Article Text

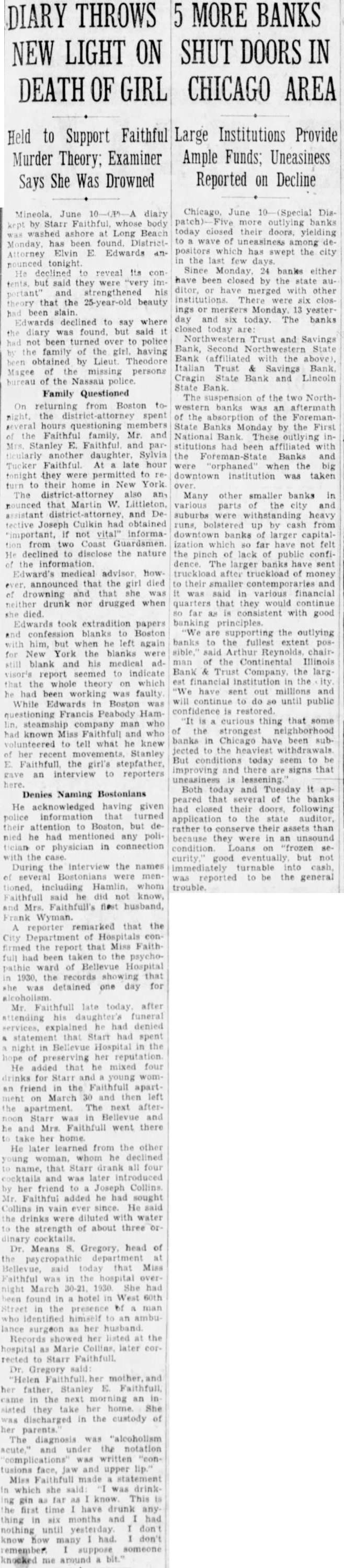

DIARY THROWS 5 MORE BANKS NEW LIGHT ON SHUT DOORS IN DEATH OF GIRL CHICAGO AREA Held to Support Faithful Murder Theory; Examiner Says She Was Drowned Mineola, June 10-(P)-A diary by Starr Faithful, whose body washed ashore at Long Beach Monday, has been found DistrictAttorney Elvin E. Edwards announced tonight He declined to reveal Its contents. but said they were "very important and strengthened his theory that the 25-year-old beauty been slain. Edwards declined to say where the diary was found. but said it not been turned over to police the family of the girl. having been obtained by Lieut Theodore Magee of the missing persons bureau of the Nassau police Family Questioned On returning from Boston tonight, the spent several hours questioning members of the Faithful family, Mr. and Mrs. Stanley E. Faithful and particularly another daughter, Sylvia Tucker Faithful. At late hour tonight they were permitted to turn to their home in New York The attorney also an, nounced that Martin W. Littleton. assistant district-attorney and Detective Joseph Culkin had obtained tion from two Coast Guardsmen He declined to disclose the nature of the information. Edward's medical advisor How ever. announced that the girl died of drowning and that she was neither drunk nor drugged when Edwards took extradition papers and confession blanks to Boston with him, but when he left again for New York the blanks were still blank and his medical advisor's report seemed to indicate that the whole theory on which he had been working was faulty While Edwards in Boston was questioning Francis Peabody Ham lin. steamship company man who had known Miss Faithfull and who volunteered to tell what he knew of her recent movements Stanley gave an interview to reporters here. Denies Naming Bostonians He acknowledged having given police information that turned their attention to Boston, but denied he had mentioned any politician or physician in connection with the During the Interview the names of several Bostonians were menFaithfull said he did not know and Mrs. Faithfull's first husband, Frank Wyman. A reporter remarked that the City Department of Hospitals confirmed the report that Miss Faithfull had been taken to the psychopathic ward of Bellevue Hospital 1930. the records showing that she was detained one day for Mr. Faithfull late today. after sttending his daughter's funeral services, explained he had denied statement that Start had spent night in Bellevue Hospital in the hope of preserving her reputation. He added that he mixed four drinks for Starr and young woman friend in the Faithfull apart ment on March 30 and then left The next afterthe apartment. noon Starr was in Bellevue and he and Mrs Faithfull went there take her home He later learned from the other whom he declined young name, that Starr drank all four cocktails and was later introduced by her friend to a Joseph Collins Mr. Faithful added he had sought Collins in vain ever since. He said the drinks were diluted with water the strength of about three or dinary Dr. Means S. Gregory head of the psycropathic department Bellevue, said today that Miss Faithful was in the hospital overnight March 30-21 1930 She had been found in a hotel in West 60th Street in the presence of man who identified himself an ambu lance surgeon as her husband Records showed her listed at the hospital as Marie Collins. later corrected to Starr Faithfull. Dr. Gregory said "Helen Faithfull her mother her father Stanley E. Faithfull, came in the next morning an in sisted they take her She discharged in the custody of her parents. The diagnosis was "alcoholism acute," and under the notation was written tusions face, jaw and upper lip. Miss Faithfull made statement in which she said was drink gin as far as know This first time have drunk any thing in six months and had nothing until yesterday I don know had. don't how many remember suppose someone knocked me around bit. Large Institutions Provide Ample Funds; Uneasiness Reported on Decline Chicago, June -(Special Dispatch)- Five more outlying banks today closed their doors, yielding wave of uneasiness among depositors which has swept the city in the last few days. Since Monday 24 banks either have been closed by the state auditor, or have merged with other institutions. There were six closings or mergers Monday 13 yester day and six today. The banks closed today are: Northwestern Trust and Savings Bank, Second Northwestern State Bank (affiliated with the above). Italian Trust & Savings Bank, Cragin State Bank and Lincoln State Bank The suspension of the two Northwestern banks was an aftermath of the absorption of the ForemanState Banks Monday by the First National Bank These outlying institutions had been affiliated with the Foreman-State Banks and were "orphaned" when the big downtown institution was taken over Many other smaller banks in various parts of the city and suburbs were withstanding heavy runs, bolstered up by cash from downtown banks of larger capitalization which so far have not felt the pinch of lack of public confidence. The larger banks have sent truckload after truckload of money to their smaller contemporarie and it was said in various financial quarters that they would continue so far as is consistent with good banking principles. "We are supporting the outlying banks to the fullest extent possible, said Arthur Reynolds chairman of the Continental Illinois Bank & Trust Company the larg. est financial institution in the ity "We have sent out millions and will continue to do so until public confidence is restored. It is curious thing that some of the strongest neighborhood banks in Chicago have been subjected to the heaviest withdrawals But conditions today seem to be improving and there are signs that uneasiness is lessening Both today and Tuesday It appeared that several of the banks had closed their doors, following application to the state auditor, rather to conserve their assets than because they were in an unsound Loans on "frozen curity. good eventually but not immediately turnable into cash, reported to be the general