Click image to open full size in new tab

Article Text

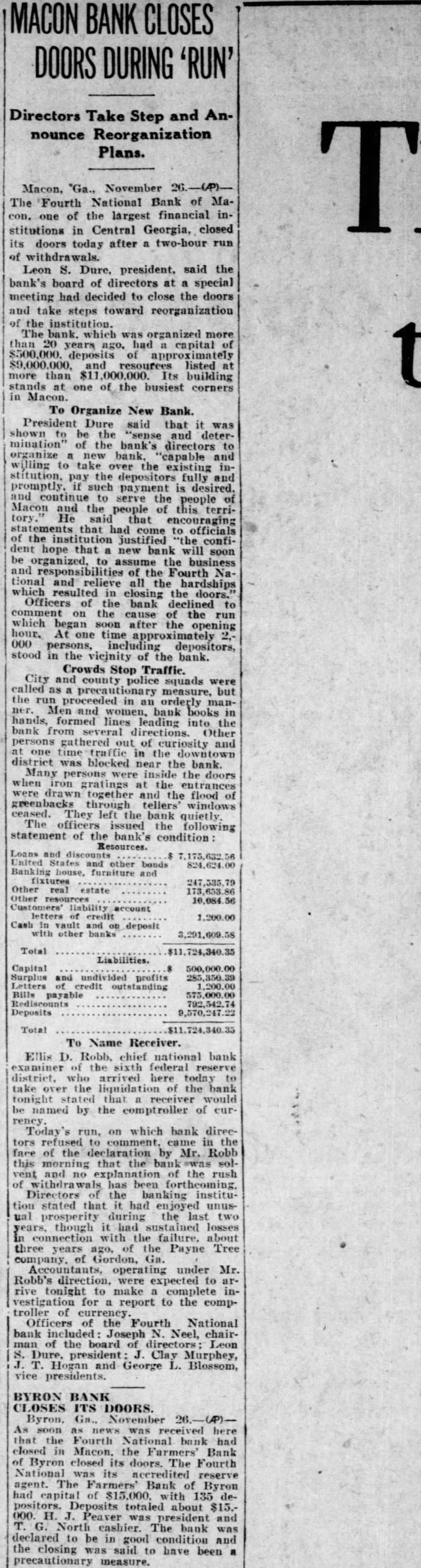

MACON BANK CLOSES DOORS DURING 'RUN'

Directors Take Step and Announce Reorganization Plans.

