Article Text

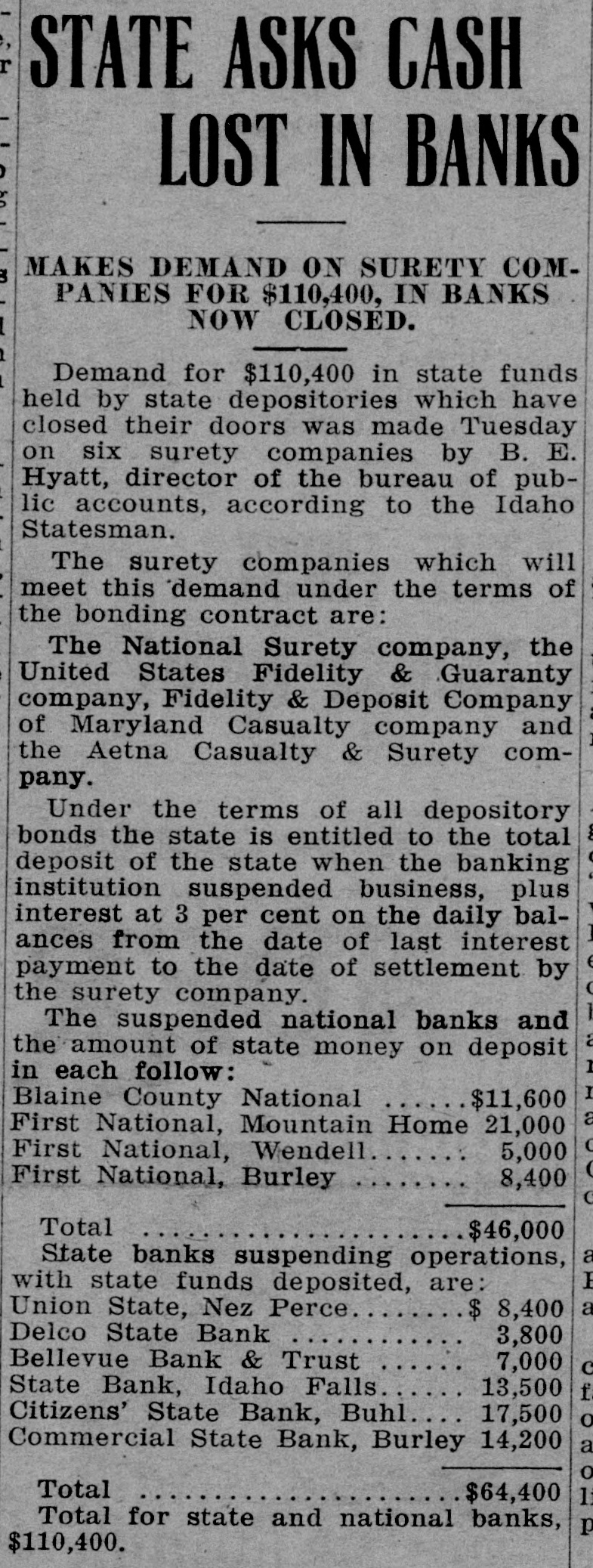

STATE ASKS CASH LOST IN BANKS MAKES DEMAND ON SURETY COMPANIES FOR $110,400, IN BANKS NOW CLOSED. Demand for $110,400 in state funds held by state depositories which have closed their doors was made Tuesday on six surety companies by B. E. Hyatt, director of the bureau of public accounts, according to the Idaho Statesman. The surety companies which will meet this demand under the terms of the bonding contract are: The National Surety company, the United States Fidelity & Guaranty company, Fidelity & Deposit Company of Maryland Casualty company and the Aetna Casualty & Surety company. Under the terms of all depository bonds the state is entitled to the total deposit of the state when the banking institution suspended business, plus interest at 3 per cent on the daily balances from the date of last interest payment to the date of settlement by the surety company. The suspended national banks and the amount of state money on deposit in each follow: Blaine County National $11,600 a First National, Mountain Home 21,000 5,000 First National, Wendell First National, Burley 8,400 Total $46,000 State banks suspending operations, E with state funds deposited, are: a Union State, Nez Perce $ 8,400 Delco State Bank 3,800 Bellevue Bank & Trust 7,000 13,500 State Bank, Idaho Falls Citizens' State Bank, Buhl 17,500 Commercial State Bank, Burley 14,200 o Total $64,400 Total for state and national banks, p $110,400.