Article Text

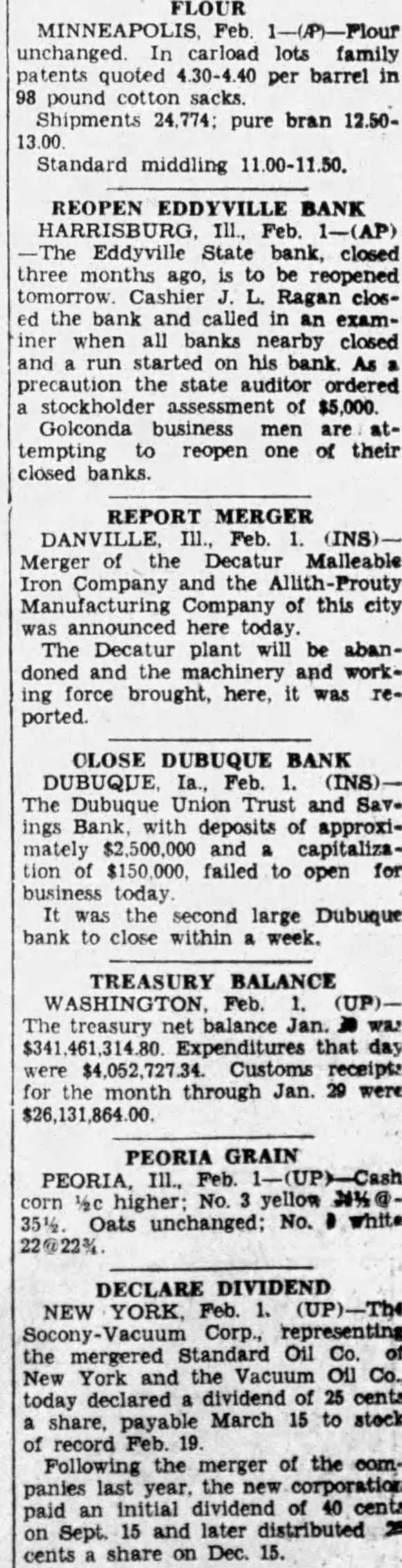

FLOUR unchanged In carload lots family patents 4.30-4.40 per barrel in 98 pound Shipments 24,774: pure bran 12.5013.00 Standard middling 11.00-11.50. REOPEN EDDYVILLE BANK HARRISBURG, Ill., Feb. 1-(AP) Eddyville State bank, closed three months ago, is to be reopened tomorrow Cashier Ragan closed the bank and called in examiner when all banks nearby closed and started on his bank As precaution state auditor ordered stockholder assessment $5,000 Golconda business are tempting to reopen one of their closed REPORT MERGER DANVILLE (INS). Merger of the Malleable Company and the Manufacturing of this city announced here today. The Decatur plant will be abandoned and the and working force brought, here, it was reported. CLOSE DUBUQUE BANK DUBUQUE Ia., Feb. (INS)The Dubuque Union Trust and Savings Bank, with deposits of approximately $2,500,000 and capitalization $150,000, failed to open for business today It the second large Dubuque bank close within week. TREASURY BALANCE The treasury net balance Jan was $341 Expenditures that day were $4,052,727.34 Customs receipts for month through Jan 29 were $26,131,864.00 PEORIA GRAIN 1/2c higher: No. yellow 351/2 Oats unchanged; No. white DECLARE DIVIDEND NEW YORK, (UP)-Th4 Corp., representing the mergered Standard Oil Co. and the Vacuum Oil Co., today declared 25 share, payable March 15 to stock of record Feb Following the merger of the last year the paid initial dividend of 40 cents on Sept. 15 and later distributed cents share on Dec. 15.