Article Text

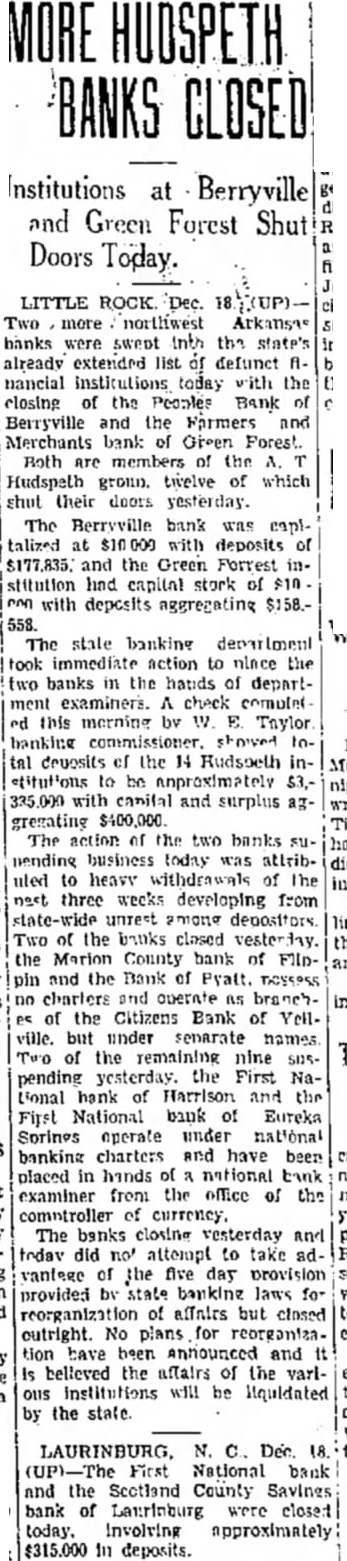

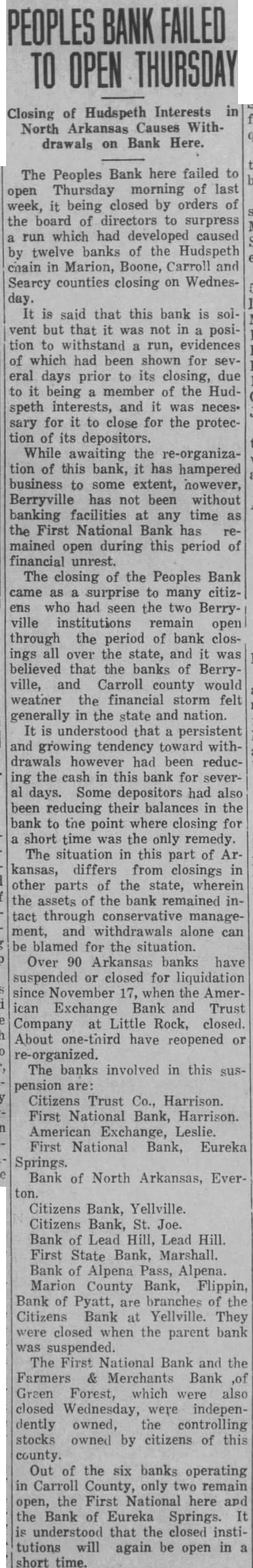

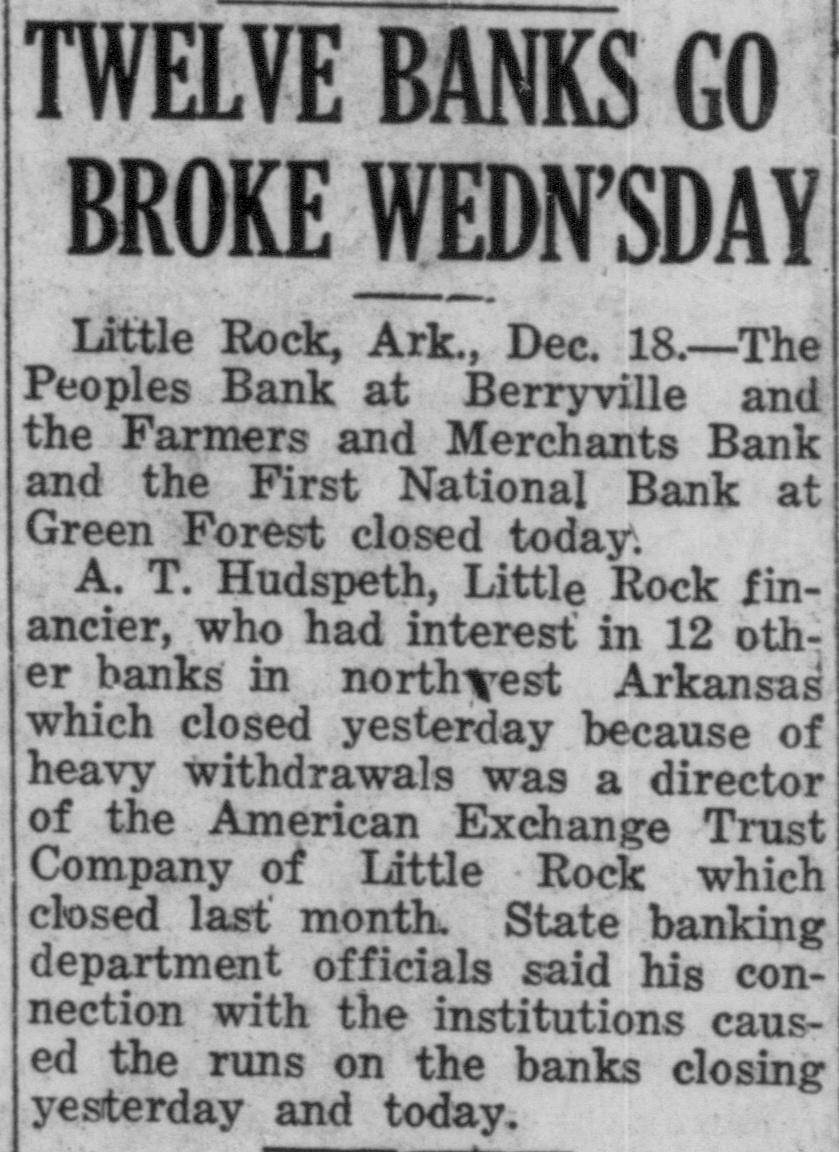

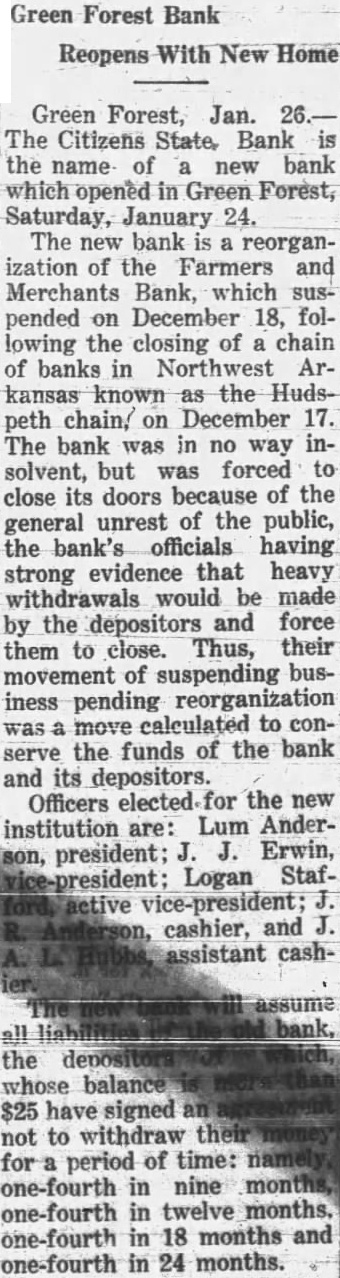

Institutions at and Green Forest Doors Today. LITTLE ROCK Two northwest banks were swept the state's already extended list defunct nancial institutions today the closing of the Peoples Bank of Berryville and the Farmers and Merchants bank of Green Forest. Both members of the twelve of which shut their doors yesterday. The Berryville bank was capitalized with deposits $177,835. and the Green Forrest institution had capital stock of with deposits aggregating $158.- The state banking took immediate action to nince the two banks the hands of department examiners. check complet this merning by Taylor banking commissioner. devosits of the Hudsoeth stitutions to anproximately with canital and surplus gregating action the two banks pending business today attributed heavy withdrawals of The three weeks developing from unrest depositors. Two of the banks closed the Marion County bank of and the Bank of Pyatt. DOYSESS charters and as the Citizens Bank of Yellville. but under senarate names the remaining nine pending yesterday. the First National hank of Harrison and the First National bank of Eureka Springs operate under national banking charters and have been placed in national bank examiner from the office of the The banks closing vesterday and today did no' attempt to take vantage the five day provision provided by state banking laws reorganization of affairs but closed outright. No plans for reprganization have been announced and believed the aftairs of the various will be the First National bank and the Scctland County Savings bank of Laurinburg were closed today. approximately In deposits.