Click image to open full size in new tab

Article Text

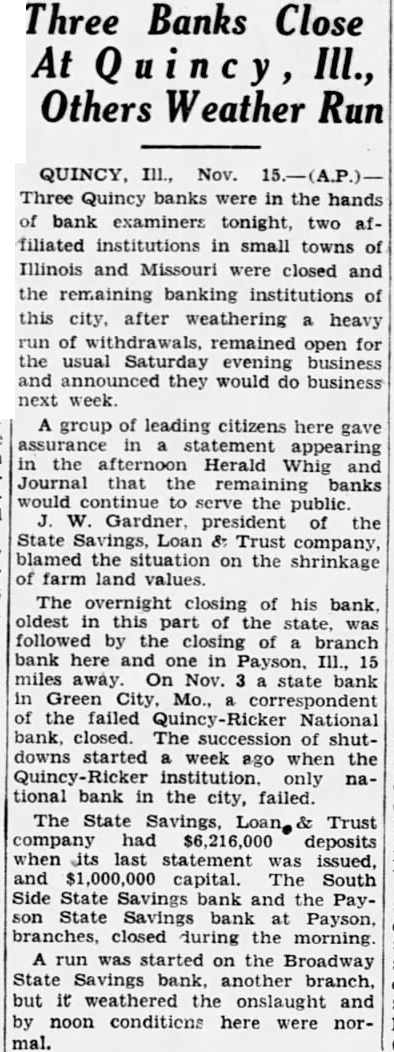

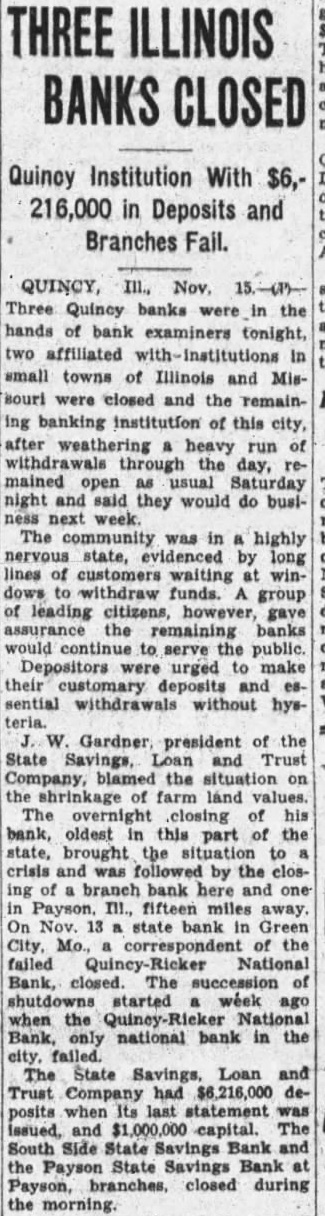

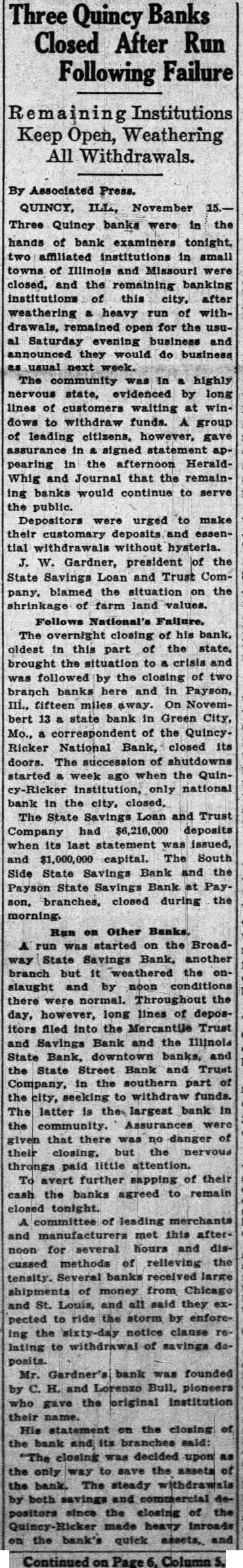

