Click image to open full size in new tab

Article Text

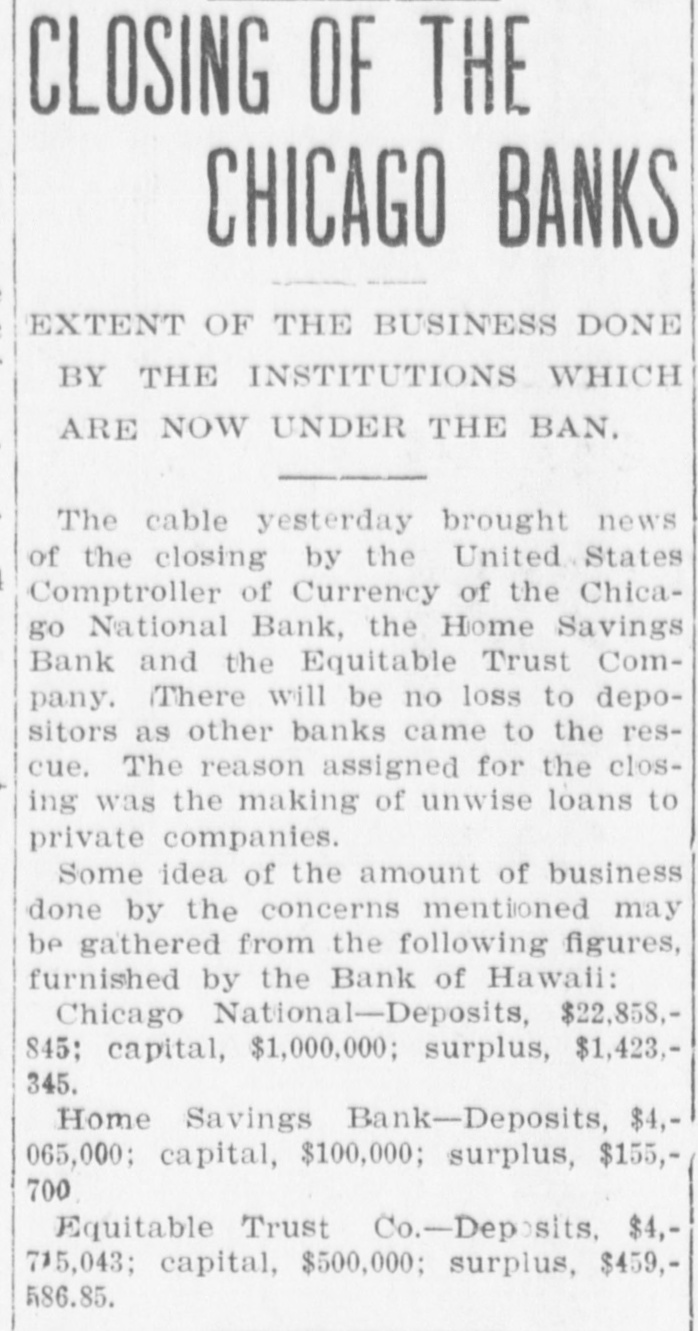

FINANCIAL CRASH CHICAGO ties include $2,707,563. of which amount $454,000 are deposits in trust National Bank, a Savings Bank and $500,000 in certificates of deposit. and a Trust Company The Chicago National bank has been an active factor in local politics for several years, and the enormous funds received from the taxation for the buildBrought Down in a Heap by ing and maintenance of the drainage canal have been a part of its deposits Comptroller Ridgley. and have been available for investment by the bank. A change was recently made in the political complexion of the LIABILITIES board and it was understood that these TOTAL funds would not remain for any length of time as deposits in the Chicago National bank. Their impending withAre Roughly Estimated at 26 drawal had much to do with the fear of the other banks of a far reaching Million Dollars. collapse if they did not come to the aid of the weakened institutions. Walsh's Operations. Assets of Three Institutions The enterprises which are generally credited with being the indirect cause Placed at $20,000,000. of the financial troubles of Mr. Walsh are the Bedford Quarries company of Indiana, and the Southern Indiana Railroad company, which was conTO BE TAKEN CARE OF. structed by Mr. Walsh for the purpose of getting the stone from his quarries to the market. This railroad was conOther Banks Promise to Provide structed by Mr. Walsh at a heavy expense some years ago, because he befor the Shortage. lieved that the Monon railroad, which was the only outlet of his stone quarries, was charging him too high a rate Trouble Is Due to Operations of freight. He endeavored to reach an agreement with the road, and failing to of John R. Walsh obtain what he considered satisfactory terms constructed a railroad of his own In addition to these two enterprises which he practically owns, Mr. Walsh And the Connection of the is a heavy stockholder in the Akron Business With Politics. Gas company, Akron, O., Illinois Southern Railroad company and Rand, McNally company, Southern Indiana Express company and a half score of Chicago, Dec. 18.-Action has been gas, electric lighting and coal mining taken by the comptroller of the curcompanies. To the stone quarries and rency, William B. Ridgley, that will the Southern Indiana railway Mr. Walsh made heavy loans of the funds compel the three large financial inof the bank and it was these to which stitutions, the Chicago National bank, objection was made by Comptroller the Home Savings bank and the EquitRidgley. able Trust company, dominated by Repeated assurances by the officers John R. Walsh, of this city, to wind of the bank that these loans would be called in, or at least largely curtailed up their affairs. The other national were not fulfilled and finally Mr. banks of Chicago have come to the Ridgley determined on a personal inrescue, and it is declared on the auvestigation. The action of last night thority of the clearing house associafollowed his determination. It is declared by local financiers that tion, the comptroller, and also by the Mr. Walsh has invested all the way officers of the Chicago National bank. from $5,000,000 to $15,000,000 in the that not a single depositor will lose a quarries and the railroad. His great cent. The difficulties of the three desire was to gain for the railroad an wrecks. which are practically branchentrance into Chicago but in this he was not successful. During the last es of the same institution, are attribthree years he has endeavored to sell uted by the comptroller of the curthe road to the Pennsylvania company rency to the large loans made by the but the terms could not be agreed upon Chicago National bank to the railroad, and the sale never could be put through. coal mining and other private enterprises controlled by Mr. Walsh. A Tremendous Surprise. Some time ago the comptroller To the public at large, which was called the attention of the officers of not acquainted with the magnitude of Mr. Walsh's enterprises, the news of the bank to the fact that they were the difficulties surrounding his banks making loans to these enterprises of came as a tremendous surprise. Not Mr. Walsh which in his opinion were a word of the difficulties had reached too large for the safety of the instithe public Saturday night and the first information was conveyed by extra tution. Repeated promises were editions of the morning papers. made that the condition