Article Text

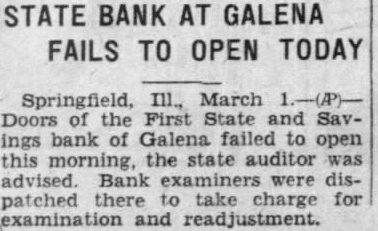

STATE BANK AT GALENA FAILS TO OPEN TODAY Springfield, March Doors of the First State and Savings bank of Galena failed to open this morning, the state was advised. Bank examiners were dispatched there take charge for examination and readjustment.