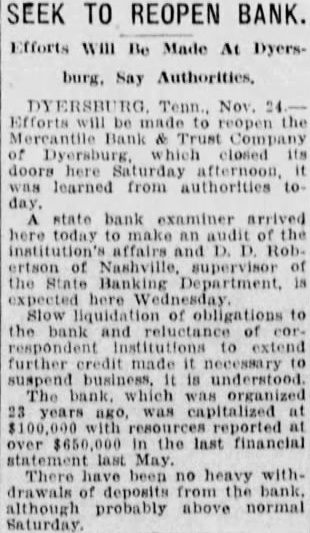

Article Text

SEEK TO REOPEN BANK. Efforts will Be Made At Dyers- Tenn. Nov. 24 Efforts will be made to reopen the Mercantile Bank & Trust Company of Dyersburg, which closed its doors here afternoon was learned from authorities to day. state bank examiner arrived here today to make an audit of the institution's affairs and D. D. Rob. ertson of Nashville, supervisor of the State Banking Department, is here Slow liquidation of obligations to the bank and reluctance of cor respondent Institutions to extend further credit made it necessary to suspend business, It is understood The bank was organized 23 years ago, was capitalized with reported at over $650,000 in the last financial statement last There been no heavy with drawals of deposits from the bank, although probably above normal Saturday