Article Text

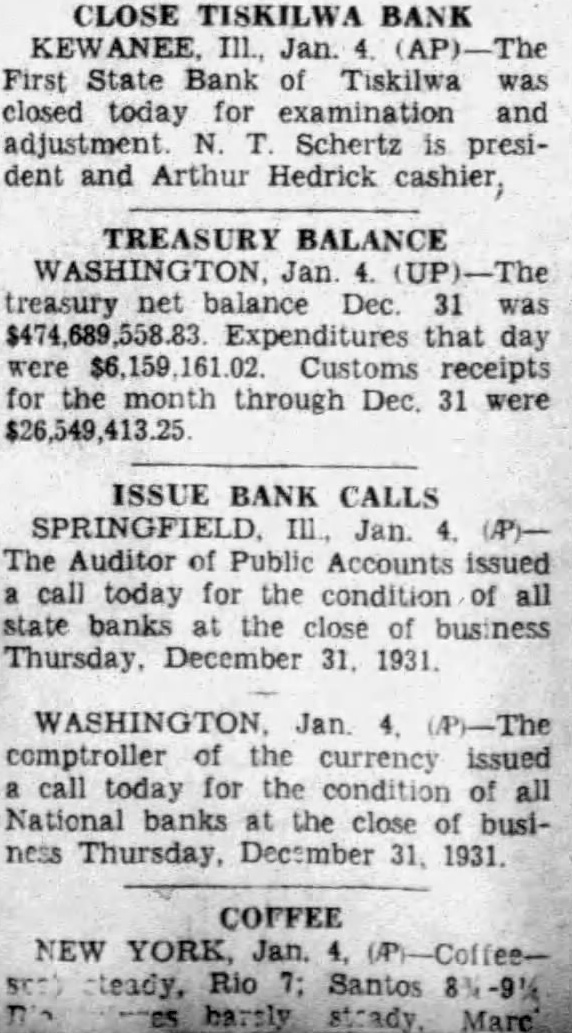

CLOSE TISKILWA BANK First State Bank of Tiskilwa was closed today for examination and adjustment Schertz president and Arthur Hedrick cashier, TREASURY BALANCE WASHINGTON Jan. treasury net balance Dec. was that day were Customs receipts month through Dec. 31 were $26,549,413.25 ISSUE BANK CALLS SPRINGFIELD Jan. The Auditor Public Accounts issued call today for the condition of all banks the business Thursday, December 31. 1931 WASHINGTON Jan (/P)-The comptroller currency issued call today for the condition of National banks the close of business Thursday, December 31, 1931. COFFEE NEW YORK, Jan.