Article Text

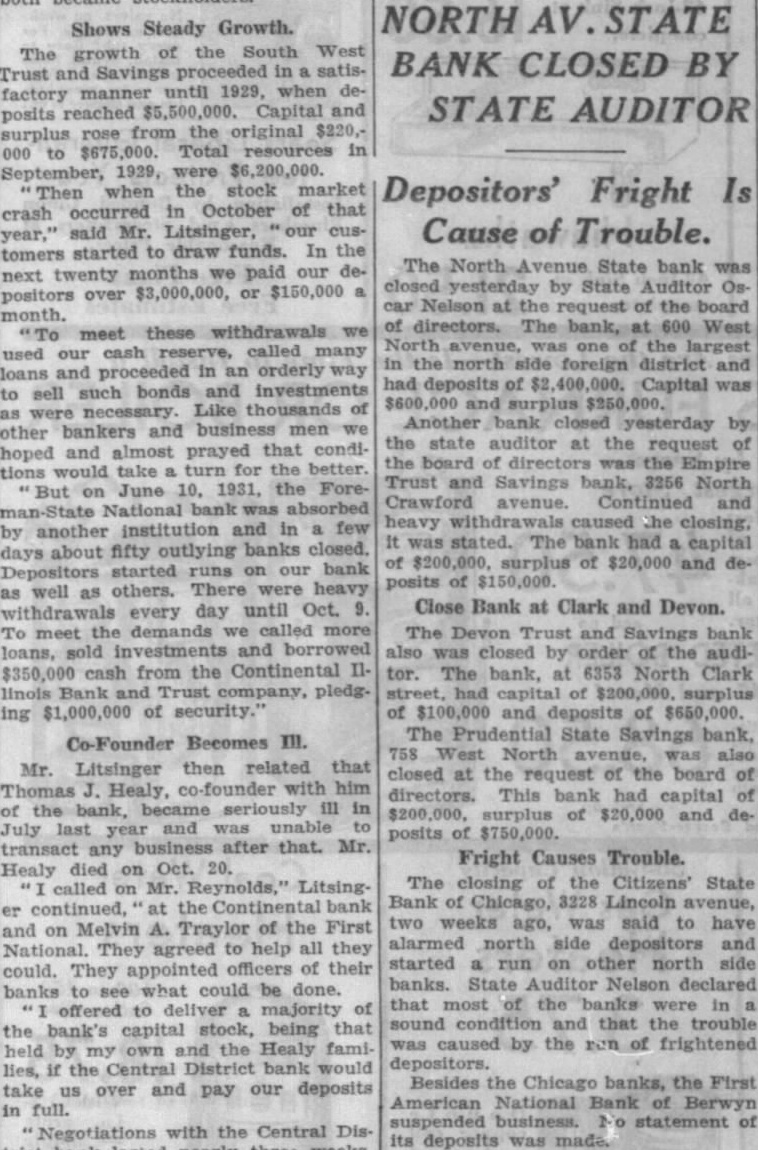

NORTH AV. STATE BANK CLOSED BY STATE AUDITOR Depositors' Fright Is Cause of Trouble. The North State bank was closed yesterday by State Auditor Oscar Nelson at the request of the board of directors. The bank, 600 West North avenue one of the largest in the north district and had deposits of $2, Capital was $600,000 and Another bank closed yesterday by the state auditor at the request of the board of directors the Empire Trust and Savings bank, 3256 North Crawford avenue. Continued and heavy caused closing, It was had capital of surplus of $20,000 and deposits of $150,000 Close Bank at Clark and Devon. The Devon Trust and Savings bank also was closed by order of the auditor. The bank, at 6353 North Clark of surplus of $100,000 and deposits of The Prudential State Savings bank, 758 West North was closed at the request of the board of directors. This bank had capital surplus of $20,000 and deposits of $750,000. Fright Causes Trouble. The closing of the Citizens' State Bank of Chicago, 3228 Lincoln avenue, two weeks ago, was said to have alarmed north side depositors and started run on other north side banks. State Auditor Nelson declared that most of the banks were in sound condition and that the trouble was caused by the run of frightened Besides the Chicago banks, the First American National Bank of Berwyn suspended business. statement of its deposits was made.