Article Text

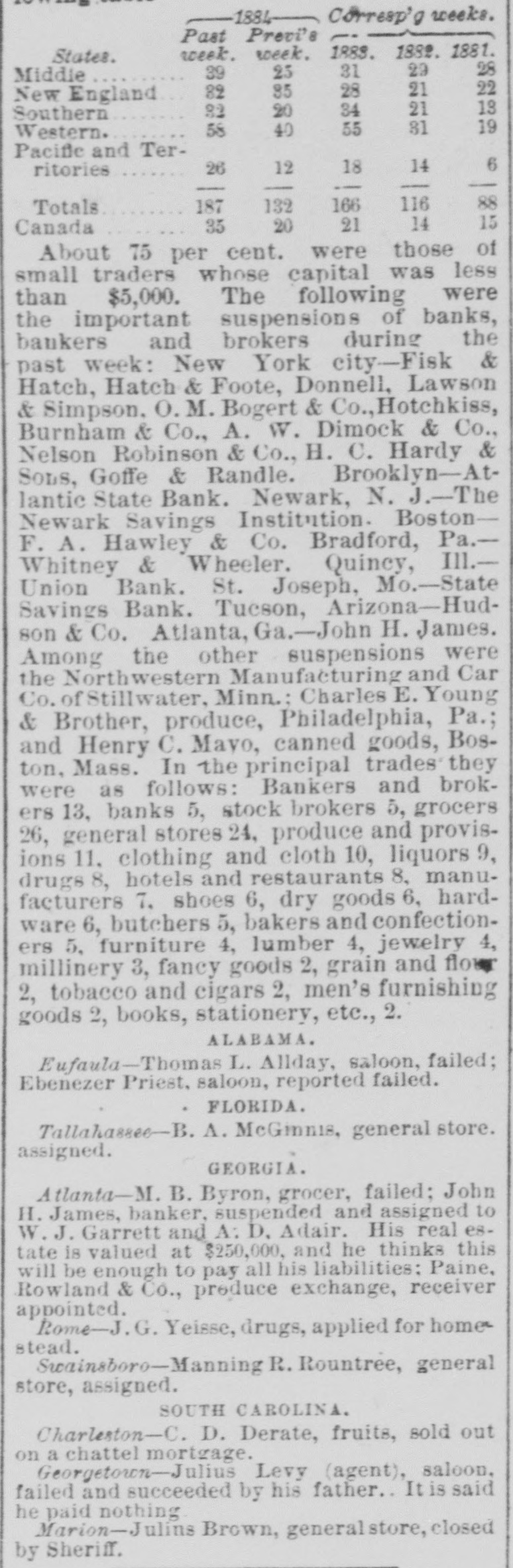

MORE FAILURES. WALL STREET, May 15th-2:30 P. M.Fisk & Hatch have suspended. The firm of Fisk & Hatch was composed of A. S. Hatch, President of the Stock Exchange, and Harvey Fisk. The firm has been the heaviest dealers in Government bonds on the street, and were considered stanch, conservative and reliable, and have been recognized as the financial agents here for the Chesapeake and Ohio Railroad system. They carried heavy amounts of their stock. The announcement of their suspension came like a thunderboldt on the Exchange. A. W. Dimick & Go., brokers, have suspended. A dispatch from Boston reports the suspension of F. A. Hawley & Co., a firm which, although not heavy dealers, was regarded in good standing. BOSTON, May 15th.-Hill, Stanwood & Co., brokers, correspondents of Goff. Randall & Co., of New York, have suspended, with liabilities at $1,000,000. ST. PAUL (Minn.), May 15th.-Armstrong Taylor has been appointed receiver of the St. Croix Land and Lumber Company, of which E. S. Austin is President. The assets are placed at $500,000; liabilities about $400,000. QUINCY (III.), May 15th.-The Union Bank of this city failed to open its doors this morning. When the Marine Bank of New York failed the Union transferred its account to the Metropolitan Bank, and the closing of the doors of that bank yesterday is given as the cause of the suspension.