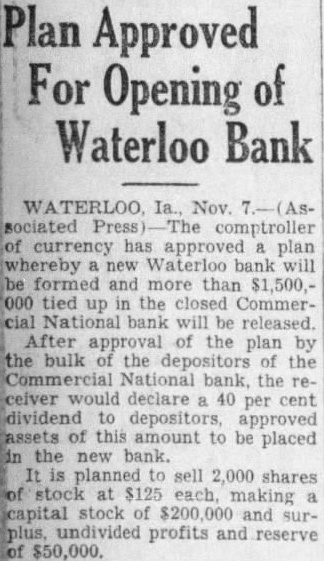

Article Text

Approved For Opening of Waterloo Bank Nov. comptroller has plan formed and more than tied up the Commerwill released. After approval of the plan by bulk depositors the National the ceiver declare 40 cent depositors, approved this amount to be placed the new bank. planned to sell shares stock at $125 each, making capital stock of and undivided profits and reserve $50,000.