Article Text

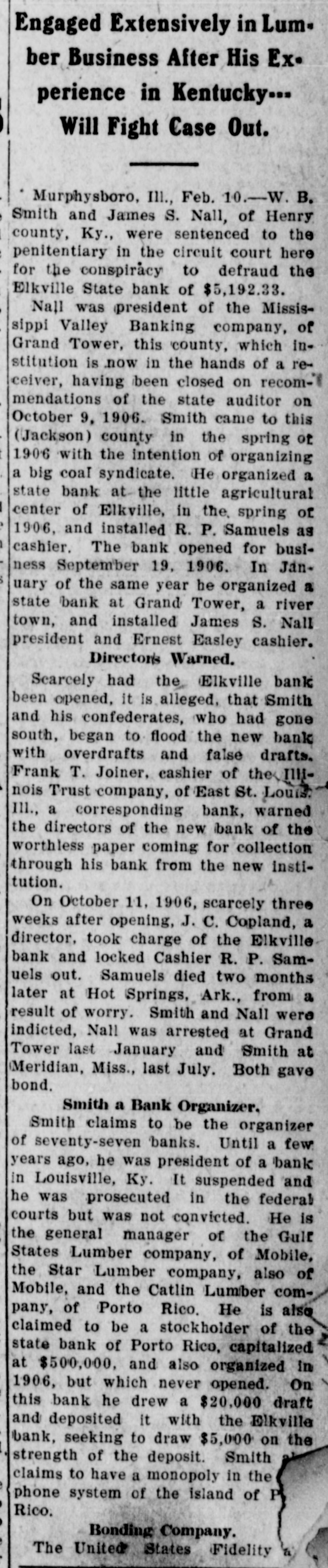

Engaged Extensively in Lumber Business After His Experience in Kentucky--Will Fight Case Out. Murphysboro, III., Feb. 10.-W. B. Smith and James S. Nall, of Henry county, Ky., were sentenced to the penitentiary in the circuit court here for the conspiracy to defraud the Elkville State bank of $5,192.33. Nall was president of the Mississippi Valley Banking company, of Grand Tower, this county, which institution is now in the hands of a receiver, having been closed on recommendations of the state auditor on October 9, 1906. Smith came to this (Jackson) county in the spring of 1906 with the intention of organizing a big coal syndicate. He organized a state bank at the little agricultural center of Elkville, in the spring of 1906, and installed R. P. Samuels as cashier. The bank opened for business September 19, 1906. In January of the same year he organized a state bank at Grand Tower, a river town, and installed James S. Nall president and Ernest Easley cashier. Directors Warned. Scarcely had the Elkville bank been opened, it is alleged, that Smith and his confederates, who had gone south, began to flood the new bank with overdrafts and false drafts. Frank T. Joiner, cashier of the IIIInois Trust company, of East St. Louis. III., a corresponding bank, warned the directors of the new bank of the worthless paper coming for collection through his bank from the new institution. On October 11, 1906, scarcely three weeks after opening, J. C. Copland, a director. took charge of the Elkville bank and locked Cashier R. P. Samuels out. Samuels died two months later at Hot Springs, Ark., from a result of worry. Smith and Nall were indicted, Nall was arrested at Grand Tower last January and Smith at Meridian, Miss., last July. Both gave bond. Smith a Bank Organizer, Smith claims to be the organizer of seventy-seven banks. Until a few years ago, he was president of a bank in Louisville, Ky. It suspended and he was prosecuted in the federal courts but was not convicted. He is the general manager of the Gulf States Lumber company, of Mobile, the Star Lumber company, also of Mobile, and the Catlin Lumber company, of Porto Rico. He is also claimed to be a stockholder of the state bank of Porto Rico, capitalized at $500,000. and also organized in 1906, but which never opened. On this bank he drew a $20,000 draft and deposited it with the Elkville bank, seeking to draw $5,000 on the strength of the deposit. Smith claims to have a monopoly in the phone system of the island of PV Rico. Bonding Company. The United States Fidelity