Article Text

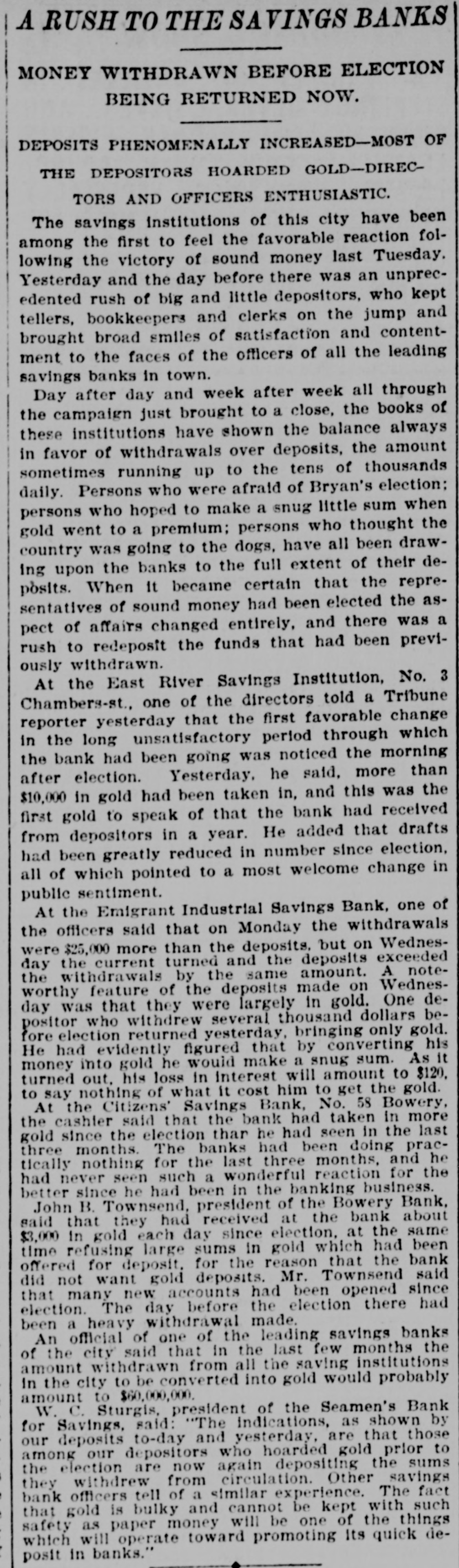

A RUSH TO THE SAVINGS BANKS MONEY WITHDRAWN BEFORE ELECTION BEING RETURNED NOW. DEPOSITS PHENOMENALLY INCREASED-MOST OF THE DEPOSITORS HOARDED GOLD-DIRECTORS AND OFFICERS ENTHUSIASTIC. The savings institutions of this city have been among the first to feel the favorable reaction following the victory of sound money last Tuesday. Yesterday and the day before there was an unprecedented rush of big and little depositors, who kept tellers, bookkeepers and clerks on the jump and brought broad smiles of satisfaction and contentment to the faces of the officers of all the leading savings banks in town. Day after day and week after week all through the campaign just brought to a close, the books of these institutions have shown the balance always in favor of withdrawals over deposits, the amount sometimes running up to the tens of thousands daily. Persons who were afraid of Bryan's election: persons who hoped to make a snug little sum when gold went to a premium; persons who thought the country was going to the dogs, have all been drawing upon the banks to the full extent of their deposits. When It became certain that the representatives of sound money had been elected the aspect of affairs changed entirely, and there was a rush to redeposit the funds that had been previously withdrawn. At the East River Savings Institution, No. 3 Chambers-st., one of the directors told a Tribune reporter yesterday that the first favorable change in the long unsatisfactory period through which the bank had been going was noticed the morning after election. Yesterday. he said, more than $10,000 in gold had been taken in, and this was the first gold to speak of that the bank had received from depositors in a year. He added that drafts had been greatly reduced in number since election, all of which pointed to a most welcome change in public sentiment. At the Emigrant Industrial Savings Bank, one of the officers said that on Monday the withdrawals were $25,000 more than the deposits, but on Wednesday the current turned and the deposits exceeded the withdrawals by the same amount. A noteworthy feature of the deposits made on Wednesday was that they were largely in gold. One depositor who withdrew several thousand dollars before election returned yesterday, bringing only gold. He had evidently figured that by converting his money into gold he would make a snug sum. As it turned out, his loss in interest will amount to $120, to say nothing of what it cost him to get the gold. At the Citizens' Savings Bank, No. 58 Bowery, the cashier said that the bank had taken in more gold since the election thar he had seen in the last three months. The banks had been doing practically nothing for the last three months, and he had never seen such a wonderful reaction for the better since he had been in the banking business. John B. Townsend, president of the Bowery Bank, said that they had received at the bank about $3,000 in gold each day since election, at the same time refusing large sums in gold which had been offered for deposit, for the reason that the bank did not want gold deposits. Mr. Townsend said that many new accounts had been opened since election. The day before the election there had been a heavy withdrawal made. An official of one of the leading savings banks of the city said that in the last few months the amount withdrawn from all the saving institutions In the city to be converted into gold would probably amount to $60,000,000. W. C. Sturgis, president of the Seamen's Bank for Savings, said: "The indications, as shown by our deposits to-day and yesterday, are that those among our depositors who hoarded gold prior to the election are now again depositing the sums they withdrew from circulation. Other savings bank officers tell of a similar experience. The fact that gold is bulky and cannot be kept with such safety as paper money will be one of the things which will operate toward promoting Its quick deposit in banks."