Article Text

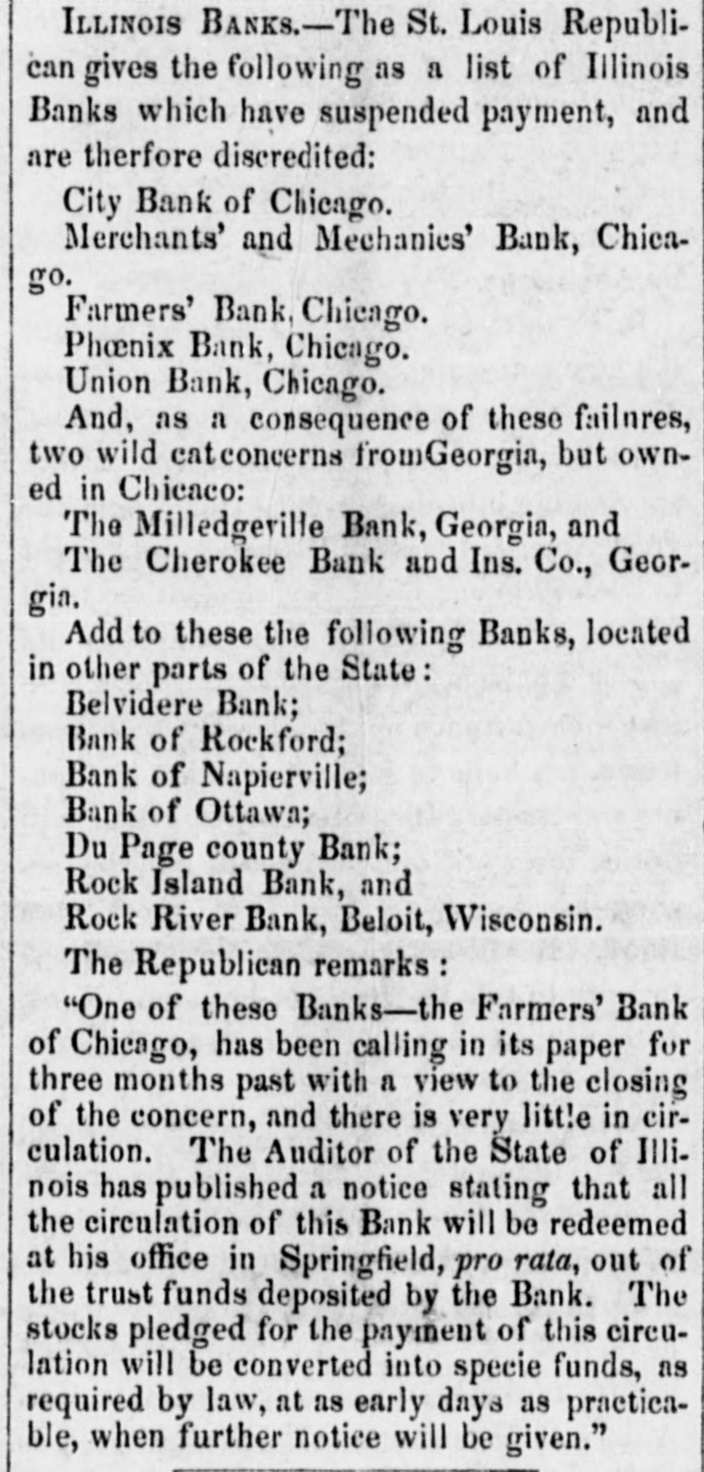

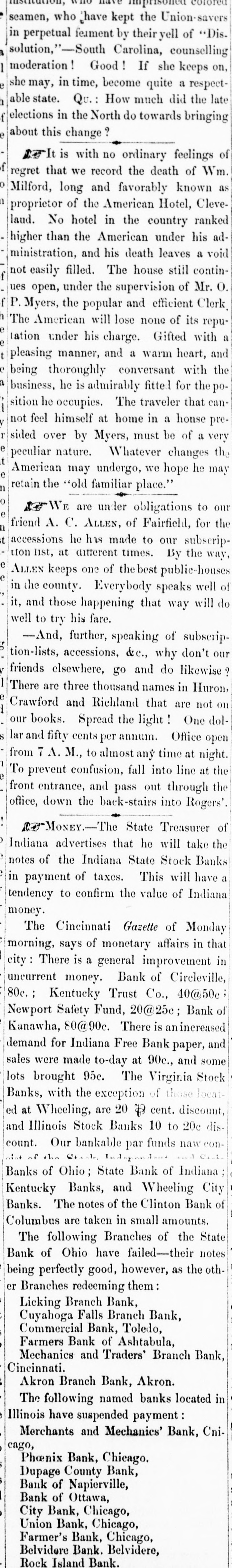

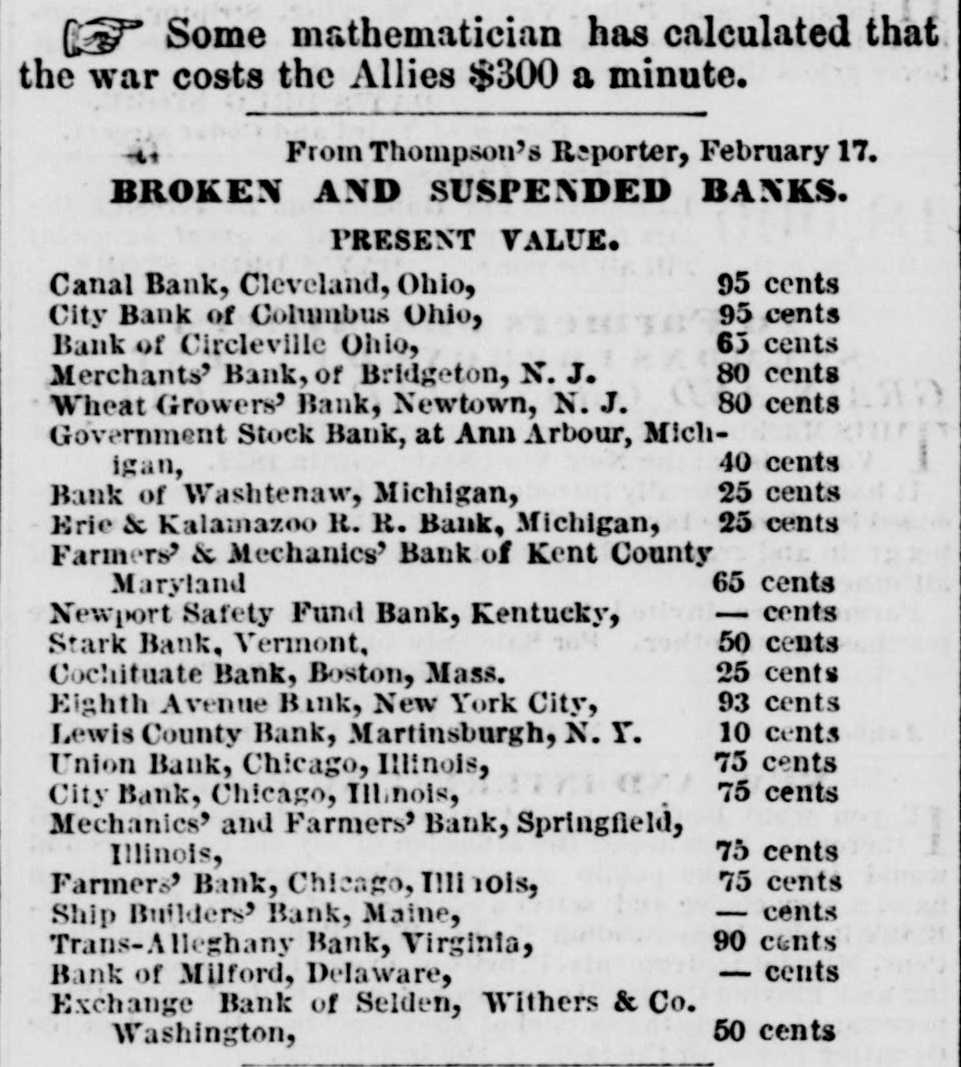

The Financial Crisis. RUN ON THE BANKS OF WASHINGTON. WASHINGTON, Nov. 14, 1854. The run on the Exchange Bank in this city continue. to-day, but there were appearances of an abatement at the close of bank hours. The paper of the bank is re. deemed promptly, but depositors are not allowed to remove their deposits, and bill holders are paid in notes on the Trans-Alleghany Bank of Virginía-an institution said to belong to the same firm. Strong doubts are entertained as to the capability of the bank to sustain itself under such sudden pressure. The run on the Trans-Alleghany, the Arlington, the Old Deminion, and the Kanawha banks, and also the Exchange Bank of Selden, Withers & Co., still continues, and each bank is redeeming its notes with those of the others. EXCITEMENT ABOUT THE CANAL BANK OF CLEVELAND. CLEVELAND, Nov. 14, 1854. Dr. Ackley, a special depositor of eight thousaed dollars in the Canal Bank of this city, as State Commissioner for the erection of an insane asylum at Newbury, attempted to get possession of the property of the bank by law, as assignee, bnt was refused the keys of the safe. Thereupon, the Sheriff caused the safe wall to be broken into. Meanwhile, a general depositor of fifteen thousand dollars sued the bank, and summoned the 33signee to give him possession. The landlord of the building then refused to accept the assignee as a sublessee, and the breaking in of the wall was temporarily suspended. It was afterwards resumed, and it was proceeded with amidst the greatest excitement. What was got by the assignee has not yet transpired. SUSPENSION OF THE CITY BANK OF CHICAGO. CHICAGO, Nov. 14, 1854. The City Bank of this city this morning suspended. Its capital was two hundred thousand dollars. STOPPAGE OF GEORGE MILNE & co., PRIVATE BANKERS. CINCINNATI, Nov. 14, 1654. George Milne & Co., private bankers, of this city, stopped this morning. WESTERN BANK DIFFICULTIES. CHICAGO, Nov. 14, 1854. The Union Bank has closed. The bills of the Elgin Bank are again being taken. Great excitement exists here in regard to the continued bank failures.