Article Text

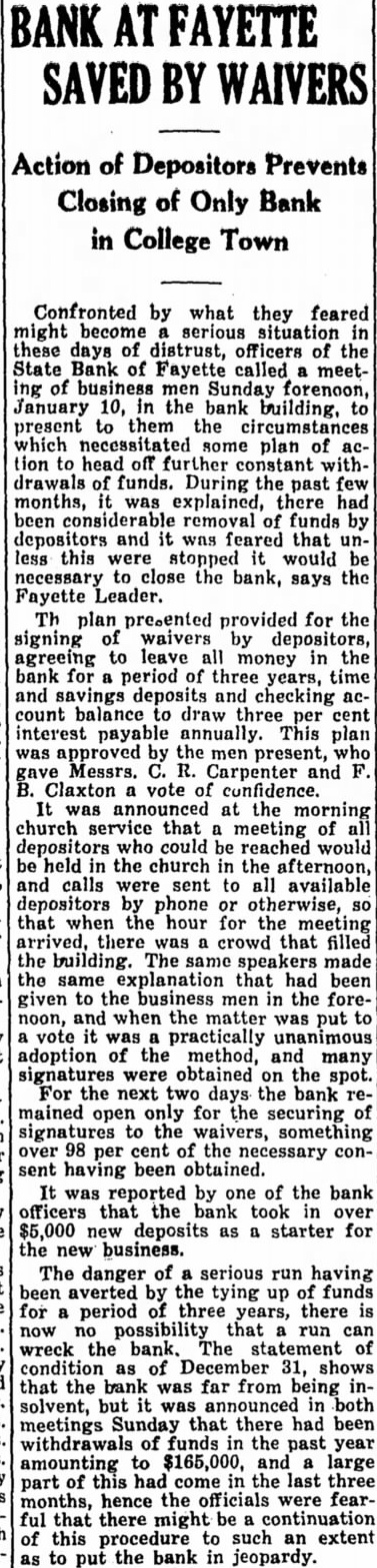

BY WAIVERS Action of Depositors Prevents Closing of Only Bank in College Town Confronted by what they feared might become serious these days of distrust, officers of the State Bank of Fayette called meetof business men Sunday forenoon, January 10, the bank building, present to them the circumstances which necessitated some plan of tion to head off further constant withdrawals of funds. During the past months, was explained, there had been considerable removal of funds depositors and was feared that less this were stopped it would necessary to close the bank, says the Fayette Leader. Th plan pre-ented provided for the signing of waivers by depositors, agreeing to leave all money in the bank for period of three years, time and savings deposits and checking account balance draw three per cent interest payable annually This plan was approved by the men present, Messrs. Carpenter and Claxton vote of confidence. It was announced at the morning church service that meeting of depositors who could be reached would be held in the church the afternoon, and calls were sent to all available depositors by phone or otherwise, that when the hour for the meeting arrived, there was crowd that filled the building. The same speakers made the same explanation that had been given to the business men in the forenoon, and when the matter was put to vote practically unanimous adoption of the method, and many signatures were obtained on the spot. For the next two days the bank mained open only the securing of signatures to the something over 98 per cent of the necessary consent having been obtained. It was reported by one of the bank officers that the bank took in over $5,000 new deposits as starter for new business. The danger of serious run having been the tying up of funds for period of three years, there now no possibility that run can wreck the bank. The condition of 31, shows that the bank was far from being insolvent, but announced in both meetings Sunday that there had been withdrawals of funds the past year amounting to $165,000, and large part of this had come in the last three months, hence the officials were fearthat there might be continuation of this procedure to such extent to put the bank in jeopardy.