Article Text

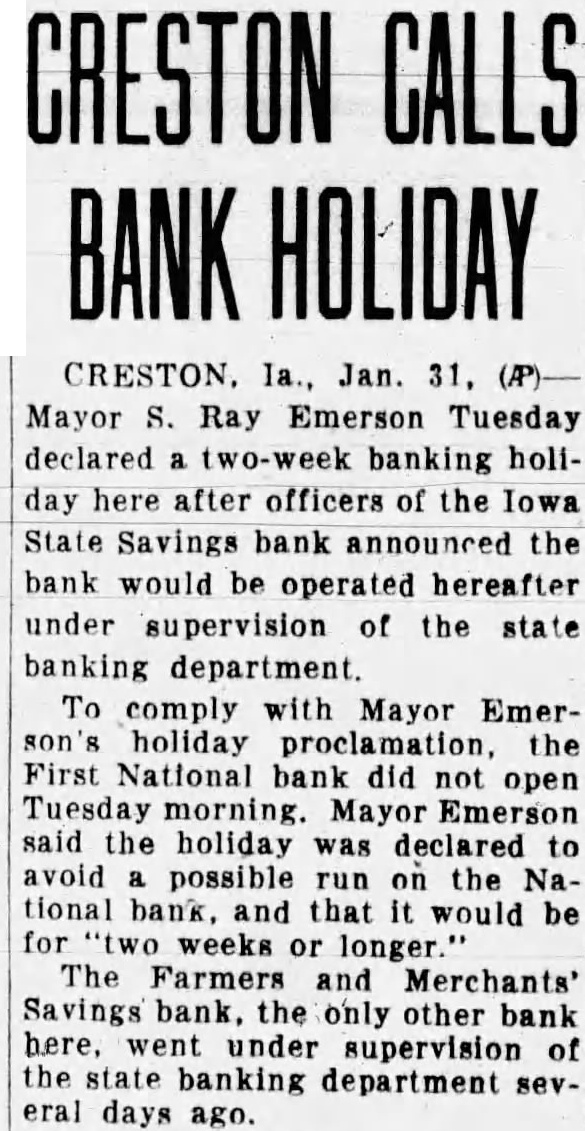

CRESTON CALLS CRESTON. Ia., Jan. 31, Mayor Ray Emerson Tuesday declared two-week banking hollday here after officers of the Iowa State Savings bank announced the bank would be operated hereafter under supervision of the state banking department. To comply with Mayor Emerholiday proclamation. the First National bank did not open Tuesday morning. Mayor Emerson said the holiday was declared avoid possible run on the National and that it would be for weeks or longer The Farmers and Merchants' Savings bank. the only other bank here, went under supervision of the state banking department several days ago.