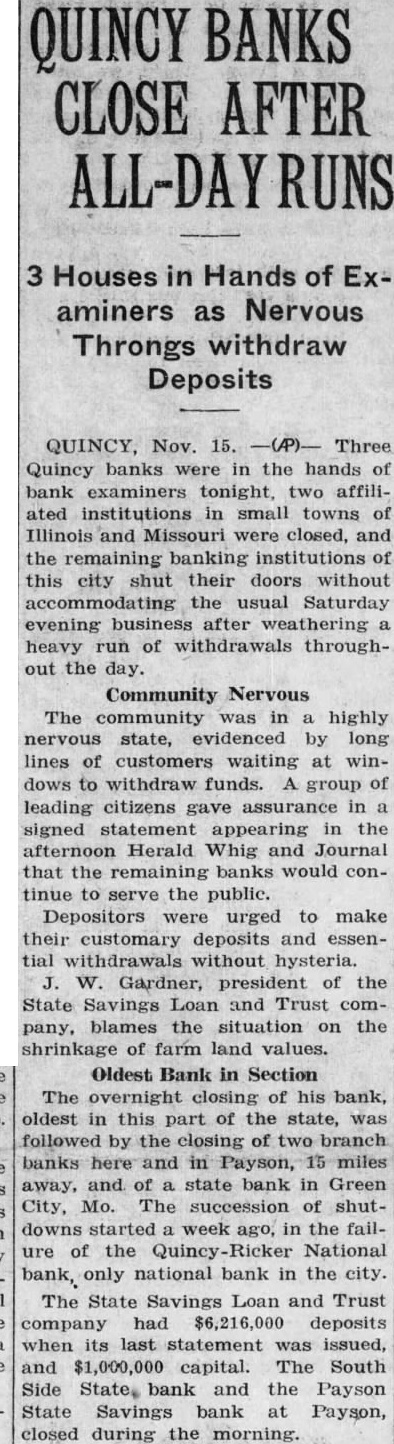

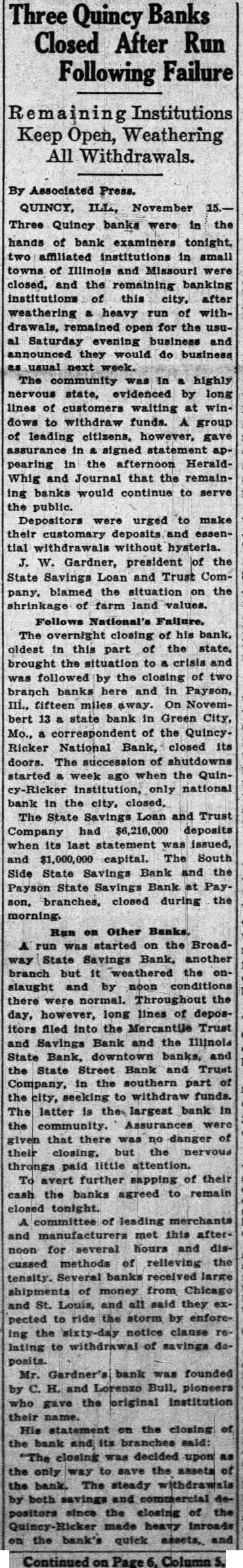

Three Quincy Banks Closed After Run Following Failure

Institutions Keep Weathering All

By Associated Press.

