Article Text

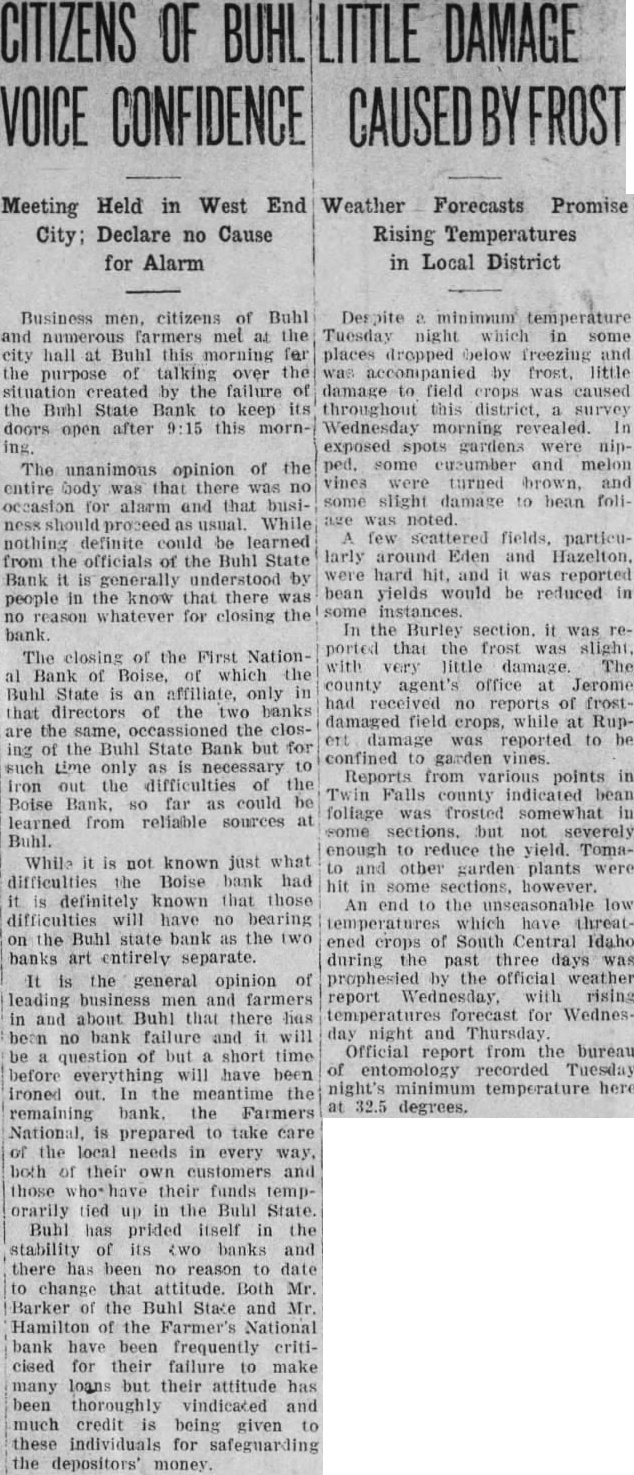

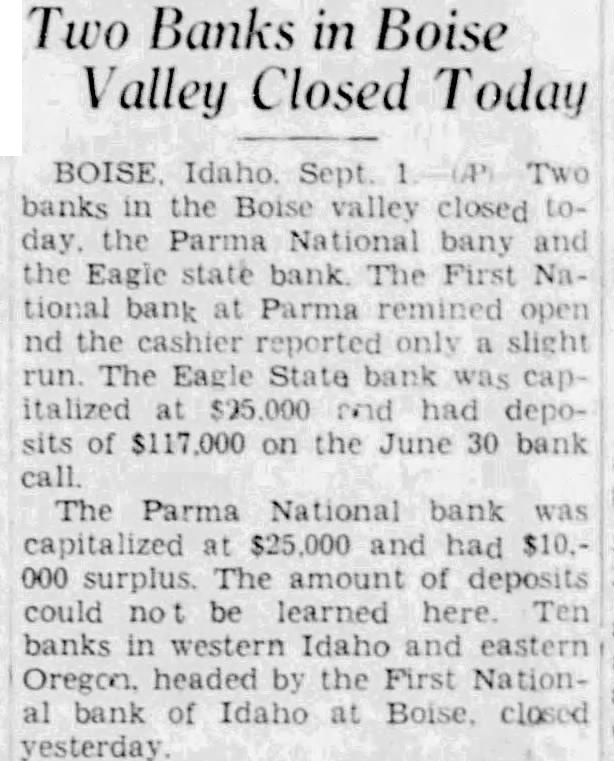

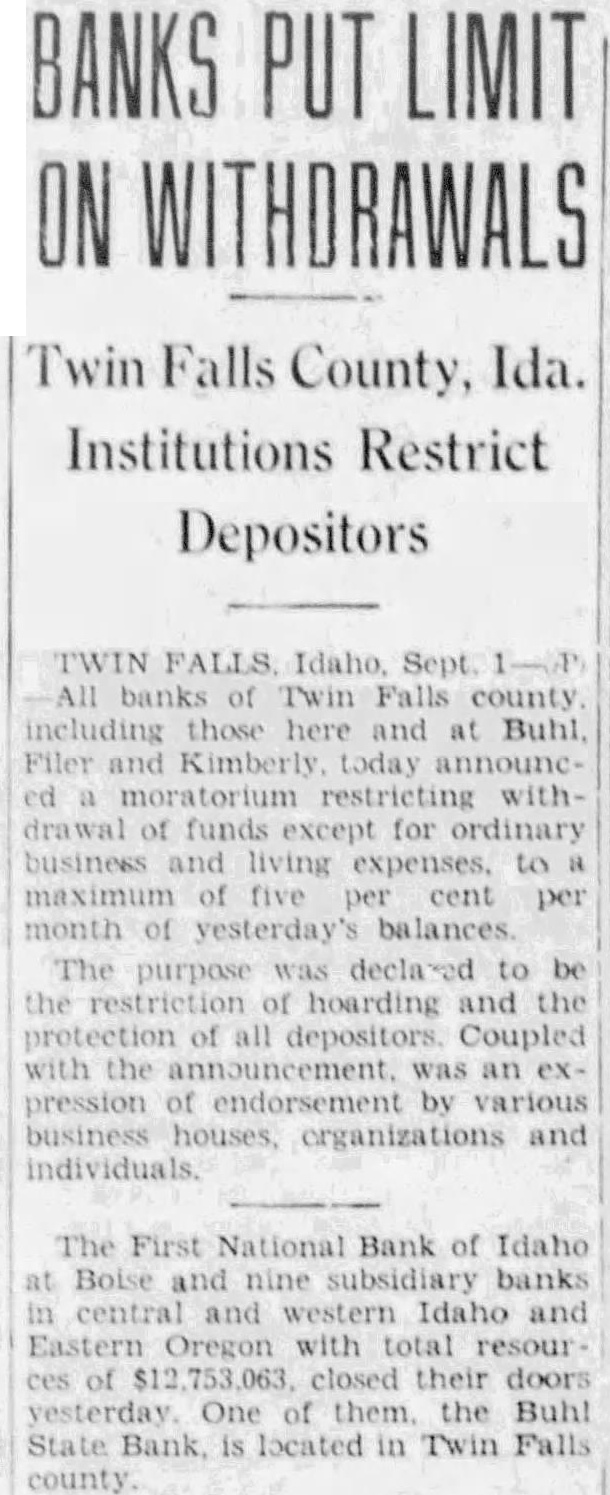

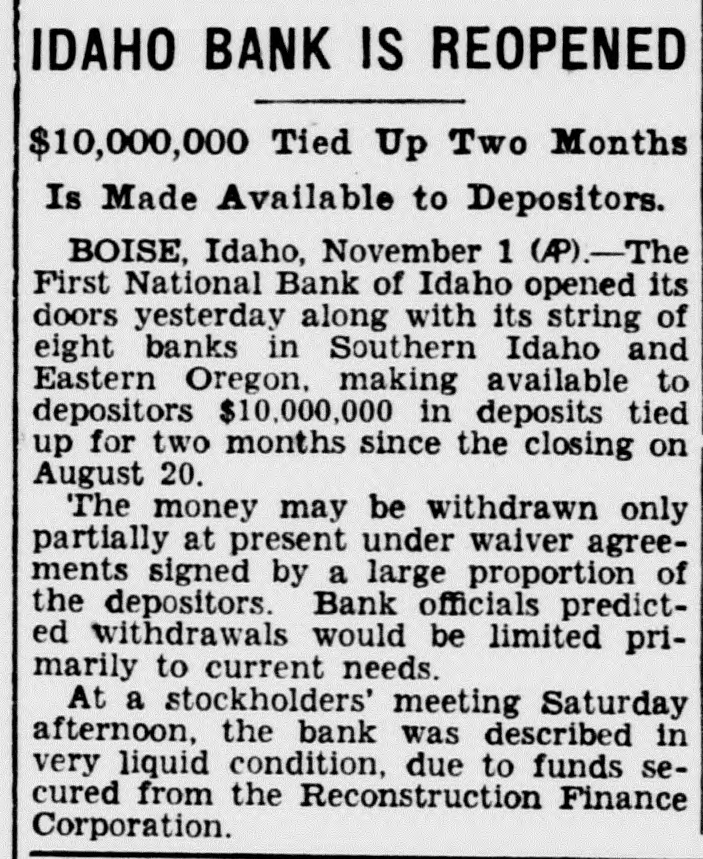

CITIZENS OF DAMAGE VOICE CONFIDENCE Meeting Held in West City; Declare no Cause for Alarm Business men, citizens of Buhl and farmers met at the city hall at Buhl this morning far the purpose of talking over the situation created by the failure the Buhl State Bank to keep its doors open after this morning. The unanimous opinion of the entire body was that there was no occasion for alarm and that business should proceed as usual. While nothing definite could be learned from the officials of the Buhl State Bank it is generally understood by people in the know that there was no reason whatever for closing the bank. The closing of the First NationBank of Boise, which the Buhl State is an affiliate, only in that directors of the two banks are the same, occassioned the closing of the Buhl State Bank but for such time only as necessary Iron out the difficulties of the Boise Bank, so far as could be learned from reliable sources at Buhl. While it is