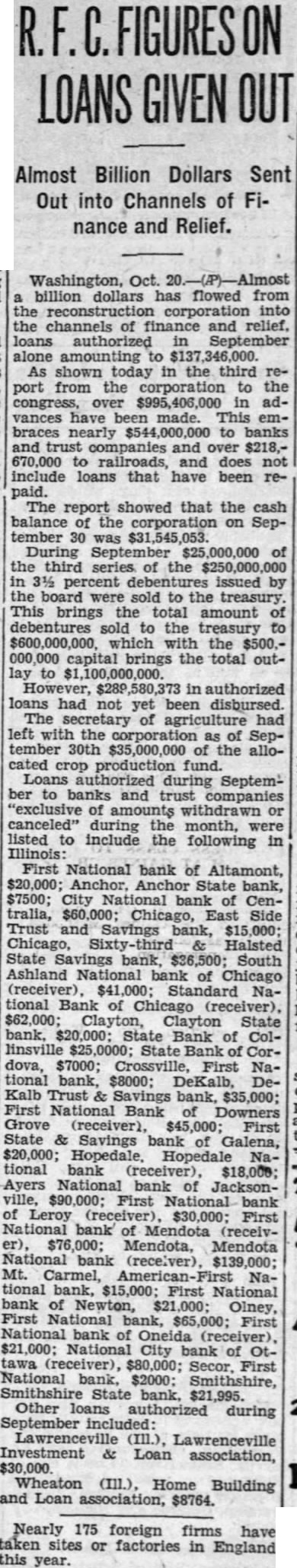

Article Text

Almost Billion Dollars Sent Out into Channels of nance and Relief. Oct. billion dollars has flowed from into the channels and relief. loans authorized September alone amounting As shown today in the third port from the corporation to congress, over in vances have been made. This braces nearly to banks and trust companies and $218,railroads, and does include loans that have been paid. The report showed that the cash balance of the corporation on September During September the third series of the percent issued sold to the This brings the total amount debentures sold to the treasury which with the capital the total outto in authorized loans had not been disbursed. yet The secretary of agriculture had left with the corporation of September 30th the allocated production fund. Loans authorized during September to banks and trust companies "exclusive of amounts canceled" during the month, were listed to include the following Illinois: First National bank of Altamont, State bank, $7500; City National bank of Centralia, Chicago, Side Savings bank, Chicago, Halsted State bank, South Ashland National bank of Chicago National Bank Clayton State bank, State Bank of ColState Bank of $7000; Crossville, First National bank, $8000; DeKalb. Trust bank, First National Bank of Downers Grove (receiver), $45,000; First State Savings bank of Galena, Hopedale, Hopedale tional bank (receiver), $18,000; Ayers National bank JacksonFirst National bank Leroy (receiver), First National bank Mendota (receiv$76,000; Mendota, Mendota National bank (recelver), Mt. Carmel, National bank, First National bank of Newton, Olney, First bank, First National bank Oneida (receiver), National City bank (receiver), Secor, First National bank, Smithshire, Smithshire State bank, Other authorized during September included: (III.), Lawrenceville Loan association, Wheaton Home Building and Loan association, $8764. Nearly 175 foreign firms have taken sites or factories in England this year.