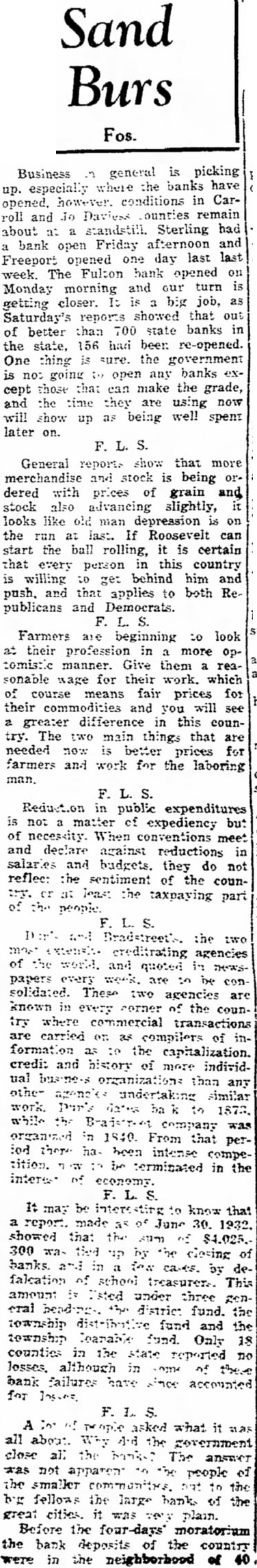

Article Text

Sand Burs Fos. Business general is picking up. especially where the banks have opened. conditions in Carroll and Jo Daviess remain about standstill. Sterling had bank open Friday afternoon and Freeport opened one day last last week. The Fulton bank opened on Monday morning and our turn is getting closer. It big job, as Saturday's reports showed that out of better than 700 state banks in the state, 156 had been re-opened. One thing is sure. the government is no: going open any banks cept those that can make the grade, and the time they are using now will show up as being well spent later on. General reports show that more merchandise and stock is being dered with prices of grain and stock also advancing slightly, looks like old man depression on the run last. If Roosevelt can start the ball rolling, it is certain that every person in this country willing get behind him and push. and that applies to both Republicans and Democrats. F. Farmers are beginning :0 look at their profession in more optomistic manner. Give them reasonable wage for their work. which of course means fair prices for their commodities and you will see greater difference in this country. The two main things that are needed now is better prices for farmers and work for the laboring man. F. Reduction in public expenditures is not matter of expediency but of necessity When conventions meet and declare against reductions in salaries and budgets. they do not reflec: the sentiment of the country. at least the taxpaying part the and the two of the world. and quoted in newspapers every week. are in con solidated. These two agencies are known in every corner of the country where commercial transactions carried on as compilers of information :0 the capitalization. credit and history of more individual than any other undertaking similar work. while the company was organized From that per:od there ha. been intense competition. in terminated in the intere- of economy. It may be to know that report. made of June 30. 1932. showed that the 300 waby closing of falcation of school treasurers. This amount Tsted under three gendistrict fund. the township distributive fund and the township learable fund Only 18 counties in the state reported no although in of bank failures have ince accounted for A asked what it all Why the government close all the Marks The answer was not apparent the people of the smaller communities. not to the bg fellows the large bank of the great cities. was plain. Before the four-days' moratorium the bank deposits of the country in the neighborhood