Click image to open full size in new tab

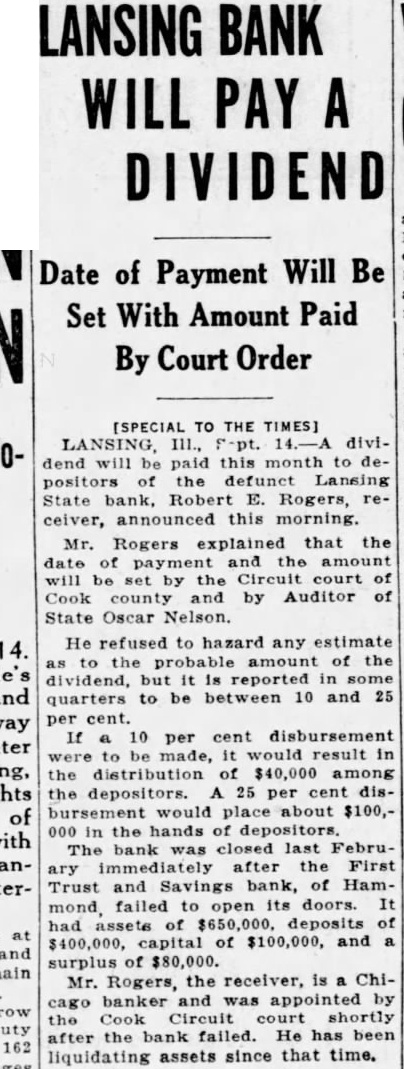

Article Text

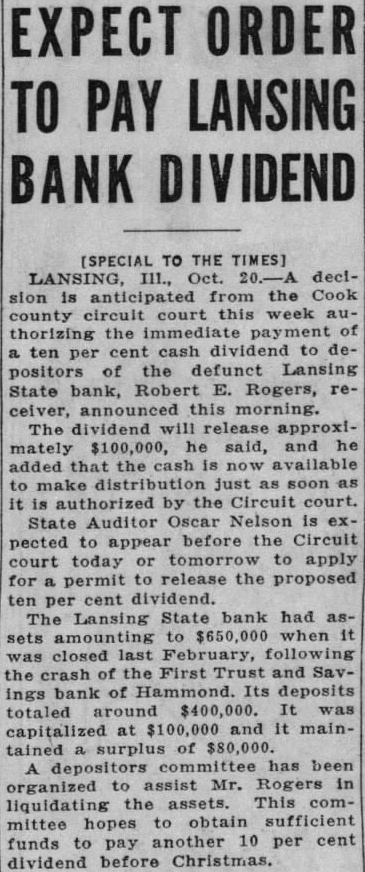

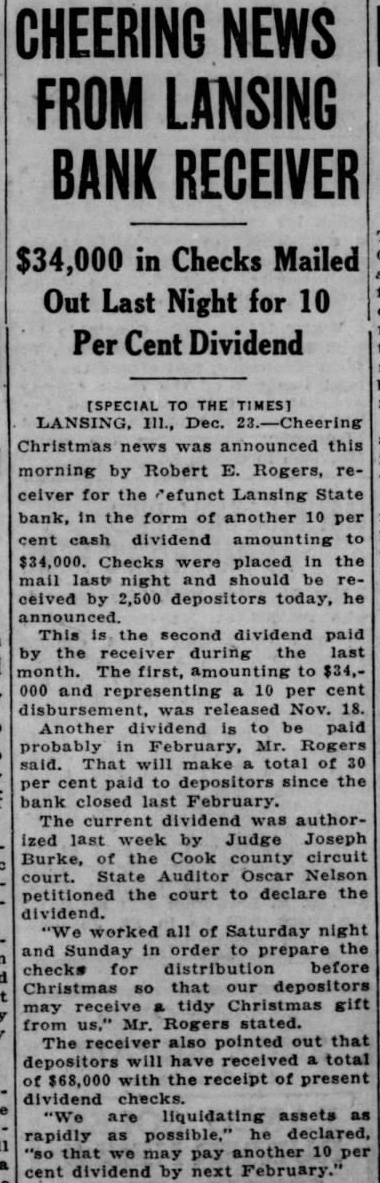

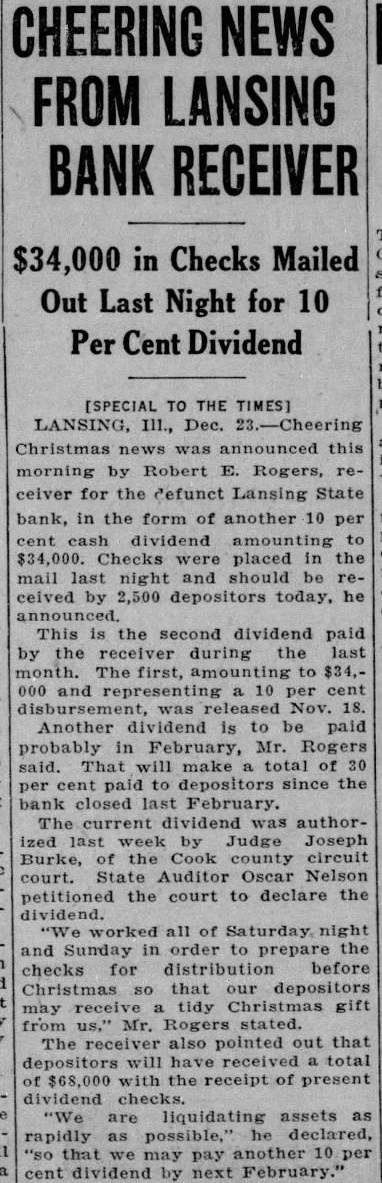

RECEIVER READY

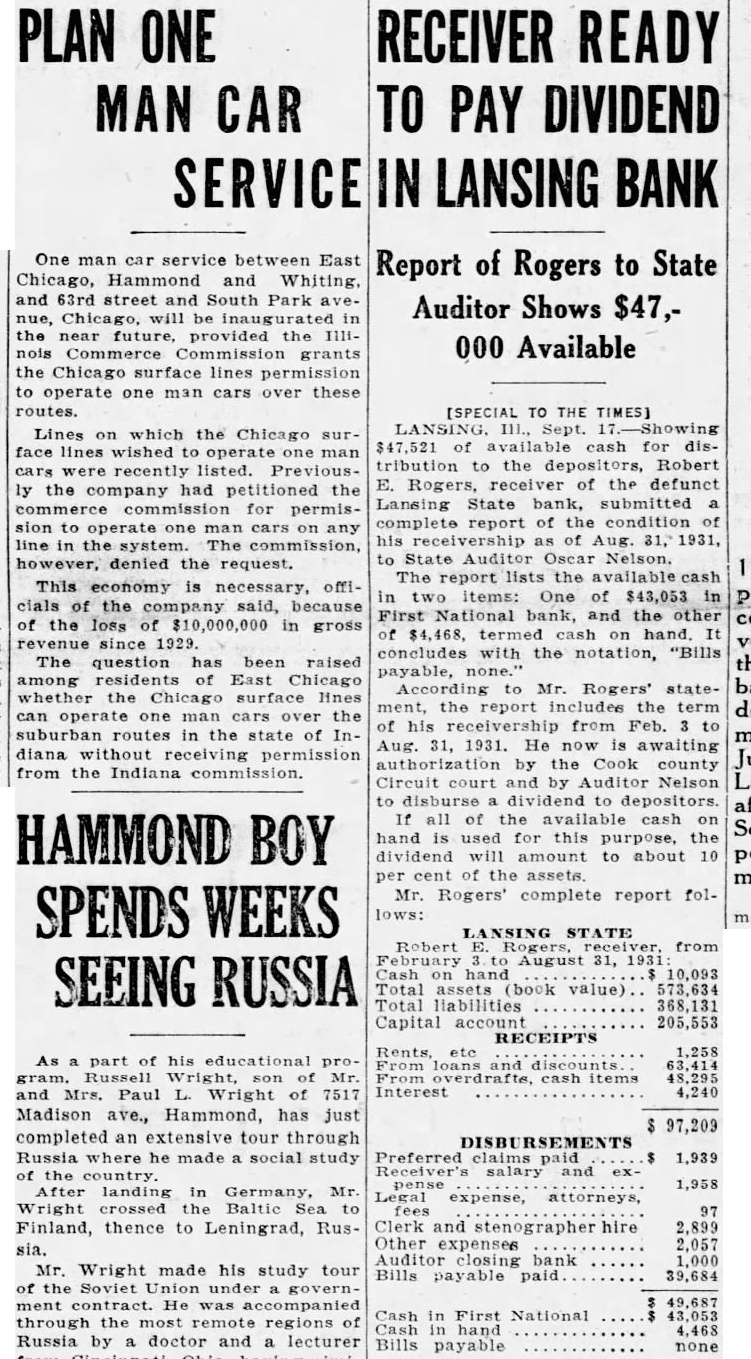

PLAN ONE MAN CAR TO PAY DIVIDEND SERVICE IN LANSING BANK

One man service East Chicago, Hammond and Whiting, and street and South Park will in the future, provided the IIIInois Commerce Commission grants the Chicago permission to operate one over these routes.

Lines on which the Chicago sur. face wished recently listed. ly the had the for permission to line denied the request. This necessary, offithe company the loss of $10,000,000 in gross since 1929. The question has been raised among residents East Chicago whether the Chicago surface lines can operate the suburban in the of Indiana permission from the Indiana commission.

