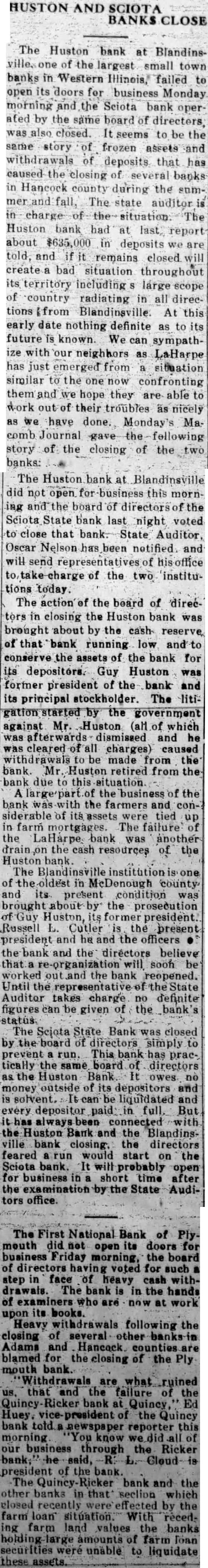

Article Text

HUSTON AND SCIOTA BANKS CLOSE The Huston bank at Blandinsville. one of the largest small town banks in Western Illinois, failed to open its doors for business Monday morning and the Sciota bank operated by the same board of directors, was also closed. It seems to be the same story of frozen assets and withdrawals of deposits that has caused the closing of several banks in Hancock county during the summer and fall, The state auditor is in charge of the situation The Huston bank had at last, report about $635,000 in deposits we are told, and if it remains closed will create a bad situation throughout its territory including S large scope of country radiating in all directions from Blandinsville At this early date nothing definite as to its future is known. We can sympathize with our neighhors as LaHarpe has just emerged from a situation similar to the one now confronting them and we hope they are able to work out of their troubles as nicely as we have done. Monday's Macomb Journal gave the following story of the closing of the two banks: The Huston bank at Blandinsville did not open for business this morning and the board of directors of the Sciota State bank last night voted to close that bank. State Auditor, Oscar Nelson has been notified and will send representatives of office to take charge of the two institutions today. The action of the board of directors in closing the Huston bank was brought about by the cash- reserve of that bank running low and to conserve the assets of the bank for its depositors. Guy Huston was former president of the bank and its principal stockholder. The litigation started by the government against Mr. Huston (all of which was afterwards dismissed and he was cleared of all charges) caused withdrawals to be made from the bank. Mr. Huston retired from the bank due to this situation A of the business of the bank was with the farmers and considerable of its assets were tied up in farm mortgages. The failure of the LaHarpe bank was another drain on the cash resources of the Huston bank. The Blandinsville institution is one of the oldest in McDonough county and its present condition was brought about by the prosecution of Guy Huston, its former president. Russell L. Cutler is the present president and he and the officers the bank and the directors believe that a re-organization will soon be worked out and the bank reopened. Until the representative of the State Auditor takes charge no definite figures can be given of the bank's The Scjota State Bank was closed by the board of directors simply to prevent a run. This bank has practically the same board of directors as the Huston Bank It owes no money outside of its depositors and is solvent. It can be liquidated and every depositor paid: in full, But it has alwaysbeen connected with the Huston Bank and the Blandinsville bank closing, the directors feared run would start on the Sciota bank. It will probably open for business in a short time after the examination by the State Auditors office. The First National Bank of Plymouth did not open its doors for business Friday morning, the board of directors having voted for such a step in face of heavy cash withdrawais. The bank is in the hands of examiners who are now at work upon its books. Heavy withdrawals following the closing of several other banks in Adams and Hancock. counties are blamed for the closing of the Ply mouth bank. 'Withdrawals are what ruined us, that and the failure of the Quincy Ricker bank at Quincy Ed Huey. vice- president of the Quincy bank told a newspaper reporter this morning You know we did all of our business through the Ricker bank; he said, R: L. Cloud is president of the bank. The Quincy bank and the other banks in that section which closed recently were effected by the farm loan situation With receding farm land values the banks holding large amounts of farm loan securities were unable to liquidate these assets