Article Text

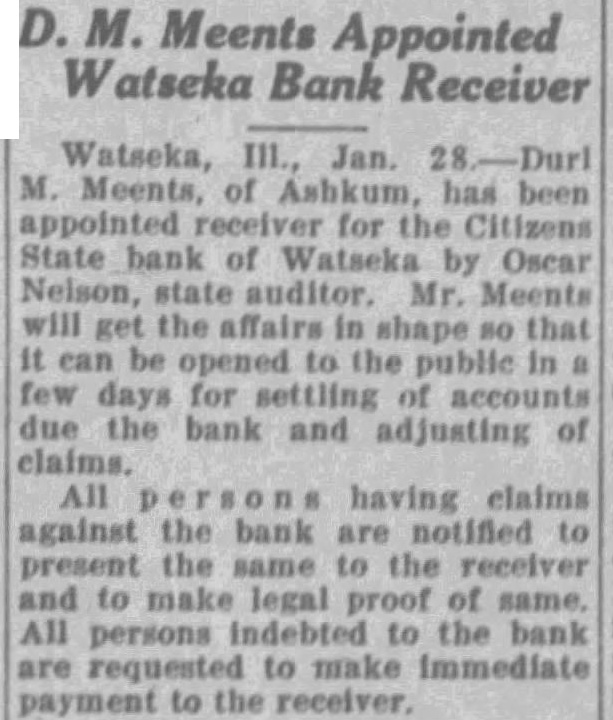

Meents Appointed Bank Receiver Watseka, Jan. Meents, has for the Citizens State bank of Watseka by Oscar auditor Mr. Meents will affairs shape that opened to the public for settling accounts due bank adjusting claims. All having claims against the bank are notified present the receiver make legal proof of All persons to the bank to make immediate payment to receiver.