Click image to open full size in new tab

Article Text

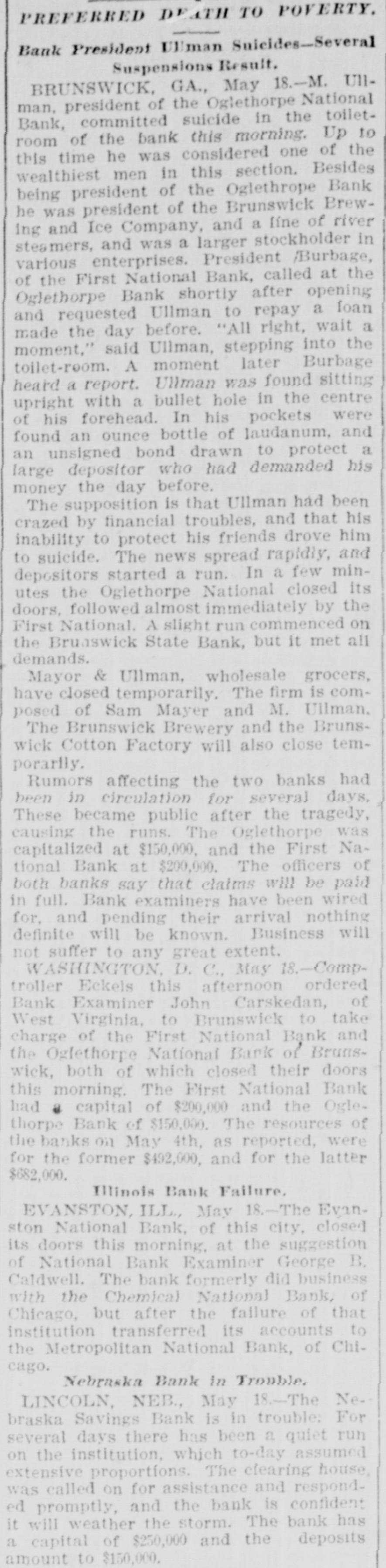

PREFERRED DEATH TO POVERTY. Bank President Ullman Suicides-Several Suspensions Result. BRUNSWICK, GA., May 18.-M. UIIman, president of the Oglethorpe National Bank, committed suicide in the toiletroom of the bank this morning. Up to this time he was considered one of the wealthiest men in this section. Besides being president of the Oglethrope Bank he was president of the Brunswick Brewing and Ice Company, and a line of river steamers, and was a larger stockholder in various enterprises. President /Burbage, of the First National Bank, called at the Oglethorpe Bank shortly after opening and requested Ullman to repay a loan made the day before. "All right, wait a moment," said Ullman, stepping into the toilet-room. A moment later Burbage heard a report. Ullman was found sitting upright with a bullet hole in the centre of his forehead. In his pockets were found an ounce bottle of laudanum, and an unsigned bond drawn to protect a large depositor who had demanded his money the day before. The supposition is that Ullman had been crazed by financial troubles, and that his inability to protect his friends drove him to suicide. The news spread rapidly, and depositors started a run. In a few minutes the Oglethorpe National closed its doors, followed almost immediately by the First National. A slight run commenced on the Brunswick State Bank, but it met all demands. Mayor & Ullman, wholesale grocers, have closed temporarily. The firm is composed of Sam Mayer and M. Ullman. The Brunswick Brewery and the Brunswick Cotton Factory will also close temporarily. Rumors affecting the two banks had been in circulation for several days. These became public after the tragedy, causing the runs. The Oglethorpe was capitalized at $150,000, and the First National Bank at $200,000. The officers of both banks say that claims will be paid in full. Bank examiners have been wired for, and pending their arrival nothing definite will be known. Business will not suffer to any great extent. WASHINGTON, D. C., May 18.-Comptroller Eckels this afternoon ordered Bank Examiner John Carskedan, of West Virginia, to Brunswick to take charge of the First National Bank and the Oglethorpe National Bank of Brunswick, both of which closed their doors this morning. The First National Bank had capital of $200,000 and the Oglethorpe Bank of $150,000. The resources of the banks on May 4th, as reported, were for the former $492,000, and for the latter $682,000. Illinois Bank Failure, EVANSTON, ILL., May 18.-The Evanston National Bank, of this city, closed its doors this morning, at the suggestion of National Bank Examiner George B. Caldwell. The bank formerly did business with the Chemical National Bank, of Chicago, but after the failure of that institution transferred its accounts to the Metropolitan National Bank, of Chicago. Nebraska Bank In Trouble. LINCOLN, NEB., May 18.-The Nebraska Savings Bank is in trouble: For several days there has been a quiet run on the institution, which to-day assumed extensive proportions. The clearing house, was called on for assistance and responded promptly, and the bank is confident it will weather the storm. The bank has a capital of $250,000 and the deposits amount to $150,000.