Article Text

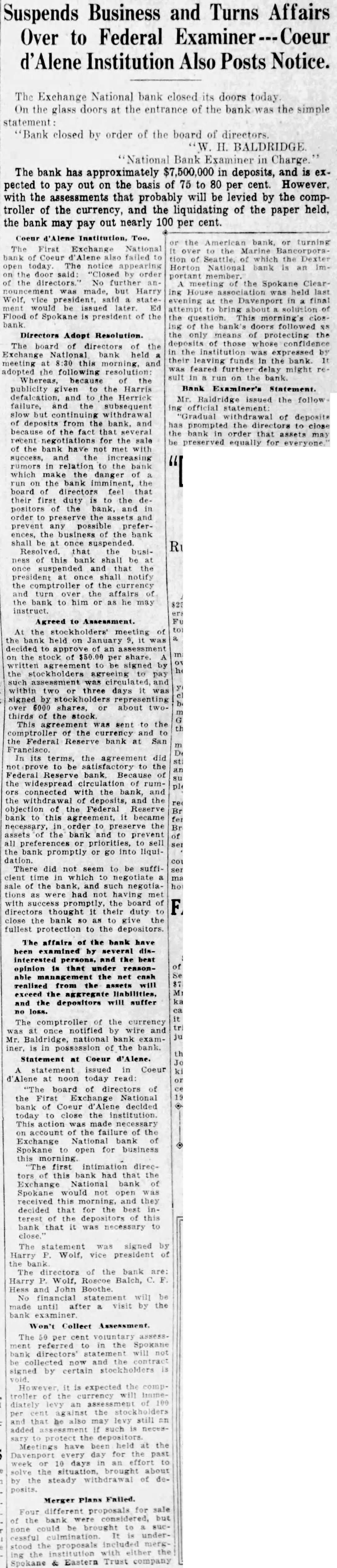

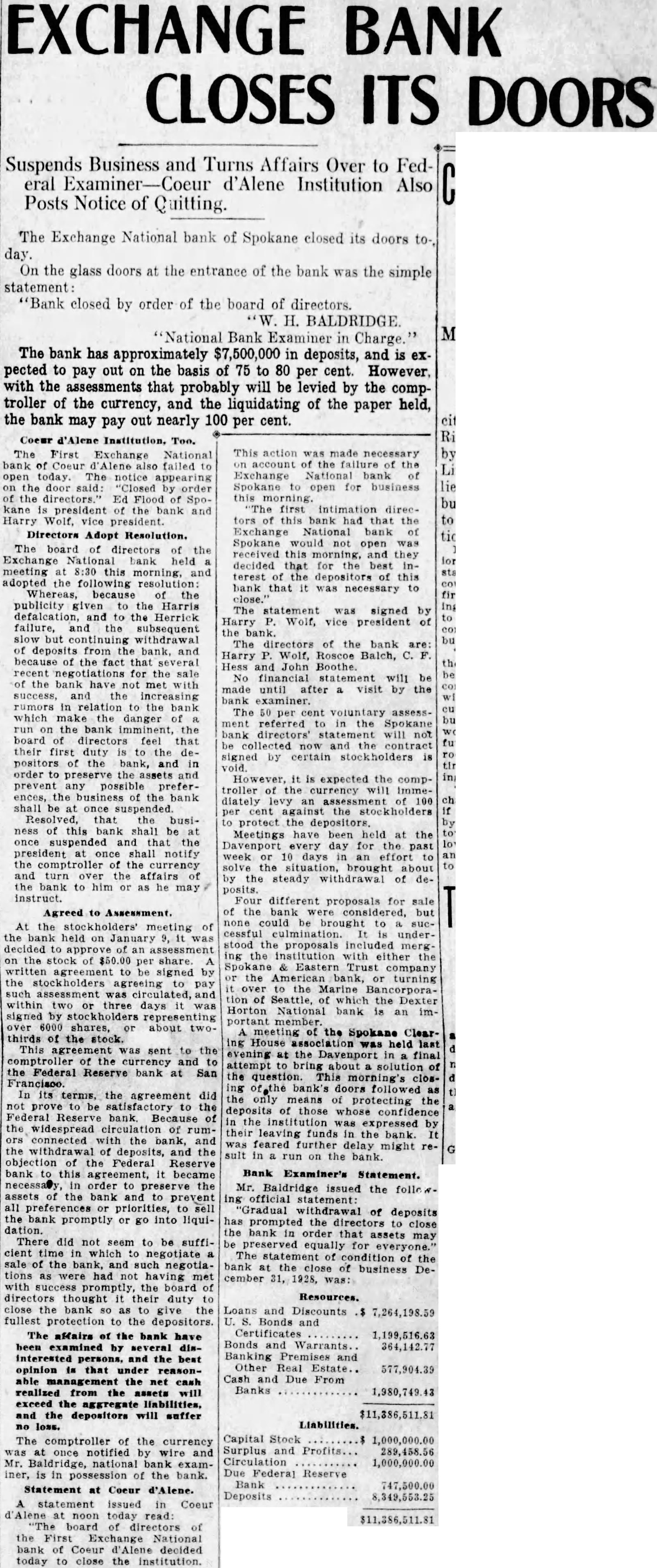

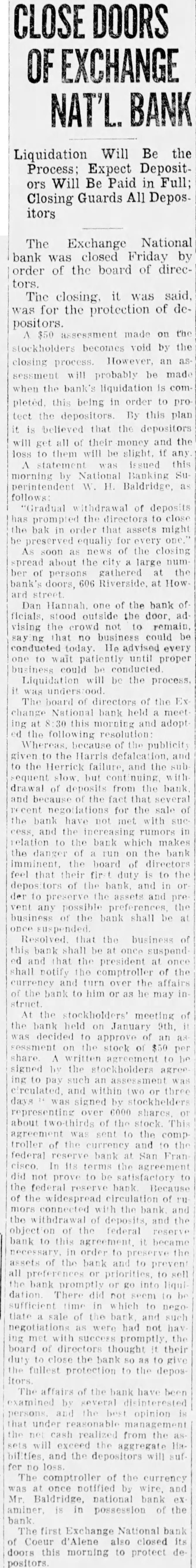

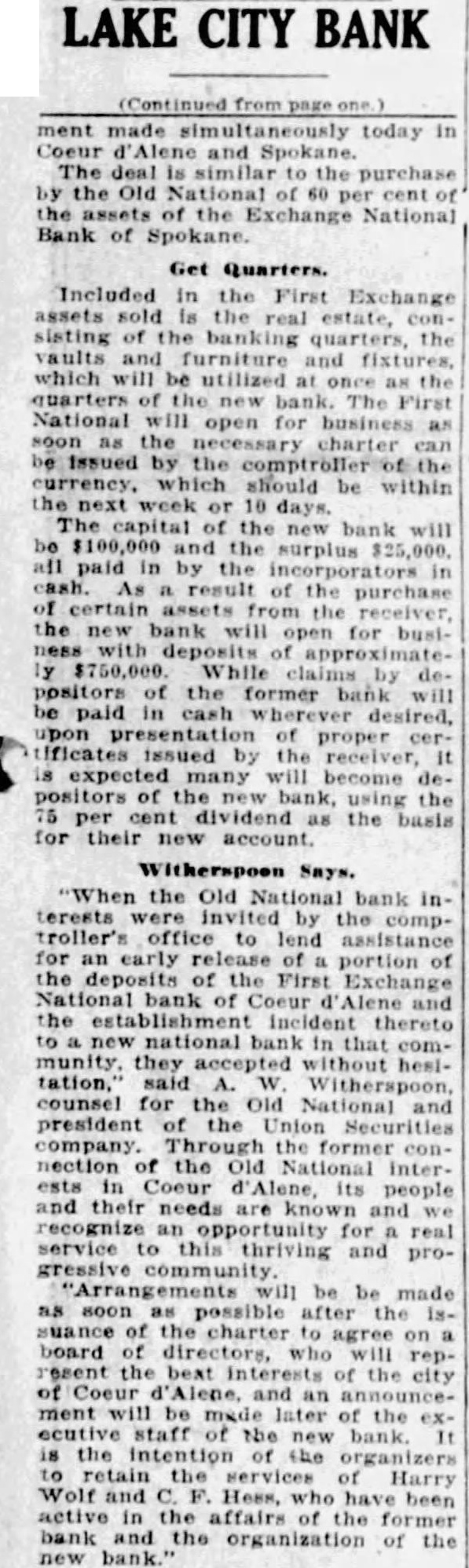

Suspends Business and Turns Affairs Over to Federal d'Alene Institution Also Posts Notice. The Exchange National bank closed its doors today. On the glass doors at the entrance of the bank was the simple statement Bank closed by order of the board of directors. "W. H. BALDRIDGE "National Bank Examiner in Charge. The bank has approximately $7,500,000 in deposits, and is expected to pay out on the basis of 75 to 80 per cent. However, with the assessments that probably will be levied by the comptroller of the currency, and the liquidating of the paper held, the bank may pay out nearly 100 per cent. Coeur d'Alene Institution. Too. The First Exchange National Coeur Alene failed to open today. The notice on door "Closed by order of the No further made, Harry vice statewould be issued Ed Flood of Spokane of the Directors Adopt Resolution. The board of directors the Exchange National bank held meeting this morning, and adopted the following resolution: because the publicity the Harris defalcation to the Herrick failure, and the subsequent slow but continuing withdrawal deposits from the bank, and because the fact several negotiations for the sale the bank with success, increasing rumors in relation the bank which make the danger run the bank imminent, board