Article Text

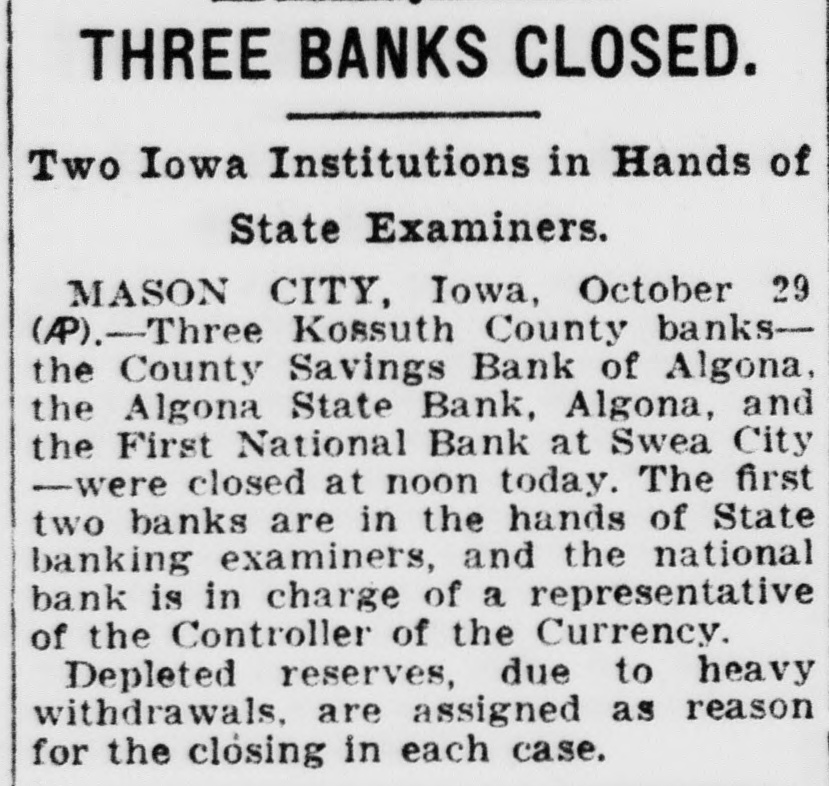

THREE BANKS CLOSED. Two Iowa Institutions in Hands of State Examiners. MASON CITY, Iowa, October 29 (AP).-Three Kossuth County banksthe County Savings Bank of Algona, the Algona State Bank, Algona, and the First National Bank at Swea City -were closed at noon today. The first two banks are in the hands of State banking examiners, and the national bank is in charge of a representative of the Controller of the Currency. Depleted reserves, due to heavy withdrawals, are assigned as reason for the closing in each case.