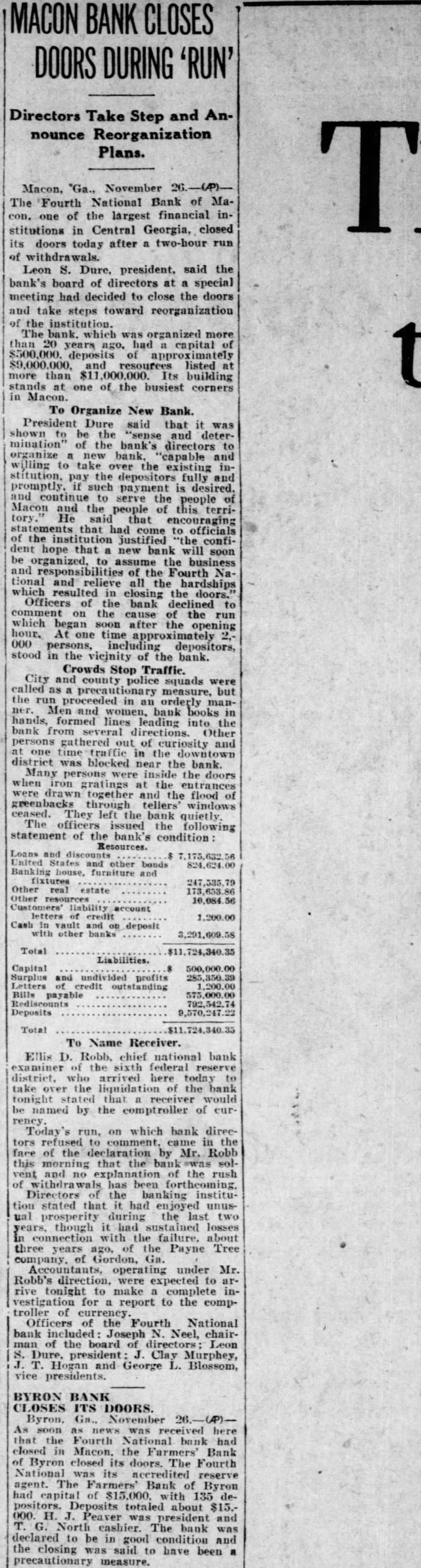

Macon, "Ga., November -(P)The Fourth National Bank of Macon. one of the largest financial institutions in Central Georgia, closed its doors today after a two-hour run of withdrawals. Leon S. Dure, president. said the bank's board of directors at a special meeting had decided to close the doors and take steps toward reorganization of the institution. The bank. which was organized more than 20 years ago. had capital of $500,000. deposits of approximately $9,000,000, and resources listed at more than $11,000,000. Its building stands at one of the busiest corners in Macon. To Organize New Bank. President Dure said that it was shown to be the "sense and determination" of the bank's directors to organize a new bank, 'capable and willing to take over the existing institution, pay the depositors fully and promptly. such payment is desired. and continue to serve the people of Macon and the people of this territory. He said that encouraging statements that had come to officials of the institution justified 'the confident hope that a new bank will soon be organized, to assume the business and responsibilities of the Fourth National and relieve all the hardships which resulted in closing the doors. Officers of the bank declined to comment on the cause of the run which began soon after the opening hour. At one time approximately 2.000 persons, including depositors, stood in the vicinity of the bank. Crowds Stop Traffic. City and county police squads were called as precautionary measure, but the run proceeded in an orderly manner. Men and women, bank books in hands, formed lines leading into the bank from several directions. Other persons gathered out of curiosity and one time traffic in the downtown district was blocked near the bank. Many persons were inside the doors when iron gratings at the entrances were drawn together and the flood of greenbacks through tellers' windows ceased. They left the bank quietly. The officers issued the following statement of the bank's condition: Resources. Loans and discounts United States and other bonds 824,624.00 Banking house, furniture and fixtures Other estate 173,653.86 Other resources Customers' liability account letters of credit 1,200.00 Cash vault and on deposit with other banks 58 Total $11,724,340.35 Liabilities. Capital 500,000.00 Surplus and undivided profits credit outstanding Bills payable 575,000.00 Deposits 9,570,247.22 Total $11,724,340.35

To Name Receiver. Ellis D. Robb. chief national bank examiner of the sixth federal reserve district. who arrived here today to take over the liquidation of the bank tonight stated that receiver would be named by the comptroller of curToday's run, on which bank directors refused to comment, came in the face of the declaration by Mr. Robb this morning that the bank was solvent and no explanation of the rush of withdrawals has been forthcoming. Directors the banking institution stated that it had enjoyed unusual prosperity during the last two years, though it had sustained losses connection with the failure. about three years ago, of the Payne Tree company. of Gordon, Ga. Accountants, operating under Mr. Robb's direction, were expected to arrive tonight to make complete investigation for report to the comptroller of currency Officers of the Fourth National bank included: Joseph N. Neel, chairman of the board of directors; Leon S. Dure, president Clay Murphey, J. T. Hogan and George L. Blossom, vice presidents.

BYRON BANK CLOSES ITS DOORS. Byron, Ga., November As soon as news was received here that the Fourth National bank had closed in Macon. the Farmers' Bank of Byron closed its doors. The Fourth National was its accredited reserve agent. The Farmers' Bank of Byron had capital of $15,000. with 135 depositors. Deposits totaled about $15.000. H. J. Peaver was president and G. North cashier. The bank was declared to be in good condition and the closing was said to have been precautionary measure.