Article Text

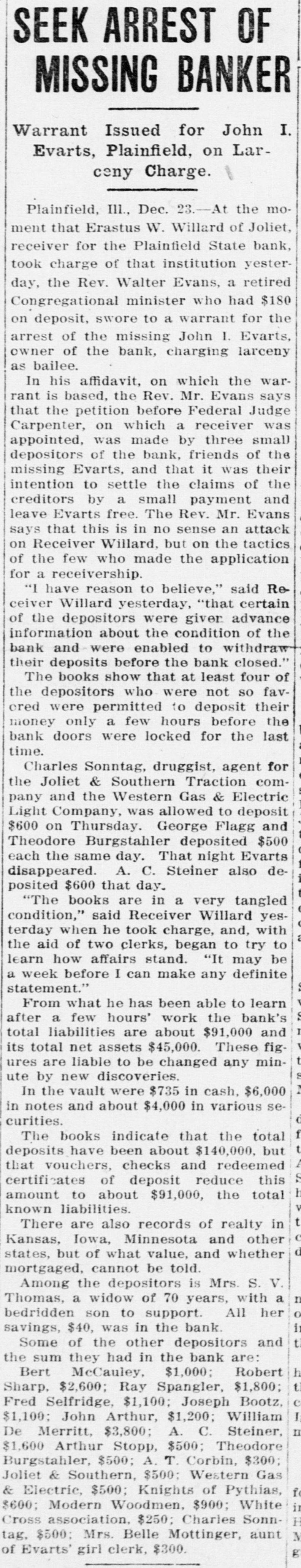

SEEK ARREST OF MISSING BANKER Warrant Issued for John I. Evarts, Plainfield, on Larceny Charge. Plainfield, III., Dec. 23.-At the moment that Erastus W. Willard of Joliet, receiver for the Plainfield State bank, took charge of that institution yesterday, the Rev. Walter Evans, a retired Congregational minister who had $180 on deposit, swore to a warrant for the arrest of the missing John 1. Evarts, owner of the bank, charging larceny as bailee. In his affidavit, on which the warrant is based, the Rev. Mr. Evans says that the petition before Federal Judge Carpenter, on which a receiver was appointed, was made by three small depositors of the bank, friends of the missing Evarts, and that it was their intention to settle the claims of the creditors by a small payment and leave Evarts free. The Rev. Mr. Evans says that this is in no sense an attack on Receiver Willard, but on the tactics of the few who made the application for a receivership. "I have reason to believe," said Re ceiver Willard yesterday, "that certain of the depositors were giver advance information about the condition of the bank and were enabled to withdraw their deposits before the bank closed." The books show that at least four of the depositors who were not so favcred were permitted to deposit their money only a few hours before the bank doors were locked for the last time. Charles Sonntag, druggist, agent for the Joliet & Southern Traction company and the Western Gas & Electric Light Company, was allowed to deposit $600 on Thursday. George Flagg and Theodore Burgstahler deposited $500 each the same day. That night Evarts disappeared. A. C. Steiner also deposited $600 that day. "The books are in a very tangled condition," said Receiver Willard yesterday when he took charge, and, with the aid of two clerks, began to try to learn how affairs stand. "It may be a week before I can make any definite statement." From what he has been able to learn S after a few hours' work the bank's total liabilities are about $91,000 and its total net assets $45,000. These figures are liable to be changed any minute by new discoveries. In the vault were $735 in cash, $6,000 in notes and about $4,000 in various securities. The books indicate that the total deposits have been about $140,000. but that vouchers, checks and redeemed certificates of deposit reduce this amount to about $91,000, the total known liabilities. There are also records of realty in Kansas, Iowa, Minnesota and other states, but of what value, and whether mortgaged, cannot be told. Among the depositors is Mrs. S. V. Thomas, a widow of 70 years, with a o bedridden son to support. All her in savings, $40, was in the bank. t Some of the other depositors and the sum they had in the bank are: Bert McCauley, $1,000; Robert t Sharp, $2,600; Ray Spangler, $1,800; e Fred Selfridge, $1,100; Joseph Bootz. I $1,100: John Arthur, $1,200; William III De Merritt, $3,800; A. C. Steiner, $1,600 Arthur Stopp, $500; Theodore Burgstahler, $500; A. T. Corbin, $300; Joliet & Southern, $500; Western Gas & Electric, $500; Knights of Pythias, in $600; Modern Woodmen, $900; White H Cross association, $250; Charles SonnM tag. $500: Mrs. Belle Mottinger, aunt of Evarts' girl clerk, $300. g