of directors that their first duty to the depositors bank, and in order preserve and prevent preferences, the the bank shall once suspended that business of this bank shall be suspended the once notify the the and turn the affairs of the bank to him or as he may instruct. Agreed to At the of held January decided to approve an assessment on the stock per share. signed by the stockholders agreeing pay such assessment was and within two three days signed by stockholders representing over 6000 shares, about twothirds of the This was sent to the comptroller the and the Federal bank at San Francisco. its terms, the agreement did to be satisfactory the Federal Reserve bank, the widespread connected with bank, and withdrawal deposits, and objection the Federal Reserve bank to this agreement, became necessary, order to preserve the assets the bank and to all priorities, sell the bank promptly or go into liquidation. There did not seem to be sufficient time which negotiate sale of the bank, and such negotiations as had having with promptly, the board of their duty to close the bank the fullest protection to the depositors. The affairs of the bank have been by disthe best opinion that under reasonthe net cash realized from the assets exceed the aggregate liabilities. and the depositors will suffer loss. The comptroller of the currency notified wire and Mr. national iner, is in possession of the bank. at Coeur d'Alene. statement issued in Coeur d'Alene at noon today read: board of directors of the First Exchange National of Coeur d'Alene decided today close the institution. This action made on account the failure of the Exchange National bank of Spokane open for business this first intimation directhis bank had that Exchange National bank Spokane would received morning, and decided terest bank that it to close. The statement was signed Harry Wolf, vice president The directors of the bank Harry Wolf, Roscoe Balch, and John financial will until after visit by the Won't Collect Assessment The referred Spokane now signed by certain stockholders is expected troller diately assessment the still added such necesprotect the depositors. at the day for past Davenport effort the the steady withdrawal of Merger Plans Failed. Four different proposals for the considered, none could brought undercessful stood Eastern Trust company Spokane the American turning Seattle, which the Dexter Horton National bank an member. meeting the Spokane Clearing House held last evening the final attempt bring the question morning's of the bank's doors followed only means of protecting the deposits of those confidence the institution expressed by funds in the bank was feared delay might rein run on the Bank Examiner's Statement. Mr. issued the follow ing official statement Gradual withdrawal of deposits prompted the directors close the bank order that assets be preserved equally for