Article Text

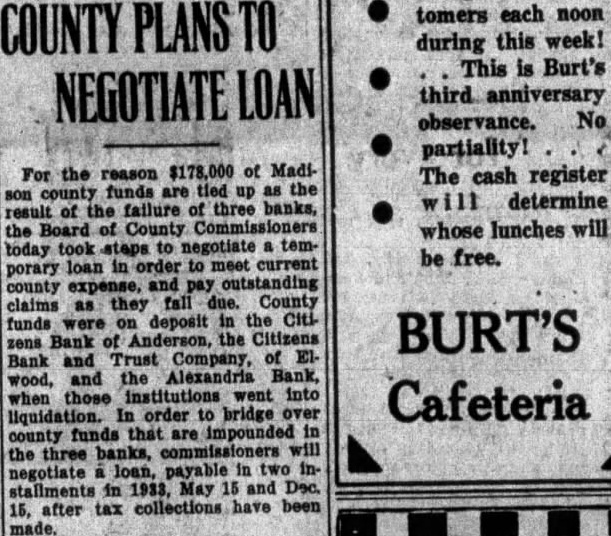

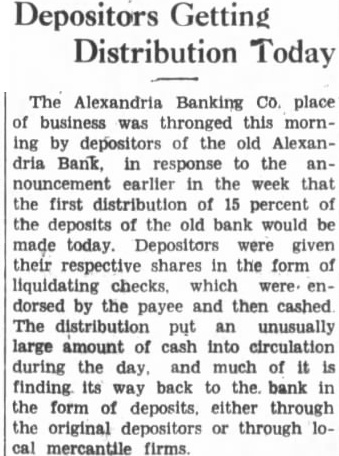

BANK SITUATION UNDER CONTROL (Continued from Page One) Directors of the Citizens Bank are Arthur W. Brady, George E. Nichol, George H. Alexander, Charles E. Strout, Ernest N. Hill, F. E. Mustard, Neel McCullough, Frank C. Cline, Charles E. Bonser, Augustus T. Dye, Robert Dorste, Daniel Boland, Thomas McCullough, G. W. Whitledge, Edward H. Matthew Jacob Groble, C. Kuch, J. Wilson Barber and George W. Pierce. Closed as Protection Rumors circulated Friday and which spread rapidly was the immediate cause of the closing of the bank. Conferences held during the night contemplated reopening the bank on Saturday, but the reports had gained such wide circulation that it was finally decided to close the bank rather than expose depositors to the risk of heavy run. Public Funds Protected The civil city of Anderson had $120,000 deposited at the Citizens Bank, in funds as follows: Municipal electric light plant, $70,000; Barrett law department $30,000; general fund, $20,000. City Controller Ira Davis, who is acting as mayor during the illness of Mayor J. H. Mellett, withheld issuance of city pay checks untill Monday to prevent further congestion at the Anderson Bank. The city is protected against loss by $536,000 personal bond against stockholders of the Citizens Bank. Madison county funds deposited at the Citizens Bank totaled $150,000, said Marcia H. Barton, county treasurer. County money is also protected by bond. J. Wesley Stewart, township trustee, said his office would be handicapped somewhat during the temporary closing of the bank, where he had between $8,000 and $9,000 on deposit. School teachers and bus drivers were paid yesterday by checks issued against township accounts in the Anderson Bank. ALEXANDRIA ACTION Notice Posted on One Bank-Other Meets All Demands. ALEXANDRIA, Ind., Oct. 31.-In the face of heavy withdrawals today the Alexandria Bank today posted notice of voluntary closure shortly before 3 p. m. State examiners will check the affairs and an announcement will be made when their work is finished. It was believed that depositors will be fully protected. Sam Phillips is president. The local situation is not critical and the Commercial Bank Trust Company, the other local bank, is meeting all of its requirements.