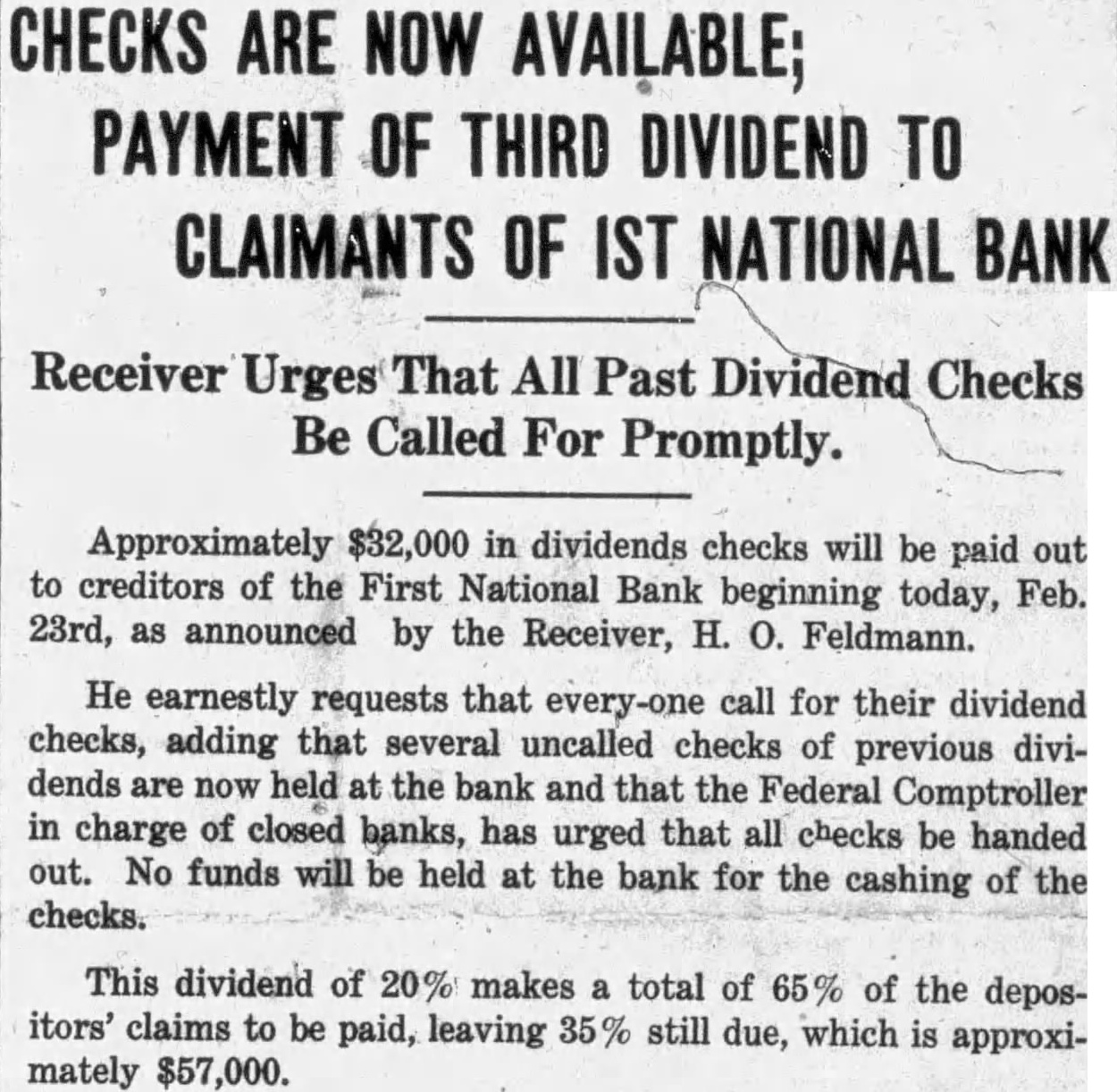

Click image to open full size in new tab

Article Text

first for restaurant. Some of former tauranteurs were Charles Kimler, Claude Gilmore and Skillman. Next door east what known the Wilcox building and taurant of Jimmie Poindexter, time the location of the undertaking establishment of Hallowell, George Patterson; and Michael Son's harware stores. The grocery store of Gerald Bock next in the Bratton building, comes where Bratton for years harness maker. Fay Sartain clerk. The undertaking parlors of the Iden He has been comes located here for about and his Delmar is now years son, him. Then there is the Gillock sisting barber shop, with his son, George, his father. Mr. Gillock sisting cupied this building for many years. The pierce Beauty shop occupies part of the room. The next is the hardware store of R. Stevens, who succeeded George Strayer, about two years sors of Birney Hefling, Guard Bishop, Cline and Crumbaugh in the hardware business. Son, Next comes the drug Williams. This has been of drug store for many years since of Dr. Buckworth and his the days Dana, to be followed by Henry son, Peters. Mr. Williams veteran the business men having come mong here in 1921 to clerk for Deventer. He also has the Varitey next door, which managed by his wife and his daughter, Bonna Pickard. Mr. Pickard works in the drug store. Next comes an old land mark, the location of the clothing store of later the store of St. Elmo Young, the Schumacher dry Murray, goods store and now that of his son, John H. Schumacher. There we find Mrs. Grace Underwood and Gertrude McCracken, as clerks. Rices next was the location bakery of Elmo Ed. Beckham and Murray, restaurant. David King built building in the 1870 and the the postoffice was located here at one time.

Next door the Watt building the cleaning of Dewey Here located the first Holderly. was picture house run by Harry moving VanAtta, later Harry Clarey had jewelry store here. On the in the Watt building corner the meat market of Markland, location of the old King Parks the and later that of Barngrocery store Sarver and Barnum. um Across East street, the old location of The Journal, is the Princess Theatre built Marcus West, and now under by of Chas. Lewis. the management VanAtta ran the theatre for Harry number of years before going/to Callfornia. In the same building is the Radio Shop, Oscar Kirchner, proprieJust east is the office of the tor. Power Light Company, with nois Russell Brown local manager, Lloyd electrician and Miss Maude Kindig The last business Cline, secretary the street that of place on Whitecraft in the hardware pump business Whitecraft LeRoy business men having here in work for come Morris in the South Center Street

