Click image to open full size in new tab

Article Text

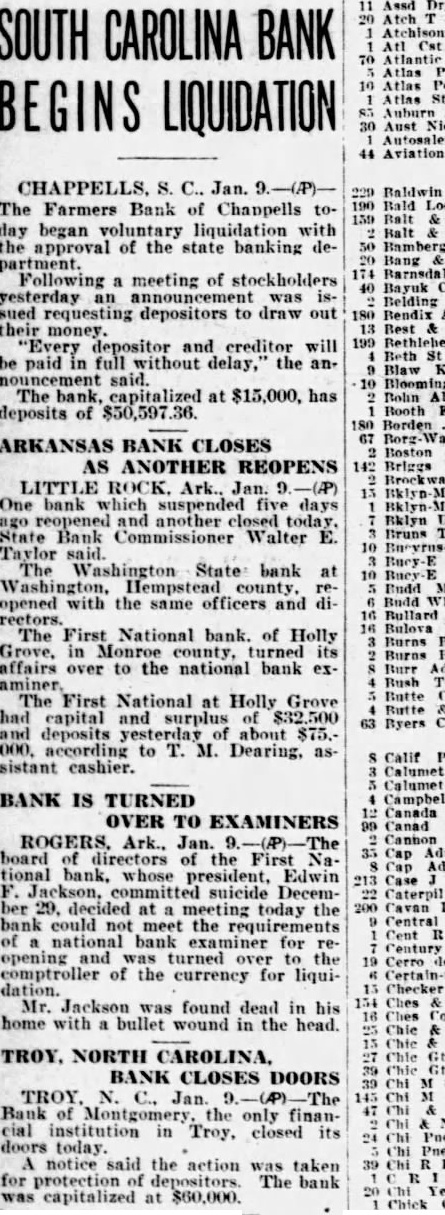

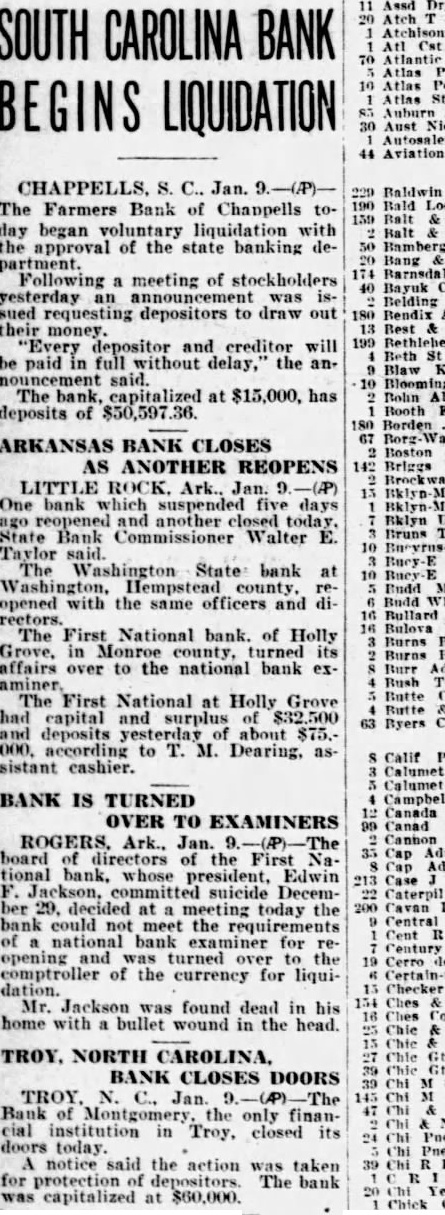

SOUTH CAROLINA BANK BEGINS LIQUIDATION

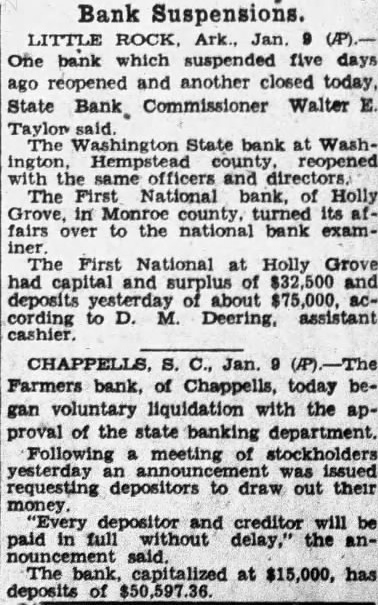

The Farmers Bank of Chappells today began voluntary liquidation with the approval of the state banking department. Following a meeting of stockholders yesterday an announcement was issued requesting depositors to draw out Bendix their money. Every depositor and creditor will be paid in full without delay, the anBloomingd The bank, capitalized said. at $15,000, has Bohn deposits of $50,597.36.

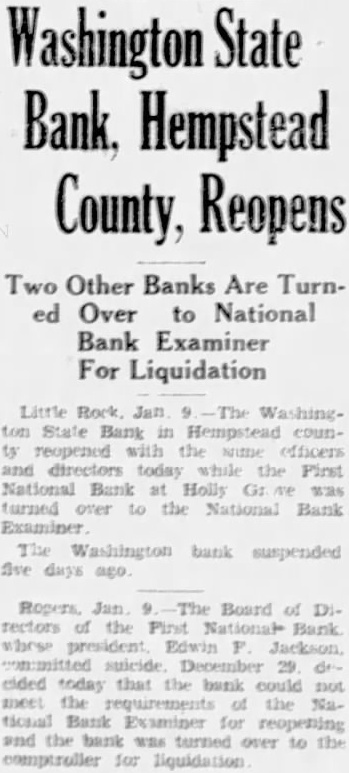

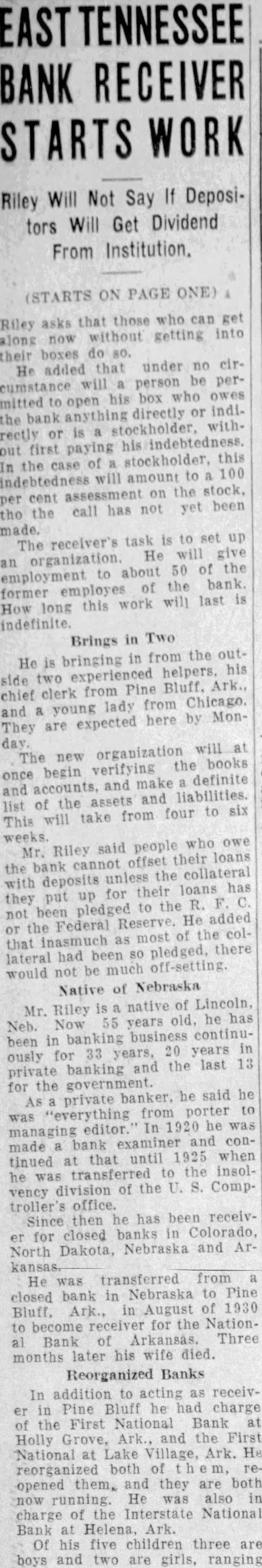

ARKANSAS BANK CLOSES AS ANOTHER REOPENS LITTL ROCK. Ark., Jan. -(AP) One bank which suspended five days ago reopened and another closed State Bank Commissioner Walter E. Taylor The Washington State bank at opened with the same officers and directors. The First National bank. of Holly Grove, in Monroe county, turned its affairs over to the national bank exThe First National at Holly Grove had capital and surplus $32,500 deposits about $75.according to T. M. Dearing, as sistant cashier.

BANK IS TURNED OVER TO EXAMINERS

ROGERS. Ark., Jan. board directors of the First National bank. whose president, Edwin Jackson, committed suicide Decem- Caterpil ber 29. decided at meeting today the Cavan bank could not meet the requirements of national bank for opening and was turned over the comptroller of the currency for liquidation. Mr. Jackson was found dead in his home with a bullet wound in the head.

TROY. NORTH CAROLINA, BANK CLOSES DOORS TROY N. C., Jan 9. The the only financial institution in Troy, closed its doors notice said the action was taken for protection depositors The bank was capitalized at $60,000.