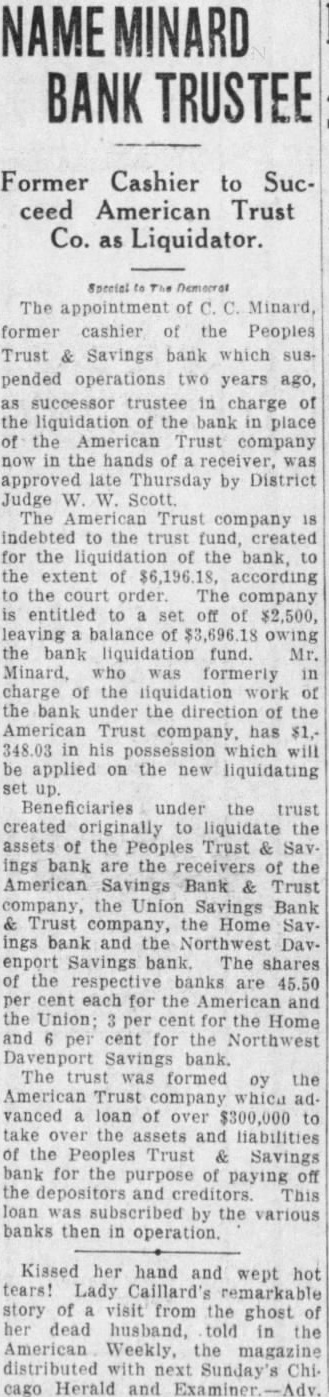

Article Text

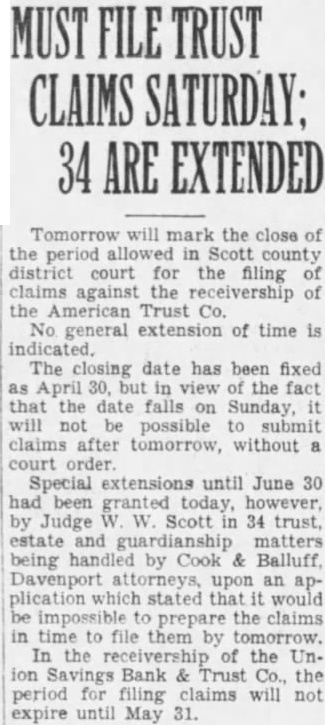

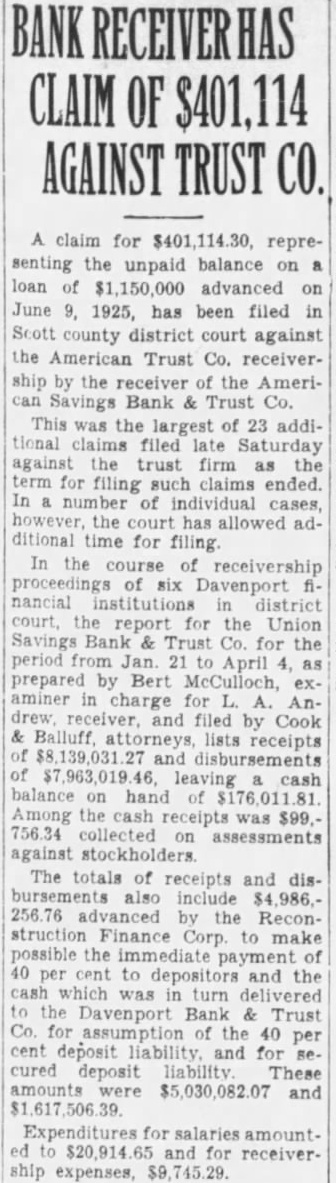

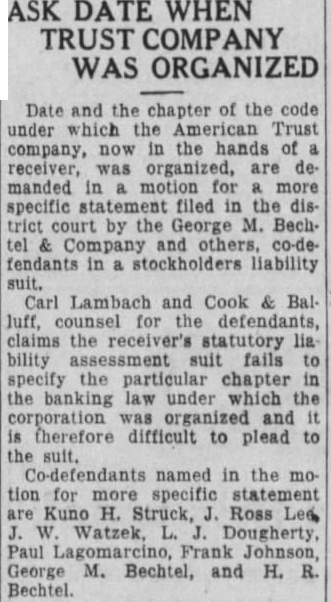

TRUST COMPANY IN VOLUNTARY RECEIVERSHIP Has $3,000,000 Assets and Outstanding Debenture Bonds of $2,700,000. The American Trust company, which has been in the process orderly liquidation since its head. quarters were moved to the Bechtel Trust company, has entered voluntary receivership on action of its officers and directors. The American Trust company has no connection with the Bechtel Trust company. and the Bechtel Trust company and other Bechtel interests way involved. The Trust company has no deposits. has capital stock of $100,000 and assets $3,000,000. There are debenture bonds which secured by assets. Recently new trustees were ap pointed hold securities for the debenture bond holders and they taken custody of the securities. That matter be handled by the trustees only and the ceivership does not apply to them. They be liquidated under the direction of the trustees, Peter Jacobsen Arthur H. Ebeling and Hugo American Trust company founded 1894 originally the German Trust company, and operated an affiliate of old German bank and in more recent years by the American Commercial Savings bank. Its M. Bechtel Vice president-J. Ross Phoenix. Johnson. above officers. with the dition Kuno Struck, Dougherty, Watzek and constitute the board directors. Organized 1894 Organized 1894, the trust company name then German Trust Co., and 1918 that name changed that of the Ameri can Trust same time the German Savings bank changed its name the American Com mercial Savings bank. At the time was organized figured that could function better than as an adjunct the bank. year operated institution bearing the bank. the many officers and tors were identical with those of the latter First of trust pany second president the German Savings Griggs, Jens Charles Brockmann and Seiffert The Griggs, president: Charles president: Richard Andresen and John treas- Capital of $100,000 The trust company began an capital stock $100,000 of which $50,000 paid 1905 the bank purchased outstanding stock the company funds being from the bank's undivided profits. provided the three principal officers bank should hold trust company trustees for the stock stock holders. The year the trust issued the remaining pany paying for undivided That done the 12 be space years proof the highly successful of the trust comIn 1902 an important step in the future trust company when the articles of taken poration amended issue and sale of debenpermit bonds