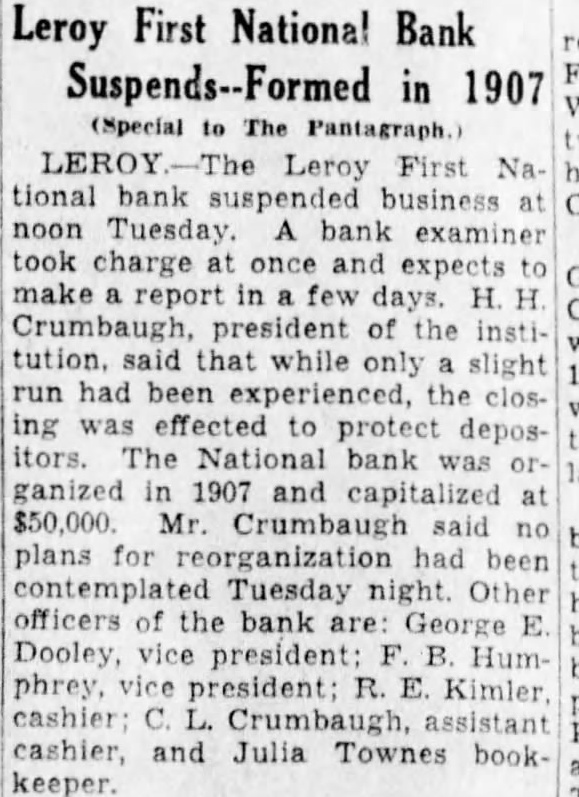

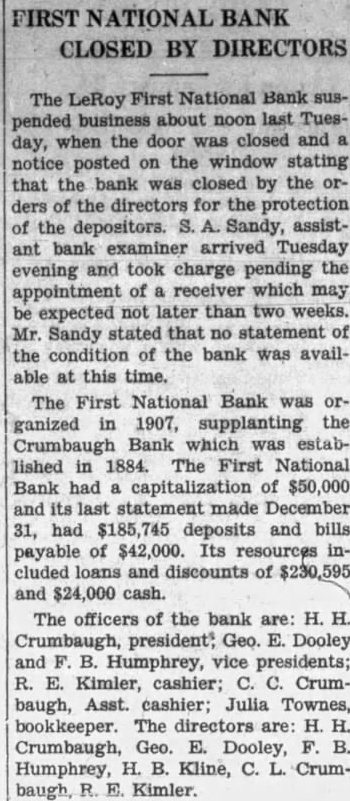

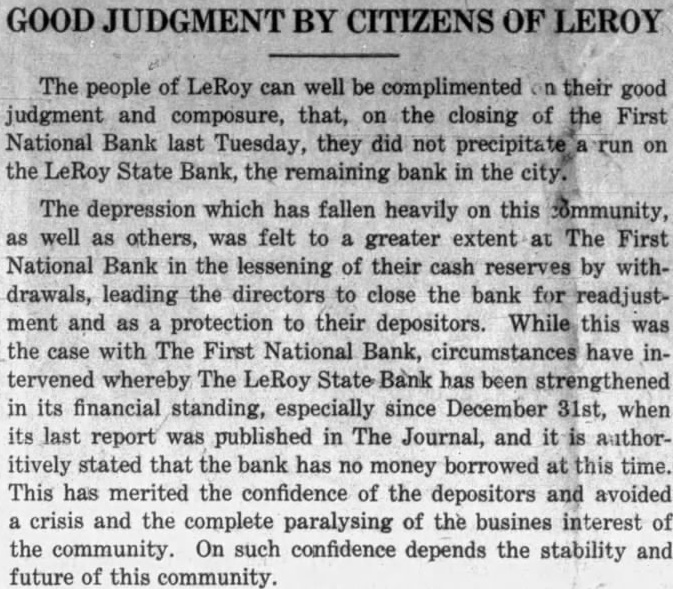

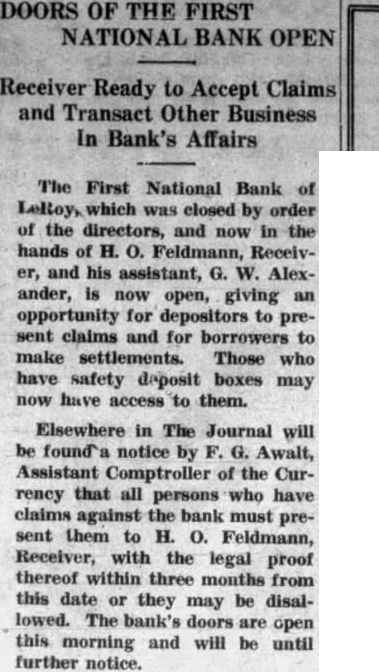

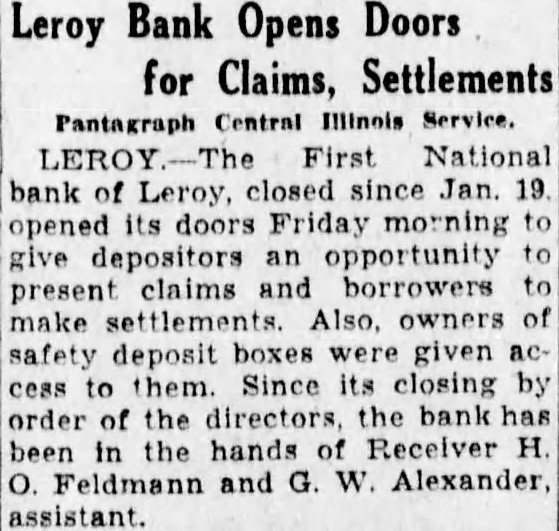

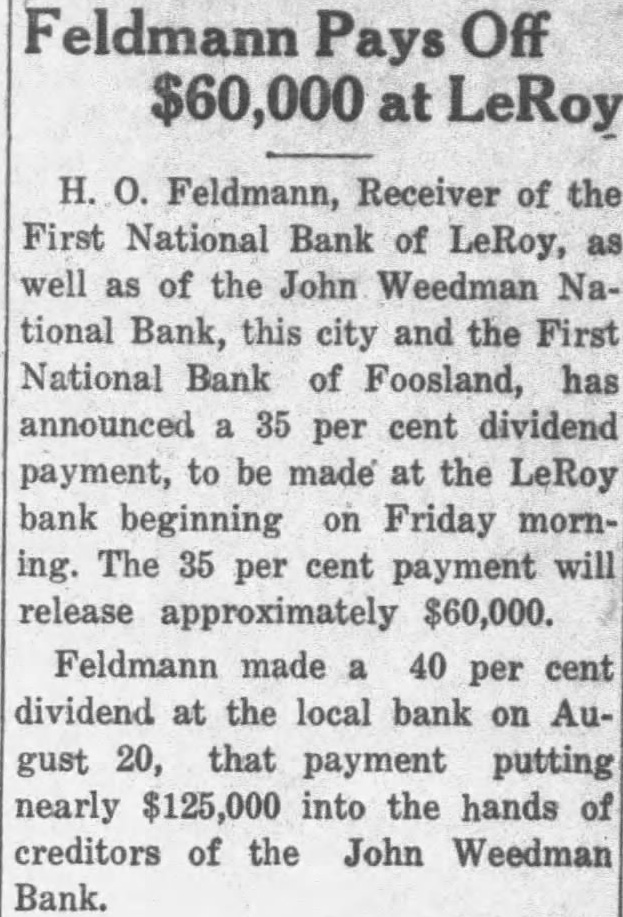

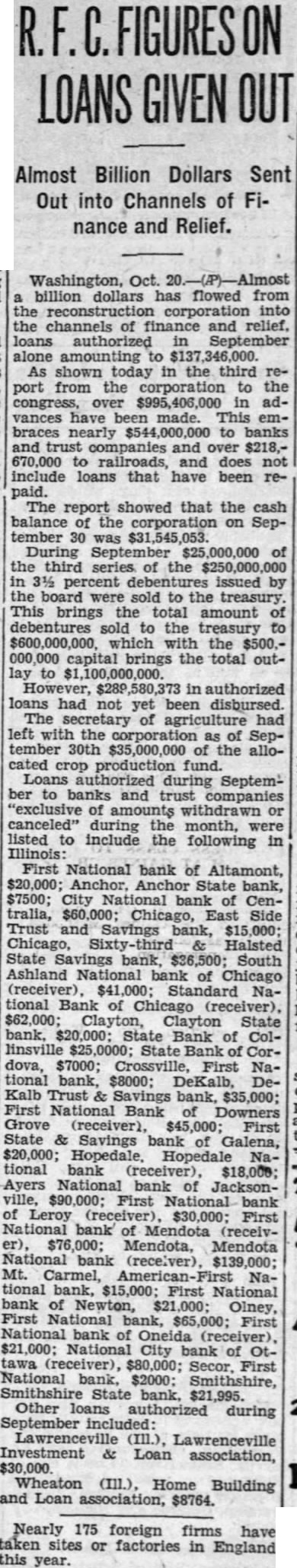

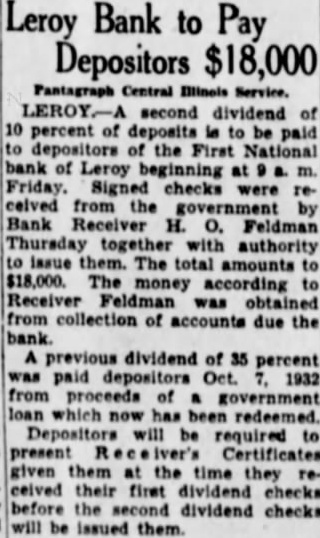

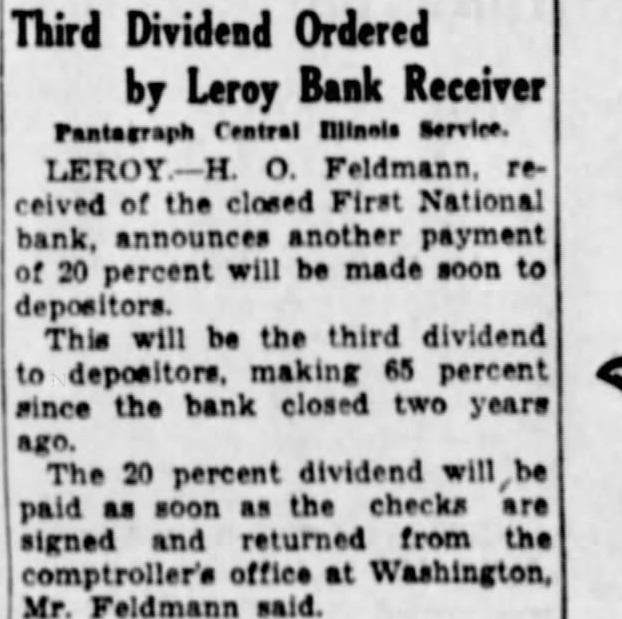

Going to the south of the street and coming back west you will find the office of Dr. Berneice McConnell, recently the office of Dr. R. May. Next is the office of veterinarian. the ing are the plumping shop Kelley and the and the Jones shop with proprifather, Jones. in the next block the pool Ray Keys, time been Donald long having Buckles. Then the restaurant of VerLand, in the building. Next the location of the stores of grocery Wm. Keys, Martin Bros., Rees & Arrowsmith, now the Kroger Grocery manager and Mr. store, and Mrs. Francis Dawson, clerks. Then the double front of The comes How, of and R. Humphrey, the location of the Morris once hardware store. Kenneth Humphrey and Kelley Schultz are store salesmen. The next