Article Text

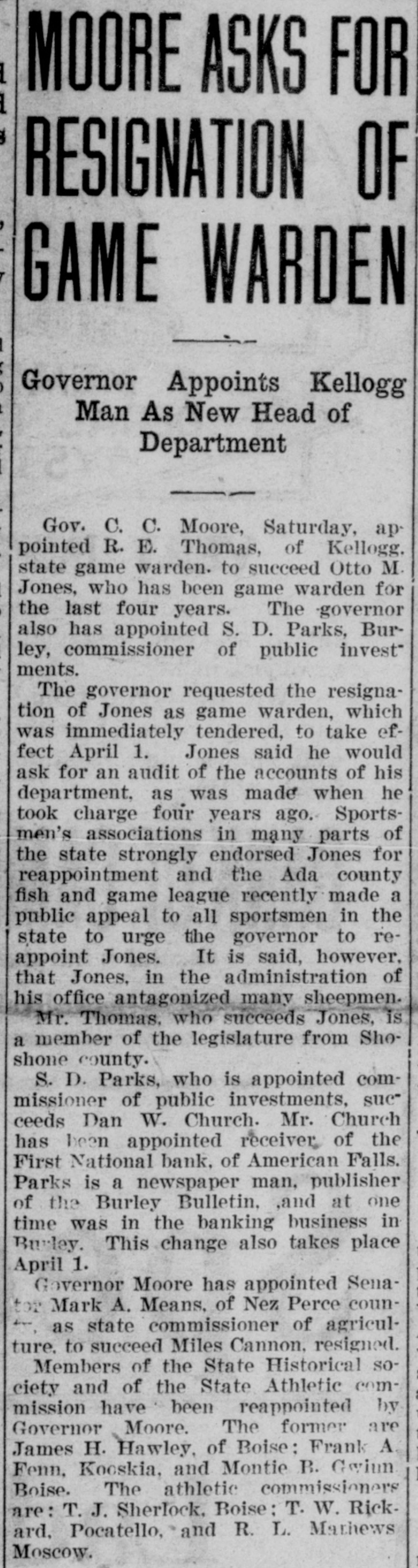

MOORE ASKS FOR RESIGNATION OF GAME WARDEN Governor Appoints Kellogg Man As New Head of Department Gov. C. C. Moore, Saturday, appointed R. E. Thomas, of Kellogg. state game warden. to succeed Otto M. Jones, who has been game warden for the last four years. The governor also has appointed S. D. Parks, Burley, commissioner of public invest" ments. The governor requested the resignation of Jones as game warden, which was immediately tendered, to take effect April 1. Jones said he would ask for an audit of the accounts of his department, as was made when he took charge four years ago. Sportsmen's associations in many parts of the state strongly endorsed Jones for reappointment and the Ada county fish and game league recently made a public appeal to all sportsmen in the state to urge the governor to reappoint Jones. It is said, however, that Jones, in the administration of his office antagonized many sheepmen. Mr. Thomas. who succeeds Jones, is a member of the legislature from Shoshone county. S. D. Parks, who is appointed commissioner of public investments, suc" ceeds Dan W. Church. Mr. Church has been appointed receiver of the First National bank, of American Falls. Parks is a newspaper man, publisher of the Burley Bulletin, .and at one time was in the banking business in Burley. This change also takes place April 1. Governor Moore has appointed Senator Mark A. Means, of Nez Perce counas state commissioner of agriculture. to succeed Miles Cannon, resigned. Members of the State Historical society and of the State Athletic commission have been reappointed by Governor Moore. The former are James H. Hawley, of Boise: Frank A Fenn, Kooskia, and Montie B. Gwiun Boise. The athletic commissioners are: T. J. Sherlock, Boise: T. W. Rickard, Pocatello, and R. L. Mathews Moscow.