages in his own accounts, Schoenrock is said to have listed Liberty bonds totaling more tian $7,000, which were placed in the bank by depositors for safe keeping, as the property of the bank instead of the depositors. Jourgen Olsen of Minot, N. D., is said to have more than 51 per cent of the bank's stock end is the heaviest stockholder. It is said that the authorities in Illinois recently closed two of Mr. Olson's banks in that State and a bank at Newburg, Ind., in which he was interested was closed. BANK WAS HELD UP. Schoenrock has been cashier of the Beech Grove State Bank since last May and was cashier at the time the bank was ribbed of about $23,000 in cash and Liberty bonds by George W. Miller and Clint Shaw and others last September. Shaw and Miller are now serving long prisor sentences for their part in the daring hold-up of the bank. Schoenrock was an important witness in identifying Miller as one of the bandits. It is understood that the Marion County grand jury will begin at once an investigation of the alleged shortages of the bank in an effort to determine who is responsible for the losses and the alleged juggling of the bonds.