Article Text

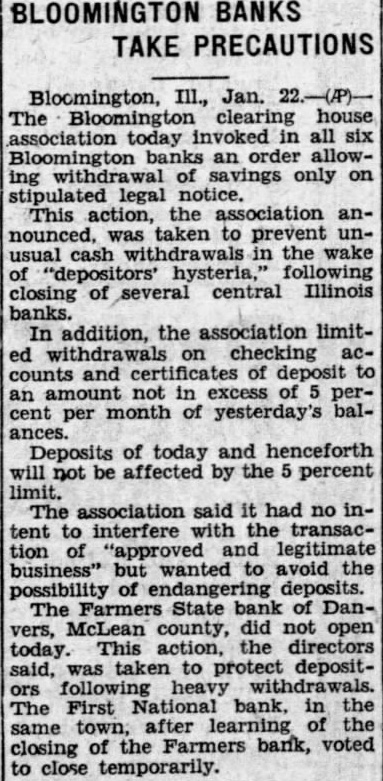

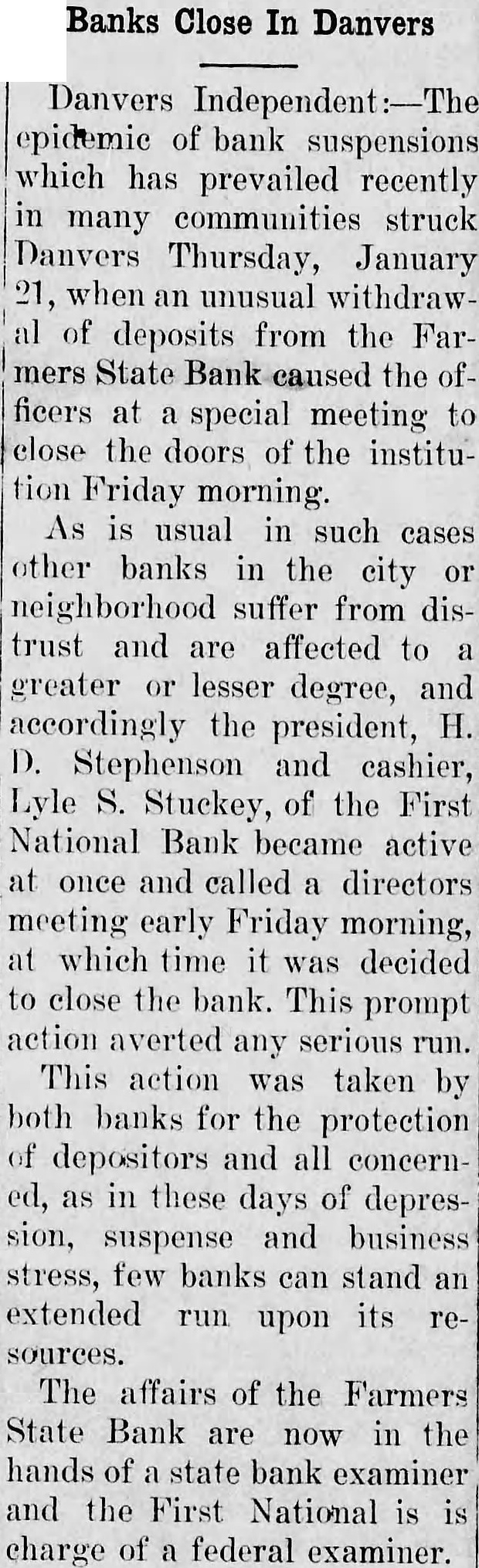

BANKS TAKE PRECAUTIONS The Bloomington clearing house association today invoked in all six Bloomington banks an order allowing withdrawal savings only on stipulated legal notice. This action, the association announced, taken prevent unusual cash withdrawals the wake of following of several central Illinois closing banks. In addition, the association limitchecking accounts and certificates of deposit to an not in excess of cent per month of yesterday's ances. Deposits of today and henceforth not be affected by the percent limit. The association said had no intent to interfere with the transaction of "approved and legitimate business" wanted to avoid the possibility of deposits. The Farmers State bank of Danvers, McLean county, did not open This action, directors today. said, was taken to protect depositors following heavy withdrawals. The First National bank, the same town, after learning closing of the Farmers bank, voted close temporarily.