should be Two hours before the time for the rectified, but no action satisfactory to opening of the bank large crowds of the comptroller was taken. Three people who had money in the Chicago days ago he came to Chicago for the National and the Home Savings bank were gathered in front of the banks purpose of making an investigation waiting for the doors to open so that into the affairs of the three banks and they might withdraw their funds. found them in such a condition that Inside the banks ample provision he judged immediate action to be had been made for the impending run, money was laid out in large piles, necessary. Some trifling delay had and additional clerks were stationed at ensued because of the inability of Mr. the paying windows and arrangements Ridgley to meet the officers of the were made in other parts of the bank banks and officials of the state auto pay out the money as fast as it was called for. G. C. Johnson, a messenditor's office. The fact that the Home ger for another bank, who had $10,000 Savings bank and the Equitable Trust in the Home Savings bank. was the company are under state supervision first at the door and he held the head made the presence of the latter offiof the line when the doors were opened cials necessary and the rush began at 10 'clock. It was announced by Vice President Clearing House Call. Blount of the Chicago National bank, The officials of the different Chicago that all demands would be paid as fast banks were told of the situation and a as they were made, by the Chicago hurried call was sent out for a meeting National bank and the Home Savings of representatives of the Chicago clearbank. The latter has the right under association as well the state law to demand 60 days' cers ing house of the city banks. as the offiThe meeting was notice of withdrawal from all deposicalled to order in the office of President tors, but it was decided not to invoke First National this rule and to pay every account as Forgan o'clock of the bank at 3 Sunday afternoon and was in soon as called for continuous session until 5 o'clock this Officers and Directors. morning. A careful canvass of the situaThe officers of the Chicago National tion revealed that the Chicago National bank are: bank had deposits to the amount of President. John R. Walsh: vice $16,000,000. the Home Savings bank had president, Fred M. Blount; cashier, T. savings deposits to the extent of $4,000,M. Jackson 000 divided among about 8,000 depositors. The directors are: F. G. McNally, The liabilities of the two banks, and of John R. Walsh, F. M. Blount, John M. the Equitable Trust company were Smythe, W. Best, C. K. G. Billings, roughly estimated at $26,000,000. The Maurice Rosenfeld. assets of the three institutions made up The officers of the Home Savings about $20,000,000 of the amount and the bank are: directors and officials of the Chicago W. J. Onahan, president; Charles E. came to the Schick, cashier. to about securities National bank amounting front $3,000,000 with The directors are: C. K. G. Billings, more. This left a deficit of about $3,000.Maurice Rosenfeld. John M. Smythe, 000 to be faced and the Chicago W.J Onahan, William Best, F. G. Mcat the represented meeting declared banks at Nally, John R. Walsh. once that they would meet the situation The officers and directors of the and care for the deficit. Equitable Trust company are pracIf it proved necessary to advance any tically the same as those of the two more than $3,000,000 to meet all demands, banks. the banks pledged themselves to make Mr. Walsh kept to his home this up the amount, whatever it might be. morning and declined to see anybody The great difficulty confronting the He has not been well for a number of bankers in the meeting was to arrange a days. and neither yesterday or today legal settlement of the case in the pitiwould he leave his room Callers at fully short time at their disposal at the his residence were referred to the bank hour of commencing business this mornfor all information, and to the request was finally for a statement which was sent to him, ing. addition It to winding arranged that in up the affairs of the Mr. Walsh sent back word: "I have three institutions ,the allied bankers nothing to say. Any statement that is should take all of Mr. Walsh's private to be made will come from the clearenterprises including his coal mines and ing house association.' railroads and stone quarries. At the close of the meeting a stateWALSH PROTESTED. ment was issued by the Chicago clearing