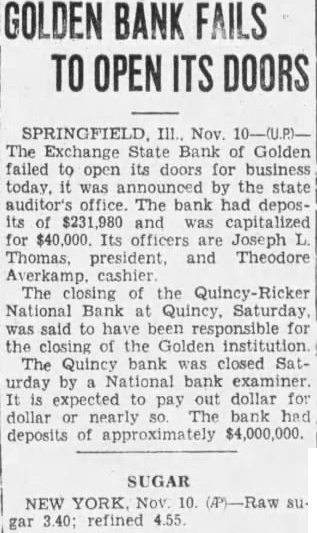

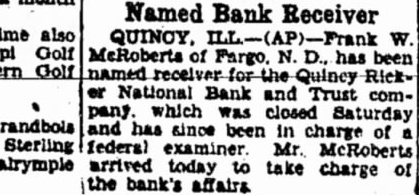

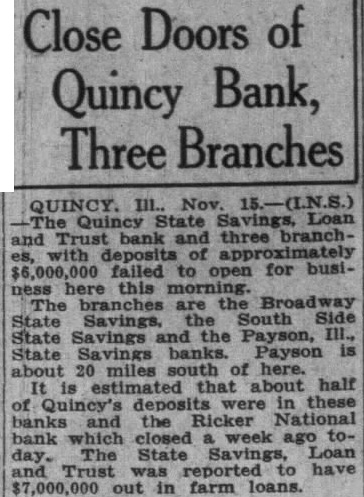

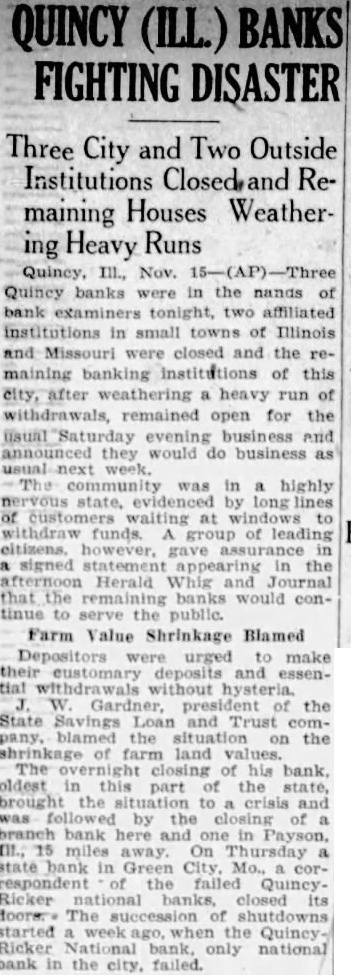

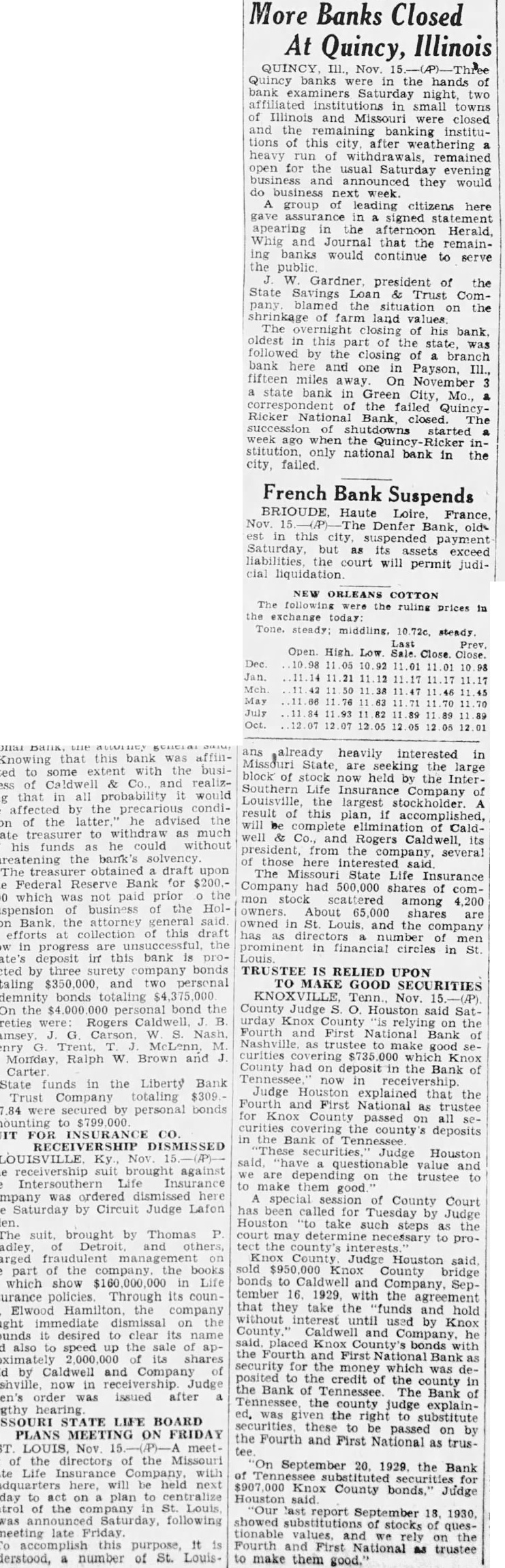

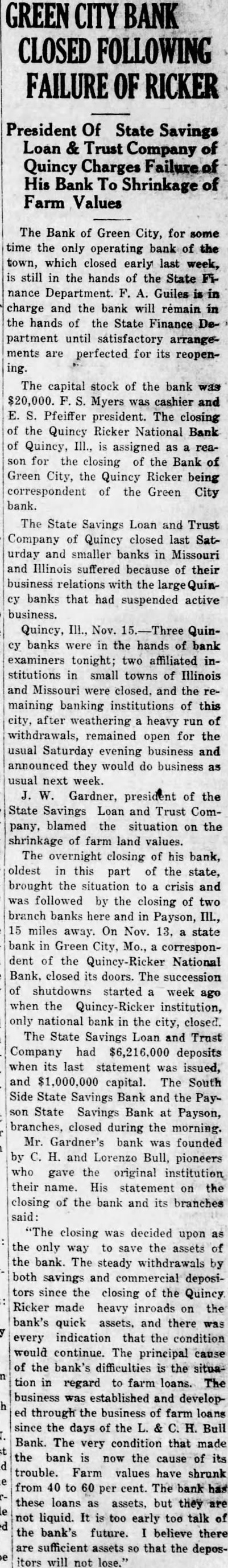

QUINCY, November Three Quincy banks were in the hands of bank examiners tonight, two affiliated institutions in small towns of Illinois and closed, and remaining banking institutions this city, after weathering heavy run of withdrawals, for the usuSaturday evening business and announced they would do business usual next The community in highly nervous state, evidenced by long lines customers waiting at windows to withdraw funds. group of leading citizens, however, gave signed pearing the afternoon HeraldWhig and Journal that the remaining banks would continue to serve public. Depositors were urged make their customary deposits essenwithdrawals without hysteria. W. Gardner, president of the State Savings Loan and Trust Company. blamed the situation on the shrinkage farm land values. Follows Failure. The closing his bank, oldest this part the state, brought the situation to crisis and was followed the closing of two branch banks here and in Payson, III., fifteen miles away. On Novembert state bank in Green City, Mo., correspondent of the QuincyRicker National closed its doors. The of started ago when the Quincy-Ricker institution, national bank in the city, The Loan and Trust Company had $6,216,000 deposits when last statement issued, and $1,000,000 capital. The South Side State Savings Bank and the Payson State Bank Payson, branches, closed during the morning.

Run on Other Banks. run started the BroadSavings Bank, another branch but weathered the onslaught by there were normal. Throughout the day, however, long lines of depositors filed into the Mercantile Trust and Savings Bank and the Illinois State Bank, and the State Street Bank Trust in the southern part the city, to funds. latter largest bank the community. Assurances that there was danger their the nervous paid little attention. To avert further sapping their cash the banks agreed remain closed tonight. merchants this afterfor several hours and disnoon cussed methods relieving the tensity. banks shipments money from Chicago and Louis, and said they pected storm enforethe notice clause lating withdrawal of posits. Mr. Gardner's bank founded and pioneers who the original their His the closing the bank closing was decided upon only way the assets the bank. The steady both savings the closing the quick assets,

Continued