Article Text

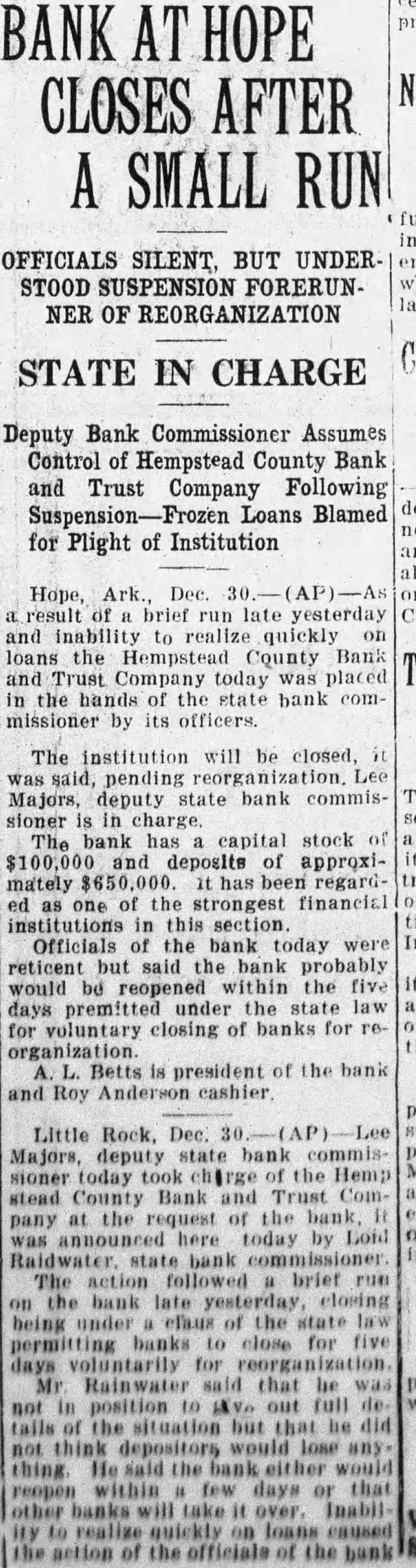

BANK AT HOPE CLOSES AFTER A SMALL RUN OFFICIALS SILENT, BUT UNDERSTOOD SUSPENSION FORERUNNER OF REORGANIZATION STATE IN CHARGE Deputy Bank Commissioner Assumes Control of Hempstead County Bank and Trust Company Following Suspension-Frozen Loans Blamed for Plight of Institution Hope, Ark. Dec. AP)-As a result of a brief run late yesterday and inability to realize quickly on loans the Hempstead County Bank and Trust Company today was placed in the of the state bank commissioner by its officers. The institution will be closed, it was said, pending ion. Lee Majors, deputy state bank commissioner is in charge. The bank capital stock of $100,000 and deposits of approximately $650,000. has been regarded as one of the strongest financial institutions in this section. Officials of the bank today were reticent but said the bank probably would be reopened within the five days premitted under the state law for voluntary closing of banks for reorganization. L. Betts is president of the bank and Roy Anderson cashier Little Rock, Dec. 30 AP Lee Majors, deputy state bank commissioner today took charge of the Hemp stead County Bank and Trust Company at the request of the bank was here today by Loid Raidwater. state bank The action followed brief run on the bank late yesterday, closing being under efaux of the state law permitting banks to close for five days voluntarily for reorganization. Mr Rainwater said that be was not in position to AVe out full de tails of the situation but that be did not think depositors would lose any thing He said the bank either would reopen within few days or that other banks will take it over. InabilBY to realize quickly on loans caused the action of the officials of the bank