Click image to open full size in new tab

Article Text

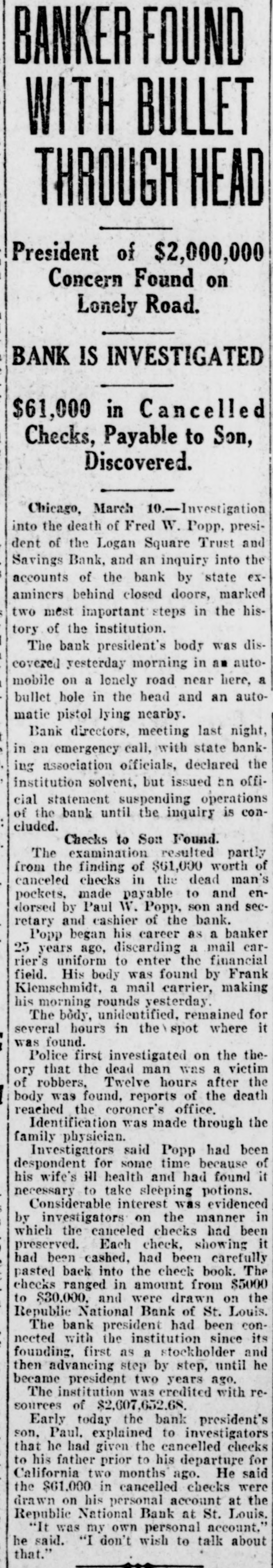

BANKER FOUND WITH BULLET THROUGH HEAD President of $2,000,000 Concern Found on Lonely Road. BANK IS INVESTIGATED $61,000 in Cancelled Checks, Payable to Son, Discovered. Chicago, March 10.-Investigation into the death of Fred W. Popp, president of the Logan Square Trust and Savings Bank, and an inquiry into the accounts of the bank by state examiners behind closed doors, marked two mest important steps in the history of the institution. The bank president's body was discovered yesterday morning in an automobile on a lonely road near here, a bullet hole in the head and an automatic pistol lying nearby. Bank directors, meeting last night, in an emergency call, with state banking association officials, declared the institution solvent, but issued an official statement suspending operations of the bank until the inquiry is concluded. Checks to Son Found. The examination resulted partly from the finding of $61,000 worth of canceled checks in the dead man's pockets, made payable to and endorsed by Paul W. Popp, son and secretary and cashier of the bank. Popp began his career as a banker 25 years ago, discarding a mail carrier's uniform to enter the financial field. His body was found by Frank Klemschmidt, a mail carrier, making his morning rounds yesterday. The bòdy, unidentified. remained for several hours in the\spot where it was found. Police first investigated on the theory that the dead man was a victim of robbers, Twelve hours after the body was found, reports of the death reached the coroner's office. Identification was made through the family physician. Investigators said Popp had been despondent for some time because of his wife's ill health and had found it necessary to take sleeping potions. Considerable interest was evidenced by investigators on the manner in which the canceled checks had been preserved. Each check, showing it had been cashed, had been carefully pasted back into the check book. The checks ranged in amount from $5000 to $30,000, and were drawn on the Republic National Bank of St. Louis. The bank president had been connected with the institution since its founding. first as a stockholder and then advancing step by step, until he became president two years ago. The institution was credited with resources of $2,007,652.68. Early today the bank president's son, Paul, explained to investigators that he had given the cancelled checks to his father prior to his departure for California two months ago. He said the $61,000 in cancelled checks were drawn on his personal account at the Republic National Bank at St. Louis. "It was my own personal account."