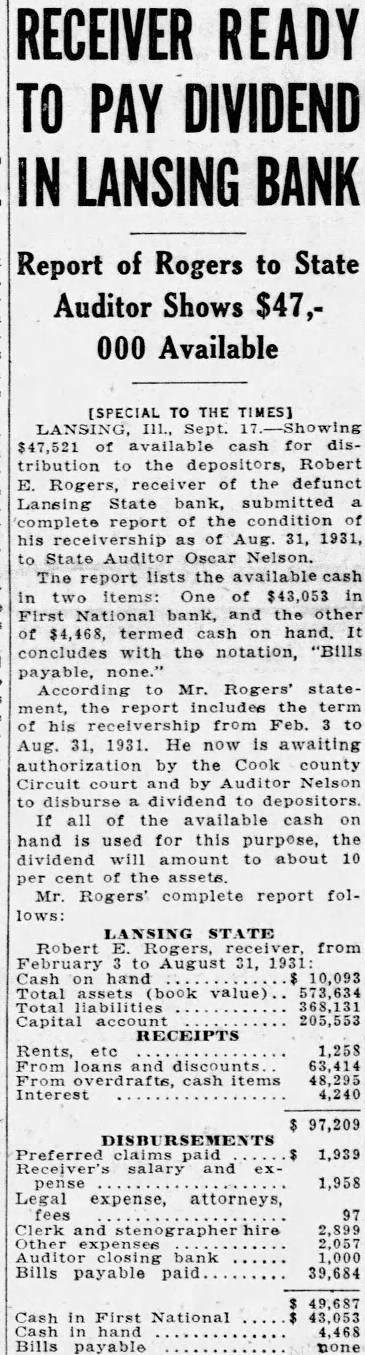

Report of Rogers to State Auditor Shows $47,000 Available

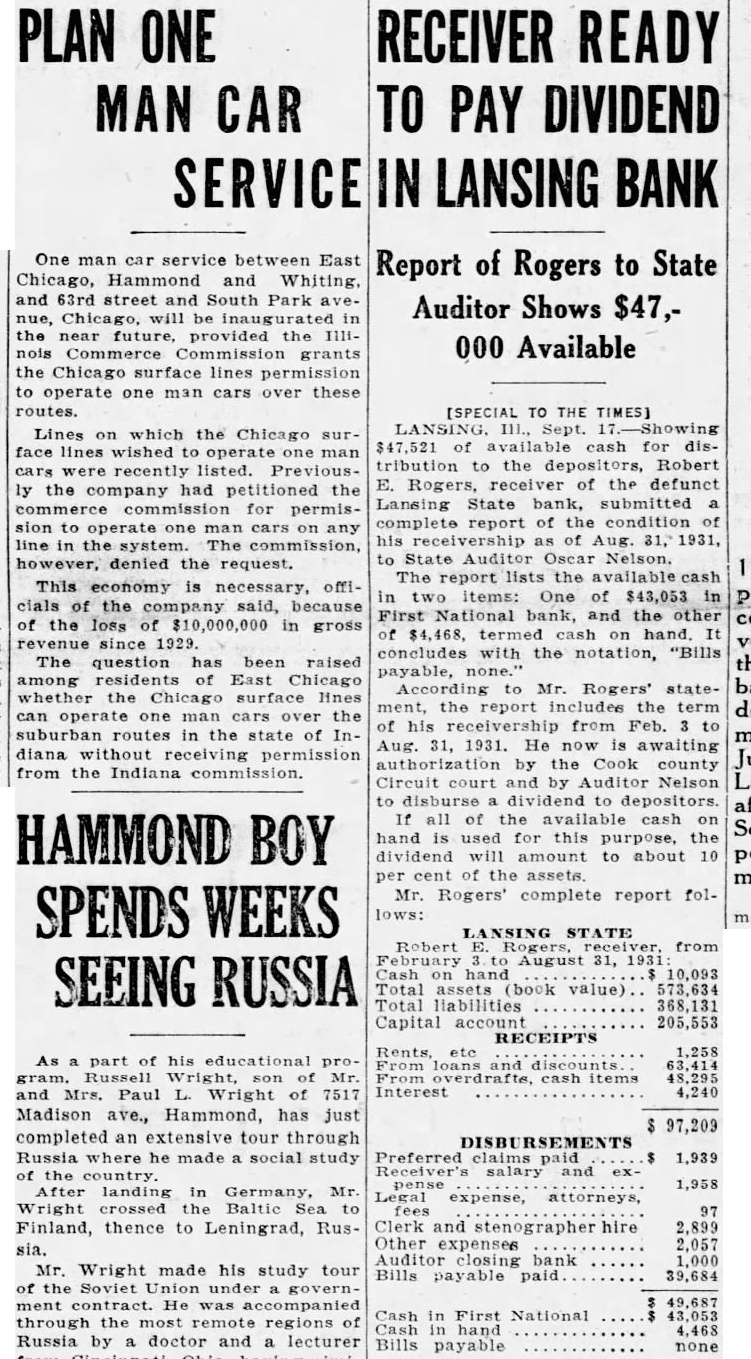

[SPECIAL TO THE TIMES) for tribution the Robert Rogers, receiver of the defunct Lansing State submitted report of the condition his receivership Aug. 31, 1931, to State Auditor Oscar Nelson. The report lists the available in two of $43,053 First National bank, and the other concludes with the notation, "Bills payable, According Mr. Rogers' statethe includes the term of receivership from Aug. 31, 1931. He awaiting authorization by the Cook county Circuit court and Auditor Nelson to dividend depositors. all of available cash hand is used for this purpose, the dividend amount to about per Mr. Rogers' complete report

STATE Robert 31, Total liabilities Capital account 205,553 RECEIPTS Interest

$ 97,209

Preferred 1,939 1,958 expense, attorneys, Clerk and stenographer hire Other expenses Auditor bank 39,684 Cash First National hand Bills none