Click image to open full size in new tab

Article Text

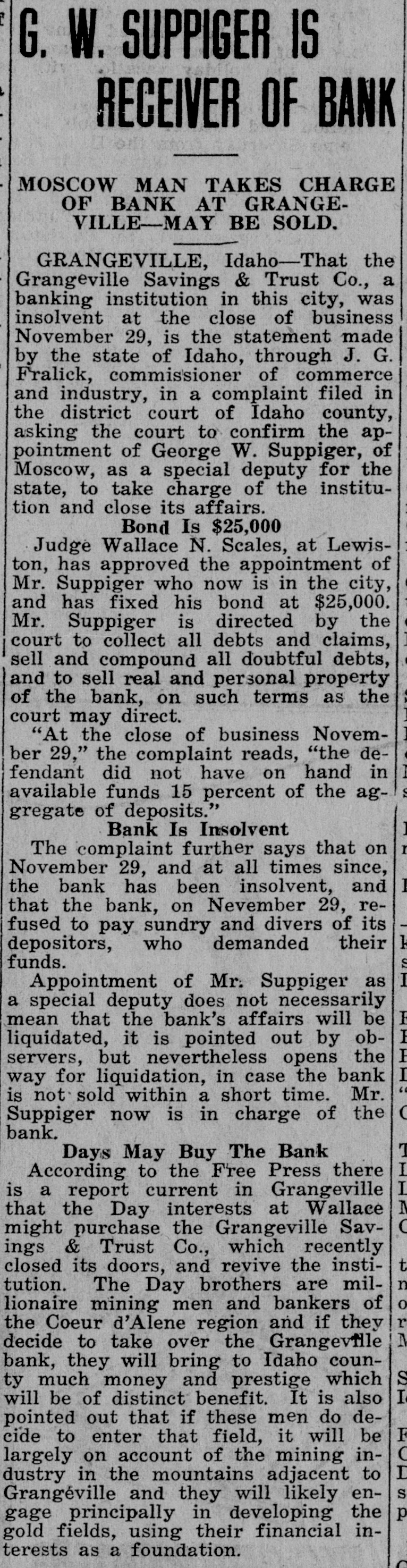

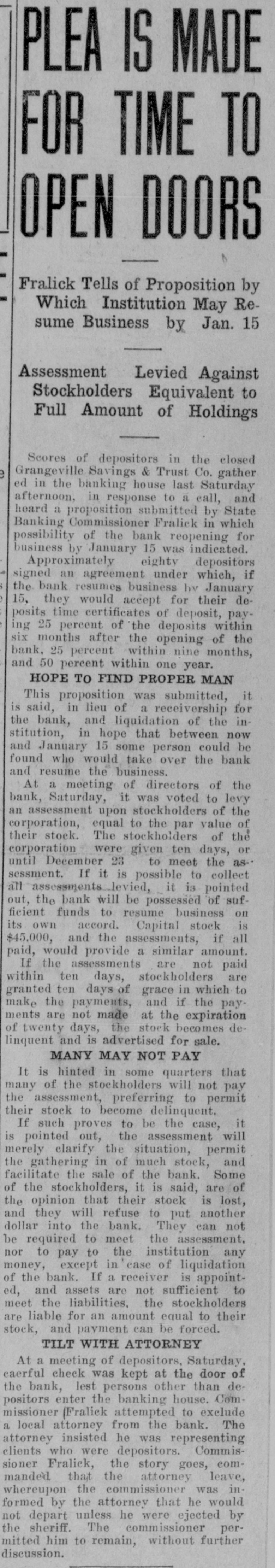

PLEA IS MADE FOR TIME TO OPEN DOORS Fralick Tells of Proposition by Which Institution May Resume Business by Jan. 15 Assessment Levied Against Stockholders Equivalent to Full Amount of Holdings Scores of depositors in the closed Grangeville Savings & Trust Co. gather ed in the banking house last Saturday afternoon, in response to a call, and heard a proposition submitted by State Banking Commissioner Fralick in which possibility of the bank reopening for business by January 15 was indicated. Approximately eighty depositors signed an agreement under which, if the bank resumes business by January 15, they would accept for their deposits time certificates of deposit, paying 25 percent of the deposits within six months after the opening of the bank, 25 percent within nine months, and 50 percent within one year. HOPE To FIND PROPER MAN This proposition was submitted, it is said, in lieu of a receivership for the bank, and liquidation of the institution, in hope that between now and January 15 some person could be found who would take over the bank and resume the business. At a meeting of directors of the bank, Saturday, it was voted to levy an assessment upon stockholders of the corporation, equal to the par value of their stock. The stockholders of the corporation were given ten days, or until December 23 to meet the assessment. If it is possible to collect all assessments levied, it is pointed out, the bank will be possessed of sufficient funds to resume business on its own accord. Capital stock is $45,000, and the assessments, if all paid, would provide a similar amount. If the assessments are not paid within ten days, stockholders are granted ten days of grace in which to make the payments, and if the payments are not made at the expiration of twenty days, the stock becomes delinquent and is advertised for sale. MANY MAY NOT PAY It is hinted in some quarters that many of the stockholders will not pay the assessment, preferring to permit their stock to become delinquent. If such proves to be the case, it is pointed out, the assessment will merely clarify the situation, permit the gathering in of much stock, and facilitate the sale of the bank. Some of the stockholders, it is said, are of the opinion that their stock is lost, and they will refuse to put another dollar into the bank. They can not be required to meet the assessment. nor to pay to the institution any money, except in case of liquidation of the bank. If a receiver is appointed, and assets are not sufficient to meet the liabilities, the stockholders are liable for an amount equal to their stock, and payment can be forced. TILT WITH ATTORNEY At a meeting of depositors, Saturday. caerful check was kept at the door of the bank, lest persons other than depositors enter the banking house. Commissioner (Fralick attempted to exclude local attorney from the bank The