building that built by Dickinson and remodeled by where he had butcher Corbin, for several years and now shop cupied by Mayfield store and by the Hurley meat grocery It is known as the Eskew market. The the post building. built by Dr. John Haig office building 1897, and where the postoffice has been located ever since. Then comes Owen building built by Leslie the Owen, law office, later the of and now that of fice McKay Arlo E. On the corcer the imposing Roy State Bank building, the old locaof the Keenan building which cation and which had been built in 1872, Reynolds Dry Goods store, the hotel. Miles Keenan bank LaMar Moore, Grizzelle is the Miss Alice Russell Clyde Killion and employed. The First NaAcross the corner in 1884, the tional bank home of the Citizen's bank for and later the First Naber of years under the receivership of tional now The next door west Feldman. store, which for the Rutledge drug half was the Vannearly century Deventer drug store. store is next, The Clothing new location of the to the soon Phares is the postand the store conducted. master Pearl Lawson Bishop.. Next the vacant store room formby Harry Buckles for erly occupied store. Robt. Murray was grocery cated here for number of years. The corner building that occupied Dean Bros., garage and filling in the Crumbaugh building built tion 1911.

Along Chestnut Street south from the old MethoWalking dist church, now Masonic Temple, to The Journal office; the come frame building, fomerly the vacant blacksmith shop and later Harrington the Tire the Harrington brick office building Sam Rutledge, and in the same building the office of Dr. Schulhof. Crossing the alley the vacant in the VanAtta which had building, many years been butcher shop. Next is the Morrow shoe repair shop where Patterson doing all the find Warren work, while Mr. Morrow recovering from illness. In is the tinshop Tice of George Schuler comes next, with The and Mrs. Morrell Cragn manager, Lucas Rubio Reynolds, Jess Minnie had for years been the clerks. the location of the harness shop. north Barley buildIn the the barber Lyle Brown, ing Dr. Bontime latter the Barley corner and Passing First National Bank building on the to the office