not known just what difficulties the Boise bank had definitely known that those difficulties will have no bearing on the Buhl state bank as the two banks art entirely separate. It is the general opinion of leading men and farmers in and about Buhl that there has been no bank failure and it will question of but short time before will have been ironed out. In the meantime the remaining bank. the Farmers National, is prepared to take care of the local needs in every way, both of their own customers and those who have their funds temporarily tied up in the Buhl State. Buhl has prided itself in the stability of its two banks and there has been no reason to date to change that attitude. Both Mr Barker of the Buhl State and Mr. Hamilton of the Farmer's National bank have been frequently criticised for their failure to make many loans but their attitude has been thoroughly vindicated and much credit is being given to these individuals for safeguarding the depositors' money. Weather Forecasts Promise Rising Temperatures in Local District minimum temperature Tuesday night which in some places dropped freezing and was accompanied by frost, little damage to field crops was caused throughout this survey Wednesday morning revealed. In exposed spots gardens were nipped. some eusumber and melon vines were turned brown. some slight damage to bean foliage noted. few seattered fields, particularly around Eden and Hazelton, were hard hit, and was reported bean yields would be reduced in some In the Burley section it was reported that the frost was slight, with very little damage. The county agent's office at Jerome had no reports of frostdamaged field crops, while at Rupent was reported to be confined to garden vines. Reports from various points in Twin Falls county indicated bean foliage frosted somewhat in some sections. tbut not severely enough to reduce the yield. Tomato and garden plants were hit in some sections. however. An end to the unseasonable low which have threatened crops of South Central Idaho during the past three days was prophesied by the official weather report Wednesday, with rising forecast for Wednesday night and Thursday Official report from the bureau of entomology recorded Tuesday night's minimum temperature here 32.5 degrees.