Article Text

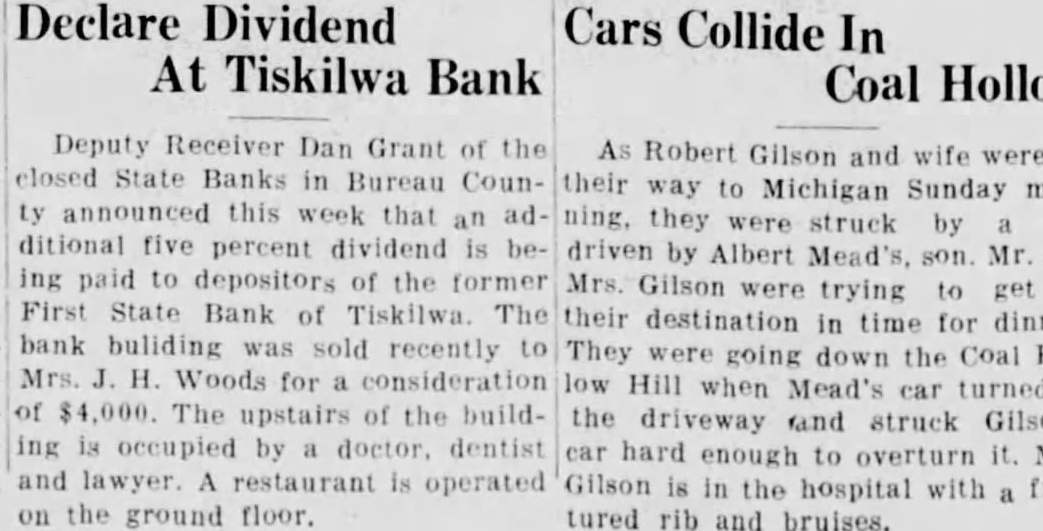

Declare Dividend Cars Collide In At Tiskilwa Bank Coal Hollow Deputy Receiver Dan Grant of the As Robert Gilson and wife closed State Banks in Bureau Countheir way to Michigan Sunday announced this week that they were struck by ditional five percent dividend driven by Albert Mr. ing paid to depositors of the former Mrs. Gilson were to get trying First State Bank of The their destination time for in bank buliding sold recently They were going the Coal down Woods for consideration low Hill when Mead's car turned The upstairs of the build- the driveway and struck is occupied by doctor. dentist hard car enough to overturn it. and lawyer. is operated Gilson the hospital the ground floor. tured rib and bruises.