Article Text

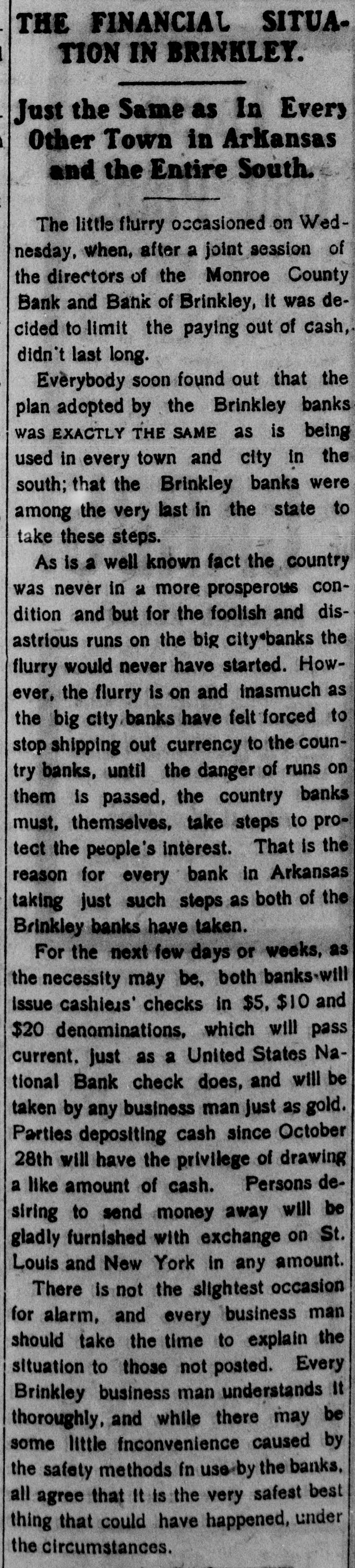

THE FINANCIAL SITUATION IN BRINKLEY. Just the Same as In Every Other Town in Arkansas and the Entire South. The little flurry occasioned on Wednesday, when, after a joint session of the directors of the Monroe County Bank and Bank of Brinkley, It was decided to limit the paying out of cash, didn't last long. Everybody soon found out that the plan adopted by the Brinkley banks was EXACTLY THE SAME as is being used in every town and city in the south; that the Brinkley banks were among the very last in the state to take these steps. As is a well known fact the country was never in a more prosperous condition and but for the foolish and disastrious runs on the big city*banks the flurry would never have started. However, the flurry is on and inasmuch as the big city banks have felt forced to stop shipping out currency to the country banks, until the danger of runs on them is passed, the country banks must, themselves, take steps to protect the people's interest. That is the reason for every bank in Arkansas taking just such steps as both of the Brinkley banks have taken. For the next few days or weeks, as the necessity may be, both banks-will issue cashiers' checks in $5. $10 and $20 denominations, which will pass current. just as a United States National Bank check does, and will be taken by any business man just as gold. Parties depositing cash since October 28th will have the privilege of drawing a like amount of cash. Persons desiring to send money away will be gladly furnished with exchange on St. Louis and New York in any amount. There is not the slightest occasion for alarm, and every business man should take the time to explain the situation to those not posted. Every Brinkley business man understands It thoroughly, and while there may be some little inconvenience caused by the safety methods in use-by the banks. all agree that It is the very safest best thing that could have happened, under the circumstances.